Content

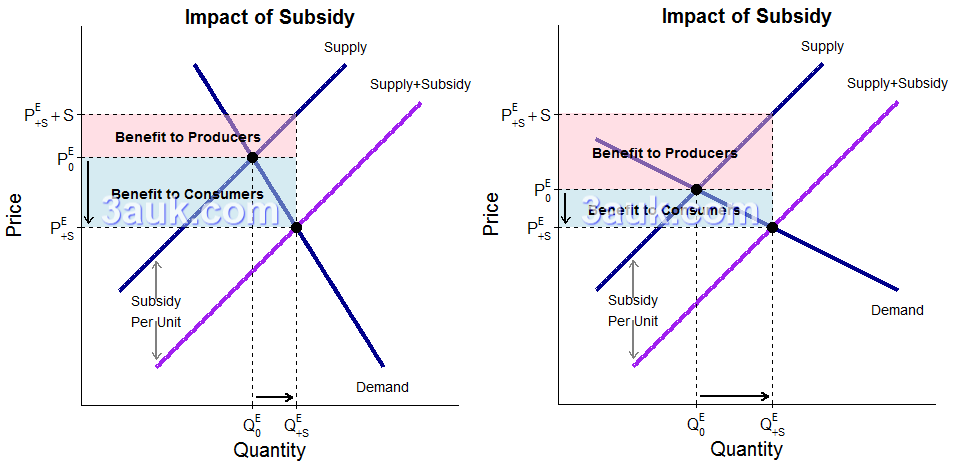

impact and incidence of subsidies

- Subsidies are government transfers to firms or individuals that aim to promote a specific economic activity or support a specific group of people.

- The impact and incidence of subsidies refer to the effects of the subsidies on different groups in the economy.

- The incidence of a subsidy refers to who ultimately benefits from the subsidy.

- The incidence of the subsidy will depend on the elasticity of demand and supply and on the structure of the market.

- In general, the benefits of the subsidy will be shared between consumers and producers, with the degree of sharing depending on the responsiveness of demand and supply to changes in price.

- For example, consider a subsidy for the production of a good.

- If the good is highly inelastic, meaning that the quantity demanded does not change much in response to changes in price, the incidence of the subsidy will fall mainly on producers, who will face higher profits.

- If the good is highly elastic, meaning that the quantity demanded changes greatly in response to changes in price, the incidence of the subsidy will fall mainly on consumers, who will pay lower prices.

- For example, consider a subsidy for the production of a good.

direct provision of goods and services

- The direct provision of goods and services by the government refers to the direct supply of goods and services to the public.

- This can be accomplished through the creation of public enterprises or the provision of goods and services directly by the government.

- Direct provision by the government can help ensure that merit goods are available to everyone, regardless of their ability to pay. This can help address the under-consumption of merit goods that can occur in a market economy.

- Direct provision by the government can help ensure public goods are provided and maintained for the benefit of everyone, regardless of their ability to pay. This can help address the non-provision of public goods that can occur in a market economy.

- The effects of the direct provision of goods and services depend on several factors, including the efficiency of the government in providing the goods and services, the level of funding provided, and the demand for the goods and services.

- Efficiency: Direct provision of goods and services by the government can lead to higher efficiency if the government has the necessary resources and expertise to provide the goods and services effectively. However, if the government lacks the resources and expertise, the provision of goods and services may be inefficient, resulting in higher costs and lower quality.

- Funding: The level of funding provided for the direct provision of goods and services will affect the quality and availability of the goods and services. If the government provides adequate funding, the provision of goods and services will be of high quality and widely available. If the government does not provide adequate funding, the provision of goods and services may be of low quality and may not be widely available.

- Demand: The demand for goods and services will also affect the provision of goods and services. If the demand for a good or service is high, the government may need to increase its provision of the good or service to meet the demand. If the demand for a good or service is low, the government may need to reduce its provision of the good or service to ensure that it is cost-effective.

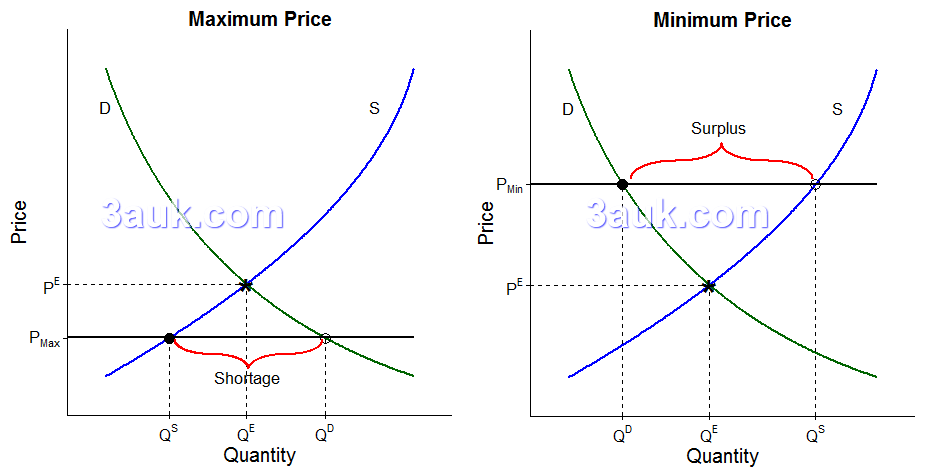

maximum and minimum prices

| MAXIMUM PRICES | MINIMUM PRICES |

|---|---|

| a price ceiling is established below equilibrium price, creating a shortage. | a price floor is established above equilibrium price, creating a surplus. |

| affordable essentials | Demerit goods |

| Rent control | Proper wages |

| Restriction of fares | Import reduction |

| More affordable to the poor | dependent |

| Queueing | Unemployment |

| Corruption | Smuggling |

| Black market | Inefficiencies |

- Maximum Prices: also known as price ceilings, are legal limits on the maximum price that can be charged for a good or service.

- This type of intervention is used when the government believes that market prices are too high and that consumers are being exploited.

- For example, the government might impose a maximum price on necessities such as food or medicine during times of scarcity to prevent prices from skyrocketing and to protect consumers from price gouging.

- The effect of a maximum price is to limit the price that a seller can charge for a good or service, which can lead to shortages and reduced supply as producers are unwilling to supply the good or service at the lower price.

- Minimum Prices: also known as price floors, are legal minimums on the price that can be charged for a good or service.

- This type of intervention is used when the government believes that market prices are too low and that producers are not being paid a fair price for their goods or services.

- For example, the government might impose a minimum price on agricultural products to ensure that farmers receive a minimum income.

- The effect of a minimum price is to increase the price that a seller can charge for a good or service, which can lead to surpluses and overproduction as producers are willing to supply the good or service at the higher price.

buffer stock schemes

- Buffer stock schemes are a method of government intervention in markets that aim to stabilize the prices of goods and services and to ensure their availability to consumers.

- The basic idea of a buffer stock scheme is to store a stock of a good or service in order to smooth out fluctuations in its supply and demand and to provide a reliable source of the good or service when it is needed.

- The basic idea of a buffer stock scheme is to store a stock of a good or service in order to smooth out fluctuations in its supply and demand and to provide a reliable source of the good or service when it is needed.

- Methods:

- A buffer stock scheme operates by purchasing a good or service when the price is low and releasing it onto the market when the price is high. This helps to regulate the supply and demand of the good or service and to prevent price fluctuations from becoming too extreme.

- The buffer stock can be funded by government or by a combination of government and private sector investment.

- Effects:

- The effects of a buffer stock scheme can include stabilizing the prices of goods and services, reducing price volatility, and ensuring the availability of the good or service to consumers.

- By smoothing out fluctuations in supply and demand, buffer stock schemes can help to reduce the risk for producers and to improve the predictability of prices for consumers.

- Buffer stock schemes can also help to improve the stability and resilience of markets, by providing a reliable source of the good or service in times of scarcity or crisis.

provision of information

- The provision of information in markets is a method of government intervention that aims to improve the functioning of markets by increasing the transparency and availability of information to market participants.

- Methods:

- Provision of information in markets can take many forms, including the creation and dissemination of market reports, price indices, and other statistical data; the establishment of consumer protection agencies that provide information and advice to consumers; and the regulation of advertising and marketing practices.

- Governments can also provide information to market participants through public education and awareness campaigns, and by promoting the use of new technologies, such as online marketplaces, that can increase the flow of information in markets.

- Effects:

- Improving the functioning of markets: By increasing the transparency and availability of information, provision of information in markets can help to reduce information asymmetry and to improve the efficiency of markets.

- Enhancing consumer welfare: Providing consumers with information about the quality, safety, and availability of goods and services can help them to make more informed and better decisions, and to avoid being misled or exploited by unscrupulous providers.

- Encouraging fair competition: Provision of information can help to level the playing field for market participants and to prevent dominant firms from using their market power to engage in anti-competitive practices.

- Promoting innovation: Provision of information about new technologies, products, and services can stimulate innovation and encourage the development of new markets.

- Improving the functioning of markets: By increasing the transparency and availability of information, provision of information in markets can help to reduce information asymmetry and to improve the efficiency of markets.

Join the conversation