Quick orientation: what the course covers and how you’ll be assessed

If you’re preparing for CAIE AS Level Economics (9708) in 2025–2026, think of the syllabus as three clear acts: microeconomics (how markets match buyers and sellers), macroeconomics (how the whole economy behaves), and international economics (how countries trade, borrow and respond to exchange rates). The official Cambridge 9708 syllabus is your roadmap — keep it bookmarked and consult it often [1].

Assessment usually involves two written papers: Paper 1 (short-answer and structured questions covering micro and macro) and Paper 2 (longer data-response and essay-style questions that often include international elements). Paper 1 rewards concise knowledge and application; Paper 2 rewards structured essays, diagram use, and evaluation. Past papers and specimen questions show how examiners phrase tasks and where marks are awarded — they’re essential for revision.

Actionable takeaways:

- Download the Cambridge 9708 syllabus and specimen papers now [1] (see our Econ, But Friendly: 2025–26 CAIE A‑level Economics Starter Guide) .

- Schedule weekly practice: one short-answer set + one essay or data question (rotate topics).

- Build a folder of current real-world examples (with sources) to cite in answers.

1. Core concepts: scarcity, choice and opportunity cost

All of economics starts with one simple fact: wants outstrip resources. That friction forces choices for individuals, firms and governments.

Key concepts to master:

- Scarcity: there are limited resources relative to infinite wants.

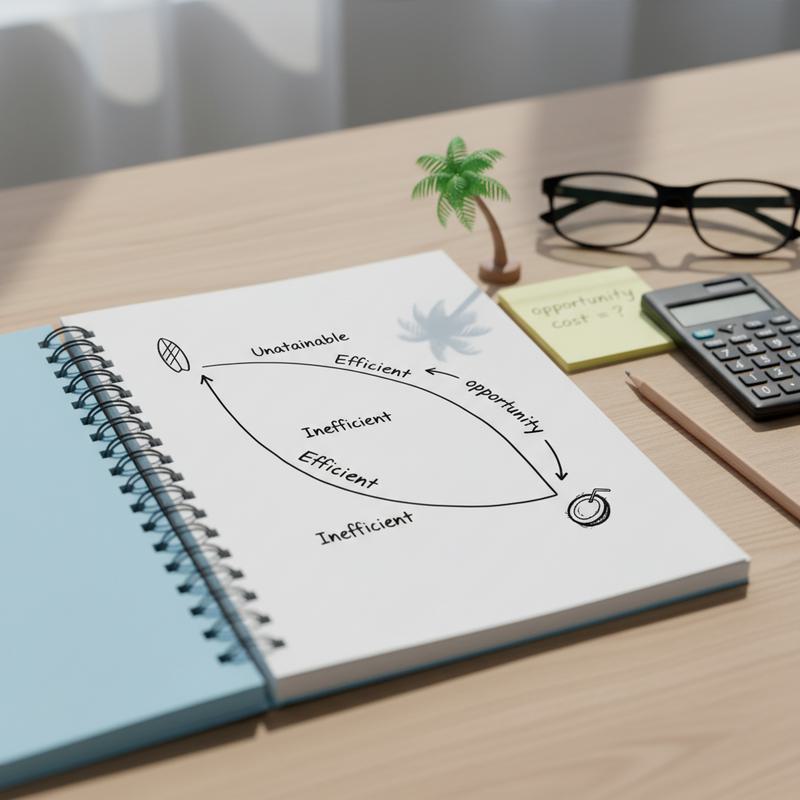

- Opportunity cost: the value of the next-best alternative you give up when making a choice.

- Production Possibility Curve (PPC): explains efficiency (on the curve), underutilisation (inside), and potential growth (outward shifts).

- Factors of production: land, labour, capital and enterprise — the inputs that create output.

- Economic systems: market, planned, and mixed economies; most real-world economies are mixed.

- Classification of goods: private, public, merit and demerit goods — useful for policy discussion.

Concrete practice:

- Memorise crisp definitions for scarcity, opportunity cost, PPC and the four factors.

- Draw and explain a PPC showing efficiency, inefficiency and growth.

- Keep a weekly log of opportunity costs you face — it cements the idea.

2. The price system and microeconomics: supply, demand and market structures

Microeconomics shows how individual markets allocate resources. The price mechanism (supply and demand) sits at its centre.

Essentials:

- Law of demand and law of supply: understand inverse and direct relationships respectively.

- Market equilibrium: how price and quantity are determined, and what happens when curves shift.

- Elasticities: PED (price elasticity of demand), PES (price elasticity of supply), YED (income elasticity of demand) — know how to calculate and interpret them.

- Market structures: perfect competition, monopolistic competition, oligopoly and monopoly — each has different implications for price, output and efficiency.

- Market failures: externalities (positive and negative), public goods, information asymmetries; and policy tools such as taxes, subsidies and regulation.

Exam-ready moves:

- Practice labelled supply and demand diagrams with equilibrium shifts and explanations.

- Do simple elasticity calculations (PED = %ΔQ / %ΔP) using exam-style numbers.

- Learn welfare analysis for taxes, subsidies and price controls; understand consumer and producer surplus and deadweight loss.

3. The macroeconomy: GDP, AD/AS and national indicators

Macroeconomics aggregates individual choices into national outcomes: GDP, inflation, employment and growth.

Core topics:

- GDP and national income: know the output, income and expenditure approaches and the limitations of GDP.

- Circular flow model: households, firms, government, financial sector and foreign sector interactions.

- Aggregate Demand (AD = C + I + G + (X − M)) and Aggregate Supply: short-run and long-run — be able to draw and explain AD/AS shifts.

- Unemployment types: frictional, structural and cyclical.

- Inflation: demand-pull vs cost-push; understand causes and consequences.

- Policy targets: how central banks and governments aim for growth, low inflation and low unemployment.

Practical revision tips:

- Be fluent at drawing AD/AS diagrams and explaining short-run vs long-run effects.

- Keep one macroeconomic indicator on your radar (CPI or GDP) and track headlines from credible sources like the Bank of England and ONS [2][5].

4. Macroeconomic policy: tools, trade-offs and real-world examples

Governments and central banks use fiscal, monetary and supply-side policies to stabilise or grow the economy. Each tool brings trade-offs.

Main instruments:

- Fiscal policy: government spending and taxation. Expansionary fiscal policy (higher G, lower taxes) can boost AD but increase deficits.

- Monetary policy: interest rate decisions and quantitative easing managed by central banks — lower rates stimulate borrowing and spending, higher rates dampen inflation [2].

- Supply-side policies: measures that improve productive capacity such as education, infrastructure and deregulation.

Policy evaluation:

- Assess who benefits and who bears costs, short-term versus long-term impact, and possible unintended consequences.

- Note policy conflicts: for example, expansionary fiscal policy can increase inflationary pressure, complicating monetary policy.

Real-world habit: Read one central bank or government macroeconomic announcement each week (Bank of England, IMF, HM Treasury) and summarise it in one paragraph with a source [2][3][6].

5. International economics: trade, exchange rates and global links

International economics explains why countries trade, how exchange rates work, and how globalization shapes living standards.

Must-know ideas:

- Comparative advantage and gains from trade: even if one country is better at producing everything, specialisation can raise world output.

- Protectionism: tariffs, quotas and subsidies protect domestic producers but distort prices and create deadweight loss.

- Exchange rates: fixed vs floating systems; currency depreciation can boost exports but make imports more expensive.

- Balance of payments: current account (trade in goods and services) and financial account (capital flows); persistent deficits and surpluses have implications.

- Development considerations: trade and capital flows can raise incomes but may increase inequality or expose countries to shocks.

Exam prep moves:

- Be ready to explain comparative advantage with a two-country, two-good numerical example.

- Draw tariff or subsidy diagrams showing domestic price changes and welfare effects.

- Keep a file of recent exchange-rate stories (currency movements after interest-rate changes) with citations [2][3][4].

Frequently asked questions (FAQs)

Is AS Level Economics hard for beginners?

It’s approachable. Regular practice, diagram fluency and the habit of linking theory to real events beat cramming.

How much math will I need?

Mostly basic arithmetic, percentages, and graph interpretation. No calculus. If you want extra practice with the maths that supports AS/A‑level economics, try our No‑Sweat Guide to CAIE A‑Level Mathematics 9709.

How different are micro and macro?

Micro focuses on individual markets and decisions; macro looks at aggregate outcomes. The logic and tools overlap, but scale and policy implications differ.

How do I score well in essays (Paper 2)?

Define terms, use diagrams, cite a real-world example (with source), evaluate opposing arguments and finish with a short judgement.

Which sources are reliable for examples?

Use authoritative institutions: Cambridge Assessment International, Bank of England, IMF, WTO, ONS and HM Treasury [1][2][3][4][5][6]. Always cite the source and date.

How important are past papers?

Crucial. They reveal question patterns, mark allocation and examiner expectations.

Should I memorise everything?

Memorise key definitions and diagrams, but focus on applying concepts to different contexts — that’s what earns marks.

Conclusion: a practical study plan that actually works

You’ve got the map: scarcity and choice, supply and demand, national income and policy tools, and international links. Here’s a no-nonsense plan to move from revision to results:

- Download and read the Cambridge 9708 syllabus and specimen papers today [1].

- Make a weekly timetable covering micro, macro and international topics — include at least one past-paper question each session.

- Collect current examples from trusted sources (Bank of England, IMF, WTO, ONS, HM Treasury) and note the source and date for each [2][3][4][5][6].

- Draw, label and explain diagrams until the shapes are automatic in exams.

- Get targeted feedback on essays — a teacher, tutor or study partner will spot gaps faster than you will.

Stick to the plan, practise deliberately, and use real-world sources to back up your arguments. Yes, this will be on the test — and yes, you’ll do better than you think.

Related reading: if you’re moving on to full A‑level or comparing exam boards, our CAIE A‑level Economics Starter Guide and Edexcel A‑Level Economics 2025–2026: Essential Student Guide explain key differences and what to expect at the next level.

References

- Cambridge Assessment International Education — AS & A Level Economics (9708) syllabus and resources: https://www.cambridgeinternational.org

- Bank of England — interest rate decisions and Bank Rate history: https://www.bankofengland.co.uk

- International Monetary Fund — World Economic Outlook and publications: https://www.imf.org

- World Trade Organization (WTO) — trade policies and resources: https://www.wto.org

- UK Office for National Statistics (ONS) — GDP, inflation and labour market data: https://www.ons.gov.uk

- HM Treasury — public finances and government publications: https://www.gov.uk/government/organisations/hm-treasury