Content

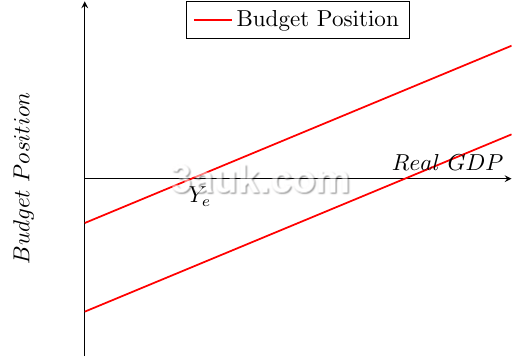

distinction between a government budget deficit and a government budget surplus

- A government budget deficit occurs when a government's expenditures exceed its revenue over a given period, typically a fiscal year.

- Cyclical budget deficit: occurs as a result of changes in the economy, such as a recession or a period of slow economic growth.

- During a recession, for example, tax revenue typically falls while government spending on unemployment benefits and other programs increases, which can lead to a budget deficit.

- Structural budget deficit: occurs as a result of a mismatch between a government's revenue and expenditures over the long term.

- This can occur if a government's spending commitments are not sustainable based on its revenue sources, leading to a persistent deficit even during periods of economic growth.

- Cyclical budget deficit: occurs as a result of changes in the economy, such as a recession or a period of slow economic growth.

- A government budget surplus occurs when a government's revenue exceeds its expenditures over a given period.

- Balanced budget: government revenue equalling government expenditure.

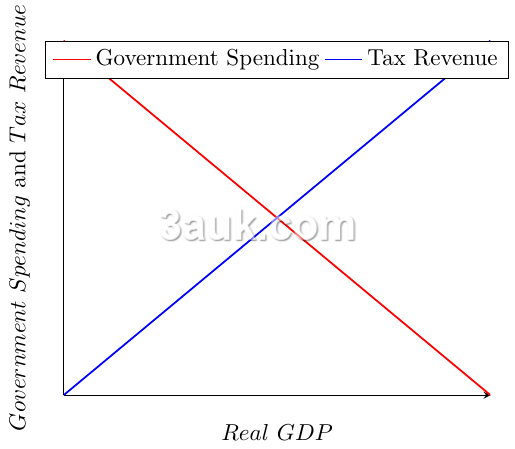

- Automatic stabilisers: changes in government spending and taxation that occur to reduce fluctuations in aggregate demand without any alteration in government policy.

meaning and significance of the national debt

- The national debt, also known as the public debt, is the total amount of money owed by the government of a country to its creditors.

- The national debt is often expressed as a percentage of GDP.

- This debt is the result of the government borrowing money to finance its activities, such as spending on infrastructure, social programs, and military operations.

- The significance of the national debt:

- Burden on future generations: The national debt is an obligation that future generations will have to repay, which can impact their economic well-being and limit their ability to invest in their own priorities.

- Effects on the economy: The national debt can affect the economy in a number of ways.

- High levels of debt can lead to higher interest rates, as creditors demand higher returns to compensate for the increased risk. This, in turn, can lead to reduced borrowing and spending, which can slow down the economy.

- International standing: A country's national debt can also impact its international standing. High levels of debt can be seen as a sign of fiscal instability, which can reduce investor confidence and make it more difficult for the country to borrow in the future.

- Crowding out private investment: The government's borrowing to finance its debt can also compete with private investment for available funds, potentially leading to higher interest rates and reduced private sector investment.

taxation: types of taxes, rates of tax, reasons for taxation

- Direct taxes: taxes that are imposed directly on individuals and organizations based on their income, wealth, or property.

- Examples of direct taxes include personal income tax, corporate tax, and wealth tax.

- The burden of direct taxes falls directly on the person or organization being taxed and cannot be passed on to someone else.

- Indirect taxes: taxes that are imposed on goods and services.

- Examples of indirect taxes include value-added tax (VAT), sales tax, and excise duty.

- Indirect taxes are typically collected by businesses and then passed on to the consumer in the form of higher prices.

- The burden of indirect taxes can be passed on to someone else, such as the consumer.

- The main difference between direct and indirect taxes is who bears the burden of the tax.

- Direct taxes are considered to be more progressive, as they tend to fall more heavily on those with higher incomes, while indirect taxes tend to be regressive, as they take up a larger share of the income of those with lower incomes.

- The effects of direct and indirect taxes:

- Direct taxes can have a range of effects on the economy.

- For example, high levels of direct taxation can reduce incentives for work and investment, as individuals and businesses are taxed more heavily on their income and profits.

- Direct taxes can also be used to redistribute income and reduce income inequality.

- Indirect taxes can have an impact on consumer behavior, as they increase the price of goods and services.

- This can lead to reduced consumption, which can have a negative effect on economic growth.

- Indirect taxes can also be regressive, as they take up a larger share of the income of those with lower incomes.

- Direct taxes can have a range of effects on the economy.

- Progressive taxes are taxes in which the tax rate increases as the taxable income of an individual or organization increases.

- This means that those with higher incomes pay a higher percentage of their income in taxes.

- The idea behind progressive taxes is to ensure that those with higher incomes pay a larger share of their income in taxes, and to reduce income inequality.

- Regressive taxes are taxes in which the tax rate decreases as the taxable income of an individual or organization increases.

- This means that those with lower incomes pay a higher percentage of their income in taxes compared to those with higher incomes.

- Regressive taxes can be seen as unfair, as they place a greater burden on those with lower incomes.

- Proportional taxes are taxes in which the tax rate is fixed, regardless of the taxable income of an individual or organization.

- This means that everyone pays the same percentage of their income in taxes.

- Proportional taxes are considered to be the most neutral type of tax system, as everyone pays the same amount, regardless of their income level.

| Income Range | Tax Rate | Tax Paid |

|---|---|---|

| $0 - $10,000 | 10% | |

| $10,001 - $20,000 | 15% | |

| $20,001 - $30,000 | 20% | |

| $30,001 and above | 25% |

-

- In this system, people earning $20000 pay S2500 in tax(25% of $12000). This is 12.5% of their income.

- People earning S40,000 pay $11000

- $2500 + 20% of $10000 + 25% of 10000 = $7000).

- This is 17.5% of their income.

- Those who earn $80,000 pay 21.25% of their income

- $2500+$4500+$10000 (25% of $40000) = $17000.

- So as income rises, a higher percentage is paid in tax.

- The marginal tax rate is the amount of tax paid on an additional dollar of income.

- It is the tax rate that applies to the last dollar of income earned.

- For example, if an individual's marginal tax rate is 35%, this means that for every additional dollar earned, 35 cents will go towards taxes.

- The average tax rate is the total amount of taxes paid divided by the total income.

- It is the average tax rate paid on all of an individual's or organization's taxable income.

- The average tax rate gives an overall picture of the tax burden, taking into account the entire income and all the tax brackets an individual or organization falls into.

- For example, if an individual has a total income of $100,000 and pays $30,000 in taxes, their average tax rate would be 30%.

- Reasons for taxation

- Revenue Generation: The most important reason for taxation is to generate revenue for the government to finance its activities and provide public goods and services. The government uses the revenue collected from taxes to fund programs and services such as national defense, infrastructure, education, healthcare, and social security.

- Redistribution of Wealth: Taxes can also be used to reduce income and wealth inequality by redistributing income from high-income individuals to low-income individuals. Through the use of progressive taxation, the government can take a larger portion of income from those who can afford it and use it to support those in need.

- Encouraging Economic Activity: Taxes can also be used to encourage or discourage certain economic activities. For example, the government may offer tax incentives for businesses that invest in research and development or for individuals who purchase environmentally friendly vehicles.

- Maintenance of Public Goods and Services: Taxes are also used to maintain public goods and services, such as roads, bridges, parks, and schools. These goods and services benefit everyone in the community and are provided by the government to ensure that they are accessible and affordable for all.

government spending: types of spending, reasons for government spending

Government spending refers to the use of public funds by the government to finance various activities and services.

- Current Spending: Also known as consumption spending or recurrent spending, this type of spending is used to fund the day-to-day operations of the government and provide services to the public.

- Examples of current spending include salaries of government employees, administration costs, and social welfare programs.

- Capital Spending: involves the acquisition of long-term assets, such as buildings, infrastructure, and equipment.

- Capital spending is used to improve the economy's productive capacity and create jobs. It is an investment in the future and helps to increase the government's assets, which can then be used to provide goods and services to the public.

- Transfer Payments: involves transferring funds directly to individuals or organizations without the provision of goods or services in return.

- Examples of transfer payments include welfare programs, unemployment benefits, and food stamps.

- These payments are designed to provide a safety net for individuals in need and to help reduce poverty and inequality.

- Exhaustive government spending: government spending which makes use of resources.

- Non-exhaustive government spending: government spending which allows others to decide how resources are used.

- Reasons for government spending

- Provision of Public Goods and Services: The government spends money to provide goods and services that are considered essential for the well-being of the citizens and the functioning of the economy. Examples of public goods and services include national defense, infrastructure, education, healthcare, and social security.

- Stimulating the Economy: During economic downturns, the government may increase spending to stimulate the economy and create jobs. This is often achieved through capital spending on infrastructure projects or transfer payments to individuals and businesses.

- Reducing Poverty and Inequality: The government may spend money on transfer payments, such as welfare programs and unemployment benefits, to reduce poverty and inequality. These programs provide a safety net for individuals in need and help to ensure a more equal distribution of wealth and income.

- Encouraging Economic Activity: The government may offer tax incentives or subsidies to encourage certain economic activities, such as investment in research and development or the use of environmentally friendly technologies.

- Meeting National Objectives: The government may spend money to meet specific national objectives, such as preserving the environment, promoting public health, or supporting the arts.

distinction between expansionary and contractionary fiscal policy

- Expansionary Fiscal Policy: is designed to stimulate economic growth by increasing government spending and/or reducing taxes.

- The goal of expansionary fiscal policy is to increase aggregate demand and boost consumer spending, which can help to stimulate economic activity and reduce unemployment.

- This is typically used during economic downturns or recessions.

- Contractionary Fiscal Policy: is designed to slow down economic growth by reducing government spending and/or increasing taxes.

- The goal of contractionary fiscal policy is to reduce aggregate demand and slow down inflation.

- This is typically used during times of high inflation or an overheated economy.

- Discretionary fiscal policy refers to deliberate and conscious changes made by the government in its spending and taxation policies to achieve specific economic objectives.

- This type of fiscal policy is flexible and can be adjusted based on the government's judgment of the current economic situation.

- Discretionary fiscal policy is often used during economic downturns or recessions to stimulate economic growth, or during times of high inflation to slow down economic activity.

- Automatic stabilizers are built-in mechanisms in the tax and transfer system that automatically respond to changes in the economy without the need for conscious policy action.

- For example, when the economy slows down, tax revenue decreases and transfer payments such as unemployment benefits increase, thereby boosting aggregate demand and stabilizing the economy.

- Similarly, when the economy is overheating, tax revenue increases and transfer payments decrease, helping to reduce aggregate demand and slow down inflation.

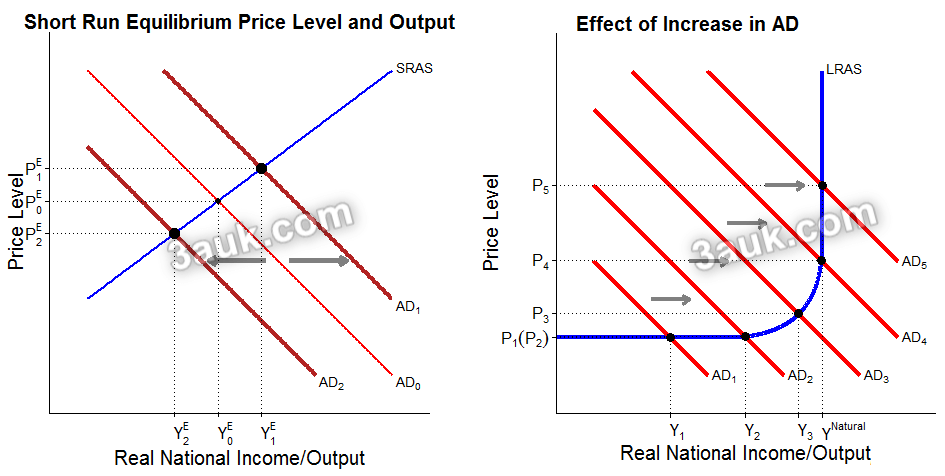

AD/AS analysis of the impact of expansionary and contractionary fiscal policy

The AD-AS model can be used to analyze the impact of expansionary and contractionary fiscal policy on the equilibrium level of national income, the level of real output, the price level, and employment.

- Impact of expansionary fiscal policy:

- An increase in government spending or a decrease in taxes will increase aggregate demand (AD) in the short run.

- This will shift the AD curve to the right, resulting in an increase in both the equilibrium level of national income and the level of real output.

- The increase in demand will also put upward pressure on the price level, potentially leading to inflation.

- In the short run, this policy can also lead to an increase in employment.

- Impact of contractionary fiscal policy:

- A decrease in government spending or an increase in taxes will decrease aggregate demand in the short run.

- This will shift the AD curve to the left, resulting in a decrease in both the equilibrium level of national income and the level of real output.

- The decrease in demand will also put downward pressure on the price level, potentially leading to deflation.

- In the short run, this policy can also lead to a decrease in employment.

- Factors that can affect the impact of expansionary and contractionary fiscal policy

- The state of the economy

- For example, during a recession, there may be excess capacity and high levels of unemployment, which could make expansionary fiscal policy more effective in boosting demand and increasing output.

- During an economic expansion, the impact of fiscal policy may be limited due to capacity constraints and supply-side factors.

- The degree of price flexibility: The degree of price flexibility refers to how quickly and easily prices can adjust in response to changes in demand.

- In general, the more flexible prices are, the less inflationary the impact of expansionary fiscal policy will be, and the less deflationary the impact of contractionary fiscal policy will be.

- When prices are less flexible, the impact of fiscal policy on inflation and deflation is likely to be more pronounced.

- The extent of crowding out: Crowding out occurs when increased government spending crowds out private investment, leading to a reduction in the overall impact of fiscal policy.

- The extent of crowding out will depend on a number of factors, including the state of the economy, the level of interest rates, and the effectiveness of government spending.

- The effectiveness of government spending

- For example, if government spending is inefficient or ineffective, the impact of expansionary fiscal policy may be limited, even if it results in increased demand.

- If government spending is well-targeted and effective, the impact of expansionary fiscal policy is likely to be more pronounced.

- The time horizon: The time horizon over which fiscal policy is being implemented can also affect its impact on the economy.

- In the short run, fiscal policy is likely to have a more immediate impact on the economy, but in the long run, the impact of fiscal policy will depend on factors such as the state of the economy, the degree of price flexibility, and the effectiveness of government spending.

- The state of the economy

Join the conversation