Content

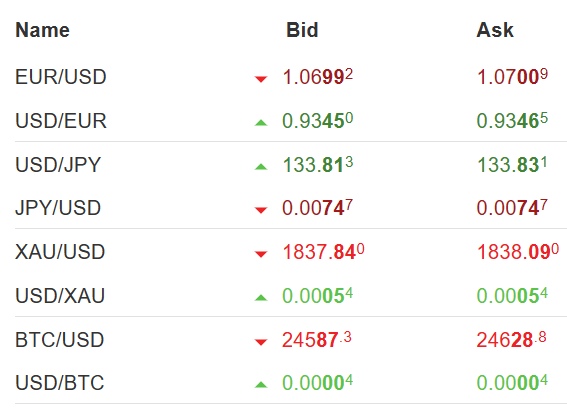

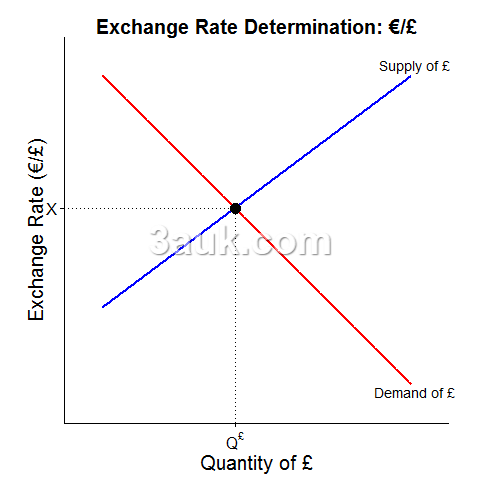

determination of a floating exchange rate

- A floating exchange rate is an exchange rate regime in which the value of a country's currency is determined by the supply and demand of the currency in the foreign exchange market.

- The exchange rate is allowed to float freely, without any intervention from the government or central bank.

- A fixed exchange rate, in which the value of a currency is pegged to another currency or to a fixed value, is subject to government or central bank intervention to maintain the exchange rate at the predetermined level.

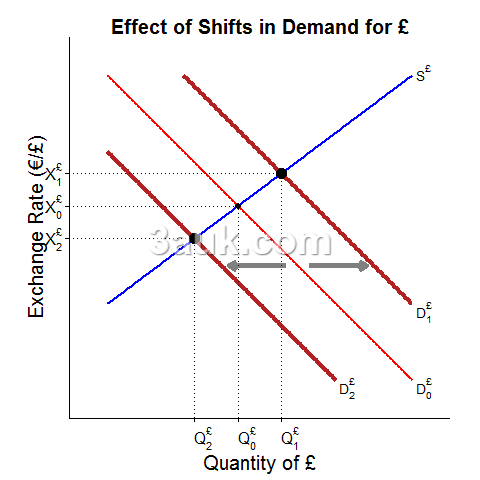

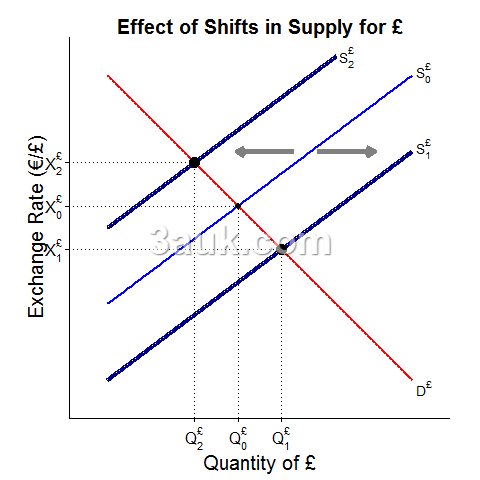

distinction between depreciation and appreciation of a floating exchange rate

- Depreciation occurs when a currency's value decreases relative to other currencies.

- This means that it takes more of the currency to buy the same amount of foreign currency.

- For example, if the exchange rate between the US dollar and the euro changes from 1 USD = 0.85 EUR to 1 USD = 0.80 EUR, the US dollar has depreciated relative to the euro.

- Appreciation occurs when a currency's value increases relative to other currencies.

- This means that it takes less of the currency to buy the same amount of foreign currency.

- For example, if the exchange rate between the US dollar and the euro changes from 1 USD = 0.85 EUR to 1 USD = 0.90 EUR, the US dollar has appreciated relative to the euro.

causes of changes in a floating exchange rate: demand and supply of the currency

- Interest rates

- When interest rates in a country increase, it can make the country's currency more attractive to foreign investors, increasing demand for the currency and potentially causing its value to appreciate.

- Conversely, lower interest rates can make a currency less attractive, decreasing demand and potentially causing its value to depreciate.

- Economic growth

- A country with strong economic growth may attract more foreign investment, increasing demand for its currency and potentially causing its value to appreciate.

- Conversely, weaker economic growth may decrease demand and potentially cause the currency to depreciate.

- Political stability

- Political instability or uncertainty can make a country's currency less attractive to foreign investors, decreasing demand and potentially causing its value to depreciate.

- Political instability or uncertainty can make a country's currency less attractive to foreign investors, decreasing demand and potentially causing its value to depreciate.

- Trade flows

- When a country imports more than it exports, it generates a surplus of its currency in international markets, increasing its supply and potentially causing its value to depreciate.

- Conversely, when a country exports more than it imports, it generates a demand for foreign currency, decreasing supply and potentially causing its own currency to appreciate.

- Speculation

- Currency traders may buy or sell a currency based on their expectations of future exchange rate movements, which can influence the demand for and supply of the currency in the short term.

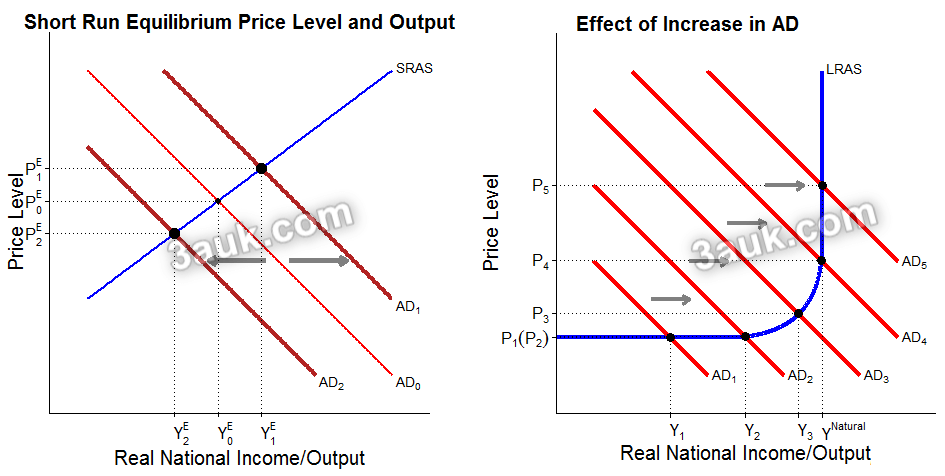

AD/AS analysis of the impact of exchange rate changes

Impact of depreciation:

- A depreciation of the domestic currency means that the domestic currency can buy fewer units of foreign currency. This makes domestic goods and services relatively cheaper for foreign buyers, while foreign goods and services become relatively more expensive for domestic buyers. This results in an increase in net exports, which is reflected in the AD equation as an increase in the net export component (NX). The increase in NX leads to an outward shift in the AD curve.

- The outward shift in the AD curve leads to an increase in both the equilibrium level of real output (Y) and the price level (P).

- This increase in real output and the price level is accompanied by an increase in employment, as firms increase their production to meet the higher demand for their goods and services.

Impact of appreciation:

- An appreciation of the domestic currency makes domestic goods and services relatively more expensive for foreign buyers, while foreign goods and services become relatively cheaper for domestic buyers. This results in a decrease in net exports, which is reflected in the AD equation as a decrease in the net export component (NX).

- The inward shift in the AD curve leads to a decrease in both the equilibrium level of real output (Y) and the price level (P).

- This decrease in real output and the price level is accompanied by a decrease in employment, as firms reduce their production to meet the lower demand for their goods and services.

Join the conversation