Meta Description: In this comprehensive article, we explain the Harrod-Domar model and its importance in understanding economic growth. We cover the key assumptions, concepts introduced by Harrod, implications, and limitations of the model. Read on to gain a deeper understanding of economic growth and its drivers.

Keywords: Harrod-Domar model, economic growth, investment, savings, production function, capital-output ratio, balanced growth, unbalanced growth, underemployment equilibrium, policymakers, technology.

Introduction

Economic growth is a crucial aspect of any country’s development. It represents an increase in the production of goods and services and is measured by the percentage change in a country’s real GDP. The Harrod-Domar model is a widely used tool for understanding the relationship between investment, savings, and economic growth. In this article, we will explain the Harrod-Domar model and its key assumptions, concepts, implications, and limitations.

What does the Harrod-Domar model state?

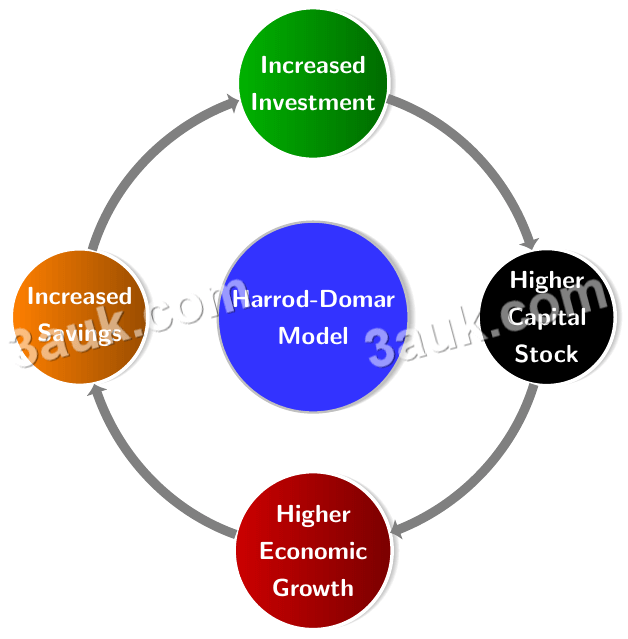

The Harrod-Domar model states that the rate of economic growth is directly proportional to the rate of savings and inversely proportional to the capital-output ratio. In other words, the model suggests that for economic growth to occur, a country needs to increase its investment and savings rates. The higher the investment and savings rates, the higher the economic growth rate. Additionally, the model suggests that the more efficient a country is at producing output, the higher its economic growth rate will be.

The importance of growth model

The Harrod-Domar model is important because it provides a framework for understanding the relationship between investment, savings, and economic growth. The model suggests that the key drivers of economic growth are investment and savings rates. By increasing these rates, countries can increase their economic growth rates and achieve higher levels of development. The model is also useful for policymakers as it provides guidance on the optimal levels of investment and savings needed to achieve desired levels of economic growth.

Key assumptions of the Harrod-Domar model

The Harrod-Domar model is based on several key assumptions. Firstly, it assumes that there is a fixed capital-output ratio, meaning that a certain amount of capital is required to produce a certain amount of output. Secondly, the model assumes that the rate of technological progress is constant over time. Finally, the model assumes that there is a constant level of labor force and that the labor force is fully employed.

The three growth concepts Harrod introduced

Harrod introduced three growth concepts: warranted rate of growth, natural rate of growth, and actual rate of growth. The warranted rate of growth is the rate of economic growth that is consistent with full employment and a stable capital-output ratio. The natural rate of growth is the rate of economic growth that is consistent with full employment but assumes a changing capital-output ratio. Finally, the actual rate of growth is the rate of economic growth that a country achieves.

Implications of Harrod-Domar model

The implications of the Harrod-Domar model are that countries need to focus on increasing their investment and savings rates to achieve higher rates of economic growth. Additionally, the model suggests that countries need to improve their efficiency in producing output to achieve higher rates of economic growth. Finally, the model implies that countries need to maintain full employment to achieve their desired rates of economic growth.

Limitation of Harrod-Domar model

- The model assumes that the production function is homogeneous of degree one, which may not be true in reality.

- The model assumes a fixed capital-output ratio, which may not hold in the long run.

- The model assumes a constant savings rate, which may not hold in reality.

- The model assumes a constant investment rate, which may not hold in reality.

- The model does not take into account the role of technology in economic growth.

Conclusion

In conclusion, the Harrod-Domar model is an important economic growth model that provides a framework for policymakers to develop policies that promote economic growth. The model highlights the importance of investment and savings in an economy and has several implications for policymakers. However, the model has several limitations and does not take into account the role of technology in economic growth.

Read more on related topics of economic growth here.