Content

different tools of protection and their impact

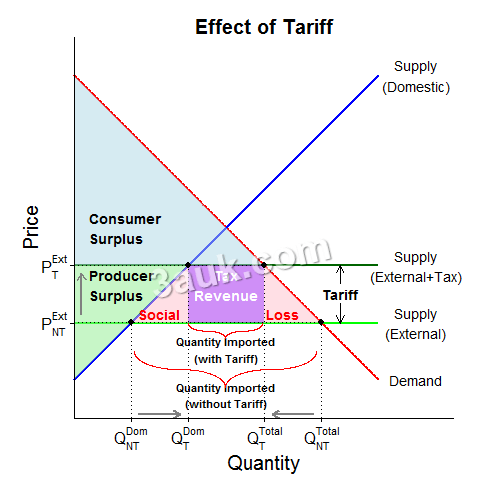

- Tariffs are taxes imposed on imports or exports, which increase the cost of imported or exported goods and make them less competitive with domestically produced goods.

-

- Import tariffs protect domestic industries from foreign competition, but they also raise prices for consumers, reduce consumer choice, and can ultimately harm domestic producers by reducing their incentives to innovate and improve efficiency.

- Export tariffs can lead to reduced exports and harm domestic producers, while increasing government revenue. This can also be used to prevent shortages of certain goods and protect strategic industries.

- Both types of tariffs can lead to retaliation by other countries, which can harm export-oriented industries and ultimately harm the economy as a whole.

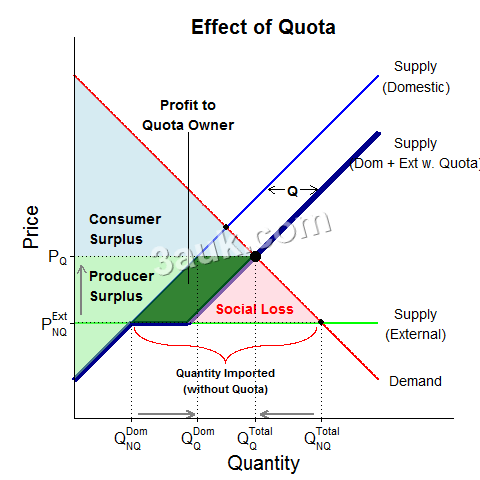

- Import quotas are limits on the quantity of a particular product that can be imported, which reduce competition for domestic producers and protect them from foreign competition.

-

- Import quotas can increase prices for consumers, reduce consumer choice, and ultimately harm domestic producers by reducing their incentives to innovate and improve efficiency.

- Import quotas can also lead to shortages of certain goods, as domestic production may not be able to keep up with demand.

- Export subsidies are financial assistance provided by governments to domestic producers to make their goods more competitive on the global market.

- Export subsidies can increase exports and support domestic industries, but they can also lead to overproduction and distort global markets.

- Export subsidies can also lead to retaliation by other countries, which can harm other domestic industries and ultimately harm the economy as a whole.

- Embargoes are prohibitions on trade with a particular country or group of countries.

- Embargoes can be used for political or economic reasons, such as to protest human rights violations or to pressure a country to change its trade policies.

- Embargoes can harm both domestic and foreign businesses, as they limit market access and reduce economic opportunities.

- Excessive administrative burdens (‘red tape’): Administrative burdens such as excessive paperwork, inspections, and customs procedures can make it difficult or expensive for businesses to import or export goods.

- These burdens can act as a de facto barrier to trade, reducing market access and increasing costs for businesses.

- Excessive administrative burdens can also create corruption and opportunities for rent-seeking, as businesses may seek to bypass or circumvent the burdensome procedures.

- Voluntary export restraints are agreements between exporting and importing countries that limit the amount of goods that can be exported to the importing country.

- Voluntary export restraints can benefit domestic industries by limiting foreign competition, but they can also lead to higher prices for consumers and reduced choice.

- Exchange control refers to government regulations that limit or regulate the buying and selling of foreign currency.

- Exchange controls can be used to protect domestic industries by limiting imports, but they can also lead to shortages of foreign goods and reduce incentives for domestic producers to improve efficiency.

arguments for and against protectionism

Arguments for Protectionism

- Protect infant industries

- Protectionism can be used to shield new or emerging industries that are not yet competitive on a global scale.

- By providing them with a period of protection, the government can help them to develop and become competitive in the long run.

- Protect declining industries

- Protectionism can also be used to protect industries that are in decline or facing competition from abroad.

- This can be seen as a way of preserving jobs and preventing the loss of valuable skills and knowledge.

- Protect strategic industries

- Protectionism can be used to protect industries that are deemed vital to national security, such as defense, energy, or food production.

- By protecting these industries, the government can ensure that the country is self-sufficient and not overly dependent on foreign suppliers.

- Prevent dumping

- Dumping refers to the practice of foreign firms selling their goods in the domestic market at prices that are lower than the cost of production.

- Protectionism can be used to prevent this by imposing tariffs or other barriers to prevent the import of these goods.

- Improve the terms of trade

- Protectionism can be used to improve the terms of trade by increasing the price of exports relative to imports.

- This can be achieved by imposing tariffs or other barriers to imports.

- Improve the balance of payments

- Protectionism can be used to reduce the trade deficit and improve the balance of payments. By restricting imports and promoting exports, the government can increase the inflow of foreign currency and reduce the outflow of domestic currency.

- Protection from cheap labor

- Protectionism can be used to protect workers from being exploited by foreign firms that pay very low wages.

- By restricting imports from countries with low labor standards, the government can ensure that domestic workers are not forced to compete with foreign workers who are paid very low wages.

Arguments against Protectionism

- Reduced competitiveness: Protectionism can lead to reduced competitiveness of domestic industries in the global market. By protecting domestic industries from foreign competition, the government can create a sheltered market that does not encourage innovation, efficiency, and quality improvements.

- Higher prices for consumers: Protectionism can lead to higher prices for consumers, as the cost of imported goods may increase due to tariffs or other barriers. This can harm low-income households, who may be unable to afford essential goods.

- Retaliation: Protectionism can lead to retaliatory actions by other countries, which can harm export-oriented industries and ultimately harm the economy as a whole. This can create a vicious cycle of protectionism, where each country imposes tariffs and other barriers in response to the actions of others.

- Loss of export markets: Protectionism can lead to a loss of export markets for domestic industries, as other countries may retaliate by imposing their own barriers to protect their domestic industries.

- Economic inefficiency: Protectionism can lead to economic inefficiency, as resources may be directed towards less productive industries. This can result in a misallocation of resources, lower productivity, and lower economic growth.

- Increased corruption: Protectionism can create opportunities for rent-seeking and corruption, as companies and individuals seek to influence government policies to protect their interests.

- Reduced consumer choice: Protectionism can reduce consumer choice by limiting the range of imported goods available in the domestic market. This can harm the quality of life for consumers and limit the options available to businesses and households.

Join the conversation