Content

measuring income and wealth inequality: Gini coefficient

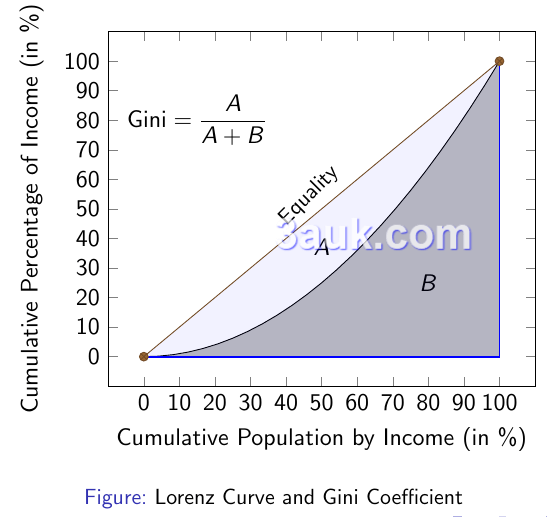

- A Lorenz curve is a graphical representation of the distribution of income or wealth in a society. It shows the cumulative percentage of income or wealth received by a given percentage of the population.

- The Lorenz curve is drawn by plotting the cumulative percentage of the population against the cumulative percentage of income or wealth they receive.

- A perfectly equal distribution of income or wealth is represented by a straight line that runs from the origin to the point (100,100), meaning that 100% of the population receives 100% of the income or wealth.

- In contrast, if the Lorenz curve is concave, it means that the distribution of income or wealth is unequal, with a smaller percentage of the population receiving a larger share of the total income or wealth.

- The Gini coefficient is a numerical measure of inequality that is derived from the Lorenz curve. It is defined as the ratio of the area between the Lorenz curve and the line of equality to the total area under the line of equality.

- A Gini coefficient of 0 indicates perfect equality, where everyone receives the same amount of income or wealth, while a Gini coefficient of 1 indicates perfect inequality, where one person receives all the income or wealth.

- The higher the Gini coefficient, the greater the inequality in the distribution of income or wealth.

economic reasons for inequality of income and wealth

- Market forces: Market forces, such as supply and demand, play a major role in determining the distribution of income and wealth. For example, individuals with highly in-demand skills and abilities are often able to command higher salaries, while those with less in-demand skills may earn lower wages.

- Education and skills: The level of education and the acquisition of specific skills also play a significant role in determining income and wealth inequality. Individuals with higher levels of education and specialized skills are often able to command higher salaries and have better opportunities for wealth accumulation.

- Inheritance: Inheritance also contributes to the inequality of wealth. Those who inherit wealth from their families are often able to accumulate more wealth than those who do not, even if they have similar levels of education and skills.

- Discrimination: Discrimination based on race, gender, ethnicity, and other factors can also contribute to income and wealth inequality. Discrimination can limit opportunities for certain individuals and groups, leading to unequal distribution of income and wealth.

- Government policies: Government policies and regulations also play a role in shaping the distribution of income and wealth. For example, tax policies and social welfare programs can help to reduce income and wealth inequality, while policies that favor the wealthy, such as tax cuts for the rich, can exacerbate inequality.

policies to redistribute income and wealth

- Minimum Wage Laws: policies that require employers to pay their employees a minimum hourly wage.

- By setting a floor on the amount of money employees can earn, minimum wage laws help to reduce income inequality by ensuring that low-wage workers receive a basic standard of living.

- Transfer Payments: government-provided financial transfers to individuals or households with low incomes.

- Examples of transfer payments include welfare programs like unemployment benefits, food stamps, and cash transfers to low-income families. Transfer payments provide a source of income for individuals who are unable to earn enough from work, helping to reduce income inequality.

- Progressive income taxes, Inheritance and Capital taxes

- Progressive Income Taxes: tax systems in which the tax rate increases as an individual's income increases.

- Progressive income taxes are designed to reduce income inequality by taxing the wealthy at a higher rate than the poor, effectively redistributing income from the wealthy to the less well-off.

- By increasing the tax burden on the wealthy, the government is able to provide more resources for social programs and public goods, helping to reduce poverty and improve the standard of living for those with lower incomes.

- Inheritance, Capital Taxes: taxes on wealth transfers and the accumulation of wealth.

- Inheritance taxes are levied on the transfer of wealth from one generation to the next, while capital taxes are levied on the value of an individual's wealth.

- These taxes help to reduce wealth inequality by reducing the ability of the wealthy to pass on their wealth to their heirs and by reducing the accumulation of wealth over time.

- By reducing the concentration of wealth, inheritance and capital taxes help to ensure a more equal distribution of resources and opportunities, reducing poverty and improving the standard of living for those with lower incomes.

- Progressive Income Taxes: tax systems in which the tax rate increases as an individual's income increases.

- State Provision of Essential Goods and Services: State provision of essential goods and services, such as education, health care, and housing, helps to reduce income and wealth inequality by providing access to these important resources to all individuals, regardless of their income or wealth.

- By investing in public goods and services, the government can help to level the playing field, reducing the impact of market forces on the distribution of income and wealth.

Join the conversation