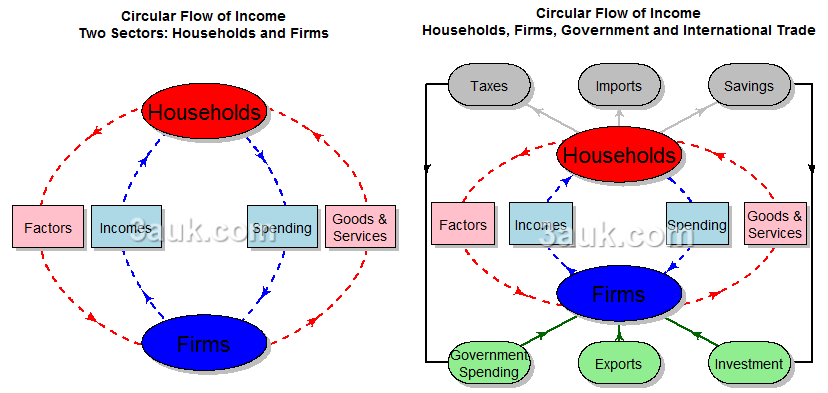

The circular flow of income model depicts the continuous movement of money, goods, and services between key economic agents, such as households and firms, within an economy. It highlights the interdependencies that drive economic activity.

- Households supply factors of production—including labour, land, capital, and enterprise—to firms, receiving income in forms like wages, rent, interest, and profits in return.

- Households use this income to purchase goods and services produced by firms, completing the basic flow.

- Leakages, or withdrawals, such as savings, taxes, and imports, diminish the circular flow by diverting money away from immediate spending.

- Injections, including investment, government expenditure, and exports, boost the flow by introducing additional money into the economy.

- Equilibrium in the circular flow occurs when total injections balance total leakages, maintaining a stable level of income and output.

In a closed economy, the model simplifies to interactions solely between households and firms, excluding external influences like trade or government.

In an open economy, the framework expands to incorporate the government sector—via taxation and public spending—and the international sector, where exports act as injections and imports as leakages.