Content

tools of monetary policy: interest rates, money supply and credit regulations

- Interest Rates: The central bank can set short-term interest rates, such as the federal funds rate in the United States, to influence borrowing and lending by banks and other financial institutions.

- By raising interest rates, the central bank can decrease borrowing and spending, which can help control inflation. Conversely, by lowering interest rates, the central bank can encourage borrowing and spending, which can help stimulate economic growth.

- Money Supply: The central bank can control the supply of money in an economy by buying or selling government securities in the open market.

- When the central bank buys government securities, it injects money into the economy, increasing the money supply.

- Conversely, when the central bank sells government securities, it removes money from the economy, decreasing the money supply.

- Credit Regulations: The central bank can also use credit regulations, such as reserve requirements or capital adequacy standards, to influence the lending behavior of financial institutions.

- By increasing reserve requirements, the central bank can reduce the amount of money that banks have available to lend, which can help control inflation.

- Conversely, by decreasing reserve requirements, the central bank can increase the amount of money that banks have available to lend, which can help stimulate economic growth.

- Exchange Rate: In some countries, the central bank can influence the exchange rate by buying or selling foreign currencies in the foreign exchange market.

- By buying foreign currency, the central bank can increase the demand for that currency, causing its value to appreciate relative to the domestic currency.

- Conversely, by selling foreign currency, the central bank can decrease the demand for that currency, causing its value to depreciate relative to the domestic currency.

- This can affect the competitiveness of domestic goods and services in the global market, which can influence economic activity and inflation.

distinction between expansionary and contractionary monetary policy

- Expansionary monetary policy refers to the actions taken by the central bank to increase the supply of money and credit in the economy, typically by reducing interest rates or purchasing government securities.

- The goal of expansionary monetary policy is to stimulate economic growth and reduce unemployment by making it easier for individuals and businesses to borrow and spend.

- Contractionary monetary policy refers to the actions taken by the central bank to decrease the supply of money and credit in the economy, typically by raising interest rates or selling government securities.

- The goal of contractionary monetary policy is to slow down the economy and control inflation by making it more difficult for individuals and businesses to borrow and spend.

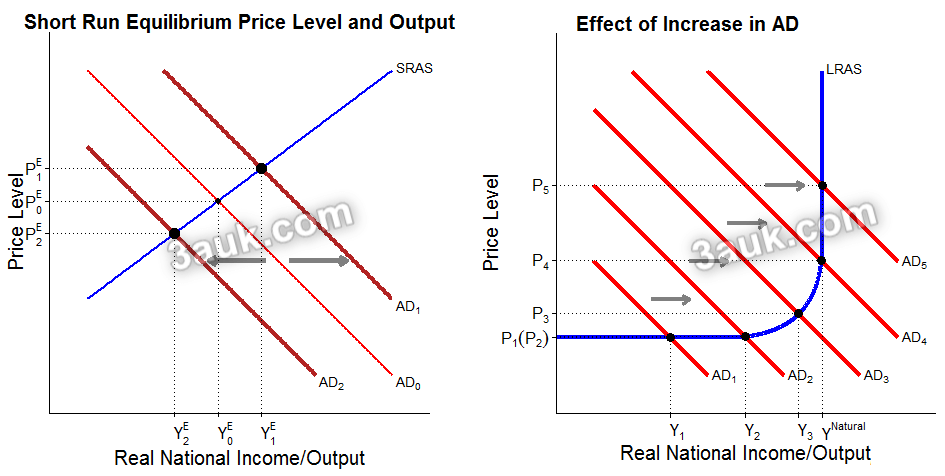

AD/AS analysis of the impact of expansionary and contractionary monetary policy

The impact of expansionary monetary policy on the AD/AS model:

- The reduction in interest rates or increase in the money supply shifts the AD curve to the right, increasing the level of national income and real output.

- The increase in demand for goods and services can lead to an increase in the price level (inflation) if the economy is operating at full capacity.

- However, if the economy has spare capacity, the increase in demand can lead to an increase in real output without causing inflation.

- The increase in national income and real output can lead to an increase in employment as businesses increase production to meet the higher demand.

The impact of contractionary monetary policy on the AD/AS model:

- The increase in interest rates or reduction in the money supply shifts the AD curve to the left, decreasing the level of national income and real output.

- The decrease in demand for goods and services can lead to a decrease in the price level (deflation) if the economy is operating at full capacity.

- However, if the economy has spare capacity, the decrease in demand can lead to a decrease in real output without causing deflation.

- The decrease in national income and real output can lead to a decrease in employment as businesses reduce production in response to lower demand.

The effectiveness of monetary policy depends on

- the responsiveness of individuals and businesses to changes in interest rates and credit availability;

- the state of the economy;

- the impact of monetary policy on the economy may be limited if other factors, such as fiscal policy or external shocks, are dominating;

- unintended consequences, such as creating asset bubbles or exacerbating income inequality;

Join the conversation