So, you want an economy that’s stronger, richer, and generally less… grumpy? Forget quick fixes and sugar rushes. Today, we’re diving into the economic equivalent of a gym membership and a really good meal plan: supply-side policies. I know, I know, “economics” can sound about as exciting as watching paint dry, but trust me, we’ll keep it fun. Think of me as your witty, slightly sarcastic tour guide through the thrilling world of national output.

Understanding Supply-Side Policies: Beyond Short-Term Fixes

Let’s be real. When someone says “economics,” most folks picture frantic traders yelling on a stock exchange or politicians arguing about deficits. But there’s a whole other side to the story, one that’s less about jiggling the immediate buttons and more about building a better machine. That’s where supply-side policies waltz in.

Imagine your country’s economy as a giant, slightly creaky factory. Demand-side policies (like government spending or cutting taxes to make people buy more stuff) are basically like shouting, “More orders! Pick up the pace!” And sure, that works for a bit. But eventually, the factory runs into its limit.

Supply-side policies, however, are all about upgrading the factory itself. We’re talking new, shiny robots, superstar engineers, better conveyor belts, and maybe even a zen garden for the workers to boost morale. The goal? To make that factory fundamentally better, so it can churn out more, higher-quality goods and services, more efficiently, and without breaking a sweat (or the bank). It’s about increasing the productive capacity and efficiency of the economy for the long haul. You feel me?

The LRAS Curve: A Key to Understanding Economic Potential

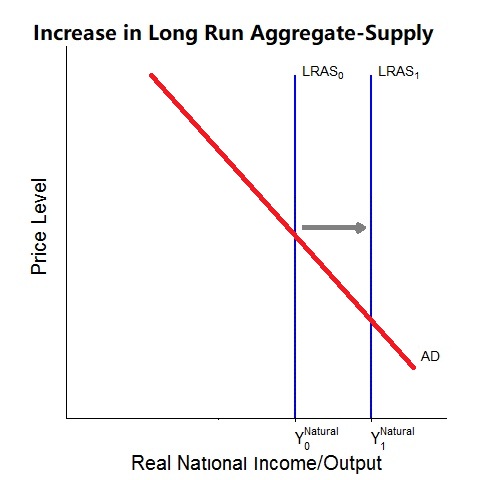

Now, for a quick date with our friend, the Long-Run Aggregate Supply (LRAS) curve. Don’t run screaming. This concept is actually pretty cool. The LRAS curve is essentially the economy’s “speed limit.” It shows the absolute maximum amount of stuff (goods and services) an economy can produce when all its resources—every worker, every machine, every bit of land—are working as hard and as smart as they possibly can. Since this maximum potential isn’t swayed by how much things cost right now, it’s drawn as a proud, unwavering vertical line.

So, what do our beloved supply-side policies do to this stoic line? They pick it up and elegantly shift it to the right. Mind blown, right? A rightward shift means the economy can now produce even more stuff, permanently. It’s like your factory upgrading its capacity from 100 widgets an hour to 150. This is the holy grail: sustained economic growth without getting all hot and bothered with inflation. Because if you can produce more, you can meet demand without prices soaring. It’s the economic equivalent of having your cake and eating it too, then being able to bake another one.

Discover more about the fundamental concepts of economics, including scarcity, production possibility curves, and resource allocation, in our CAIE AS Level Economics guide.

Core Objectives of Supply-Side Policies: Productivity and Capacity

So, why are governments so obsessed with these policies? What’s the endgame?

Increasing Productivity: Smarter, Not Just Harder

First up, increasing productivity. This isn’t just a corporate buzzword; it’s about how much output we get from a given input. If you’re a baker and you can make 10 cakes an hour, but suddenly you get a fancy new oven and can make 20, your productivity has doubled. In a country, this means generating more wealth with the same amount of effort. How?

- Improving the efficiency of factors of production: This mouthful just means getting more bang for your buck out of labor (workers) and capital (machines, buildings). We’re talking education and training programs that turn average Joes into coding wizards or master electricians. Or investing in shiny new tech: an automated production line doesn’t just look cool; it makes more stuff faster than its manual predecessor.

- Innovation and research and development (R&D): This is where the magic happens. Think government grants for scientists to invent cold fusion (okay, maybe not that far yet) or tax breaks for companies creating the next iPhone. Innovation leads to new tech, new processes, and suddenly, we’re all producing more with less effort. Remember the internet? That was an R&D game-changer.

Increasing Productive Capacity: Growing the Economic Pie

Secondly, we want to crank up the productive capacity. This is simply the maximum amount an economy can produce. It’s not just about making the factory work better; it’s about making the factory bigger.

- Increasing the availability of factors of production: More workers, more machines, better roads! This means policies that encourage a larger workforce (maybe through immigration, which—as noted by the Brookings Institute and Economic Policy Institute—actually boosts both labor supply and aggregate demand [1, 2]), or incentives to build more factories. Infrastructure, like those super-fast fiber optic cables or new highways, makes our economy run smoother and bigger.

- Encouraging investment: Governments want businesses to open their wallets and invest in new tech, expand their operations, and hire more people. Tax cuts, grants, or simply making it easier to start a business (less red tape, anyone?) can unleash a wave of entrepreneurial spirit. More investment means more capital assets, which means, you guessed it, more capacity to produce.

- Entrepreneurship: Making it easier for people to go from “hmm, I have an idea” to “I OWN MY OWN BUSINESS” is a huge part of this. Less bureaucracy, easier access to funding, and a culture that celebrates risk-takers because they’re creating competition and making things better.

Tools of Supply-Side Policy: Government’s Arsenal

So, how do governments actually do all this? They’ve got a whole utility belt of tools.

Investment in Human Capital: Empowering the Workforce

Investing in people is like giving your factory workers superpowers.

- Training and education: From making sure kids learn to read, to vocational training that turns mechanics into mechatronics engineers, to university degrees that spawn the next tech billionaires. It’s all about ensuring the workforce has the skills needed for today and tomorrow. Government-funded apprenticeships are a classic example.

- Lifelong learning initiatives: Because who wants to be obsolete by 40? Subsidies for adult education and online courses keep workers sharp and adaptable.

Investment in Physical Capital and Infrastructure: Building Foundations for Growth

You can’t have a world-class factory without decent foundations and roads.

- Improving infrastructure: Think shiny new roads (like the $21 billion Brightline West project, zipping folks between Vegas and Southern California, reducing congestion! [3]), bridges, ports, and lightning-fast internet. Good infrastructure means goods move faster, businesses connect easier, and everyone’s happier. Maryland’s $5.9 billion Frederick Douglass Tunnel modernization is all about that capacity and reliability [4].

- Modernizing public utilities: Reliable electricity for those new robot arms, clean water for happy citizens, efficient waste management so we don’t live in a landfill. Projects like Louisiana’s $15.1 billion liquefied natural gas terminal [5] or Tennessee’s Kingston Energy Complex [6] are about ensuring we have the power to run our economic engines. And globally, around 70 nuclear reactors are under construction, showing a massive commitment to long-term energy [7].

Support for Technological Improvement: Fueling Innovation

Technology is the fairy dust of productivity. Governments want to sprinkle that stuff everywhere.

- Incentives for research and development: Tax credits for companies that invent the next big thing, or grants for universities to explore the unknowns. These nudge innovation along.

- Facilitating technology transfer: Helping businesses actually use new tech. Think public-private partnerships or funding for factories to upgrade their antique machinery. The planned $5.5 billion LG Energy Solution plant in Arizona for EV batteries [8]? Or Meta’s $7.5 billion Hyperion Data Centre in Louisiana [9]? Or Amazon’s massive data center expansion in Indiana [10]? These are huge investments in the digital backbone of our future.

Reducing Barriers to Entry and Competition: Streamlining Business

A healthy economy needs competition. It keeps everyone on their toes.

- Deregulation: Cutting unnecessary rules that bog down businesses. But, let’s be clear, we’re talking about unnecessary rules, not abolishing safety standards or environmental protections. We want businesses to thrive, not pollute the river.

- Promoting competition: Breaking up monopolies, encouraging startups, and making sure the big guys don’t crush the little guys. This keeps prices fair and innovation flowing.

Tax and Regulatory Policies: Economic Incentives

Money talks, right? These policies tweak the financial incentives.

- Lowering corporate taxes: The idea: if companies keep more of their profits, they’ll reinvest it, expand, and hire more people. (Whether they actually do that is a topic for another blog post – this one’s getting long!)

- Streamlining regulatory requirements: Ever tried starting a business? The paperwork can be soul-crushing. Making it simpler frees up time and money for actual production.

Labor Market Policies: Adaptable and Efficient Workforces

A nimble workforce is a happy workforce (mostly).

- Improving labor market flexibility: Making it easier for businesses to hire and for workers to switch jobs. This often means reforming employment laws.

- Reducing labor costs: Lowering the burden of employment taxes could encourage more hiring. (Again, lots of debate here, but it’s a tool in the kit.)

- Encouraging Legal Immigration: This isn’t just about charity; it’s about smart economics. Bringing in skilled workers to fill gaps, boost our workforce, and—as those eggheads at Brookings and EPI confirm—stimulate demand [1, 2]. It’s like getting a fresh supply of highly motivated economic superheroes.

AD/AS Analysis: Impact of Supply-Side Policies

Alright, let’s get out our macroeconomics toolkit: the Aggregate Demand (AD) and Aggregate Supply (AS) model. Think of it as a fancy chart that shows the total demand and supply of everything in the economy.

For a foundational understanding of how aggregate demand works, explore our guide: Understanding Aggregate Demand: Your Economy’s Spending Explained.

The AD curve slopes downwards (because when prices are lower, people generally buy more) and the AS curve (specifically the SRAS in the short run) slopes upwards (because businesses can make more profit at higher prices). But our new superstar is the LRAS curve, which, as we established, is perfectly vertical.

Dive deeper into the mechanics of aggregate supply with our comprehensive guide: Aggregate Supply: The Economic Engine Driving What We Produce.

Impact on Equilibrium National Income and Real Output

- Shift in the Aggregate Supply (AS) curve: When supply-side policies work their magic, they improve efficiency and boost capacity. This means the economy can produce more at any given price level. So, our LRAS curve shifts rightward, indicating a bigger potential pie. And often, the short-run AS curve shifts rightward too, because of lower costs or greater efficiency.

- Increased equilibrium real output: What happens when the AS curve shifts right? The point where AD and AS meet (the equilibrium) moves to a new spot, where there’s a higher level of real national output. More goods, more services – ta-da! Economic growth!

Impact on Price Level

- Downward pressure on prices: More stuff being produced, often more efficiently, means there’s more supply to meet demand. This usually puts downward pressure on the general price level, helping to keep inflation in check. It’s like bringing more competitors into a market; prices tend to fall.

Impact on Employment

- Higher employment levels: When businesses expand, produce more, and become more efficient, they typically need more hands on deck. This means a higher demand for labor and, you guessed it, more jobs. Unemployment goes down, people are happier, and the economy hums along.

Long-Run Aggregate Supply (LRAS) Shift: The Holy Grail

- Sustained economic growth: The ultimate prize. A permanent rightward shift of the LRAS curve means the economy’s long-term potential has fundamentally increased. We’re not just growing today; we’re built to grow sustainably, without constantly bumping against capacity limits and driving up prices. It’s like permanently increasing the size of your cake pan.

To see how supply-side policies interact with other macroeconomic tools, check out our guide on Steering the Economic Ship: Navigating Macroeconomic Policy.

Effectiveness and Challenges: Not a Guaranteed Success

Even the best policies have their quirks, and supply-side policies are no exception.

Factors Affecting Effectiveness: The Economic Reality Check

- Time Lags: Building a new highway, educating a generation, or inventing the next internet takes time. Lots of time. You won’t see results tomorrow, or even next year. Some policies need decades to fully blossom.

- Cost: Oh, the cost! High-speed rail, massive training programs, tech subsidies – we’re talking billions. Governments have to juggle these investments with other priorities. (Ask your parents what budgeting is like; then multiply it by a bazillion.)

- Implementation Quality: A brilliant policy poorly executed is just… a wasted effort. An infrastructure project that goes over budget and behind schedule, or a training program that teaches skills nobody needs, is useless.

- Business Confidence: If businesses are feeling gloomy, even tax cuts might not make them invest. If the world feels like it’s ending, why build a new factory?

- External Shocks: A global recession, a pandemic, or a sudden war can throw a wrench into the best-laid plans. You can’t control everything.

Potential Drawbacks and Criticisms: The Fine Print

- Inequality: Hot take: some supply-side policies (like certain tax cuts or deregulation) can sometimes widen the gap between rich and poor if not carefully managed. If the benefits primarily go to corporations or the wealthy, while workers lose protections, then we have a problem.

- Environmental Concerns: Deregulation, if not done with a watchful eye, can lead to companies cutting corners and hurting the environment. We want economic growth, but not at the expense of breathing actual air.

- Social Costs: Policies that reduce welfare or worker protections, often marketed as increasing “flexibility,” can also lead to increased poverty or reduced access to vital services for vulnerable groups. It’s a balancing act.

- Specific Policy Problems: Training programs, while beneficial, can be costly and sometimes lack alignment with market demands. Likewise, deregulation, if not carefully managed, can lead to financial instability or compromise safety standards.

Conclusion: Investing in a Prosperous Future

Look, supply-side policies aren’t the sexiest topic on the block, but they’re incredibly important. They’re about the long game, the strategic investment in making an economy fundamentally better, stronger, and more resilient. No quick fixes here, but rather a commitment to boosting productivity, expanding productive capacity, and fostering a dynamic environment where businesses can thrive.

Yes, they have their challenges – the cost, the time, the potential for inequality if not handled with care. But the payoff? A more competitive, prosperous nation with lower inflation, more jobs, and a higher standard of living for everyone. It’s like building a super-efficient economic engine that just keeps purring.

For A-Level Economics students: This article covers key macroeconomic concepts essential for exams. To further solidify your understanding of economic principles, consider exploring our CAIE A-level Economics (9708) Starter Guide or delve into specific topics with our CAIE AS Level Economics Study Notes.

References

- Brookings Institute on Immigration’s Economic Impact

- Economic Policy Institute on Immigration’s Economic Impact

- Brightline West Project

- Frederick Douglass Tunnel Modernization (Maryland)

- Louisiana LNG Export Terminal

- Kingston Energy Complex (Tennessee)

- World Nuclear Association – Nuclear Power in the World Today

- LG Energy Solution Manufacturing Complex (Arizona)

- Meta Hyperion Data Centre (Louisiana)

- Amazon Data Center Expansion (Indiana)