What is Consumer Surplus?

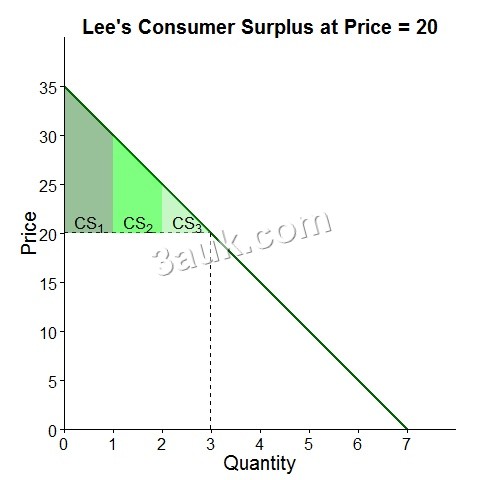

Imagine you’re craving a morning coffee so badly you’d pay up to £5 for that caffeine fix, but the shop only charges £3. That extra £2 of satisfaction you get? That’s consumer surplus in action. Simply put, consumer surplus is the difference between what consumers are willing to pay for a good or service and what they actually pay at the market price. It’s a measure of the benefit buyers receive, often visualized on a supply and demand graph as the area above the equilibrium price and below the demand curve.

For those new to economics, the demand curve slopes downward because not all buyers value the product the same way. Early buyers might pay more, while others wait for lower prices. When you add up all these individual benefits across all buyers, you get the total consumer surplus. This concept highlights how markets can deliver value beyond the sticker price, making everyday purchases feel like small victories. If you’re just starting with A-level economics, check out our beginner’s guide to the price system and microeconomy for a deeper dive into demand and supply basics.

In real life, think about snagging a deal during a sale. That rush you feel is consumer surplus at work, showing how competitive markets reward buyers with unexpected gains.

Why Consumer Surplus Matters in Economics

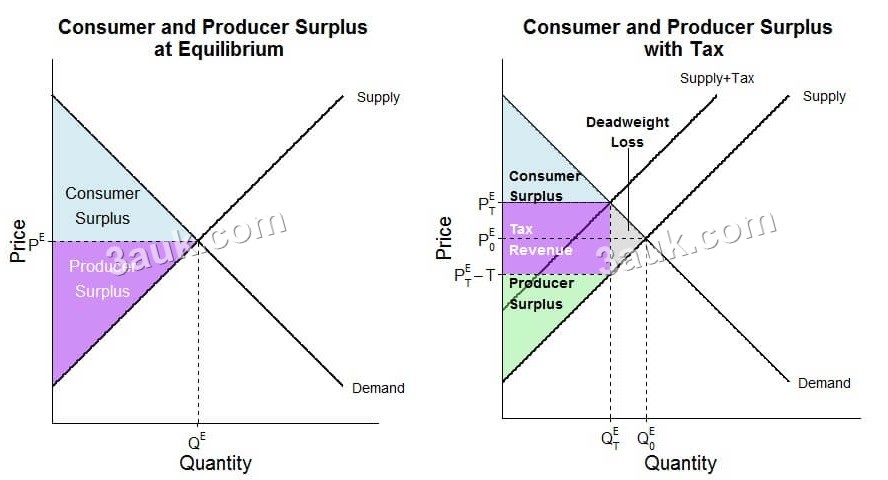

Consumer surplus isn’t just a theoretical idea—it’s a crucial indicator of market efficiency and overall economic welfare. It shows how much extra value consumers extract from transactions, which can lead to increased spending and economic growth. In a well-functioning market, consumer surplus peaks at the equilibrium point, where supply meets demand without any wasted resources.

This surplus plays a big role in policy decisions too. For instance, government subsidies on essential goods like public transport or medications can boost consumer surplus, particularly for lower-income groups, promoting fairness and access. Without considering consumer surplus, markets might exclude large segments of the population, reducing demand and stifling economic activity. To explore how governments intervene to influence these surpluses, our guide on government intervention in markets breaks it down with practical examples.

Consider the streaming service industry in recent years. Even with price increases, competition keeps alternatives viable, preserving consumer surplus compared to outdated monopolies like traditional cable. For students studying economics, understanding the significance of consumer surplus helps explain why free markets and targeted interventions can enhance societal well-being and resource allocation. If you’re preparing for CAIE A-level exams, our starter guide to CAIE A-level Economics offers a friendly overview to build your foundation.

Next time you spot a price drop, like in seasonal sales, think about your own consumer surplus—it might just inspire your next smart purchase.

Exploring Producer Surplus

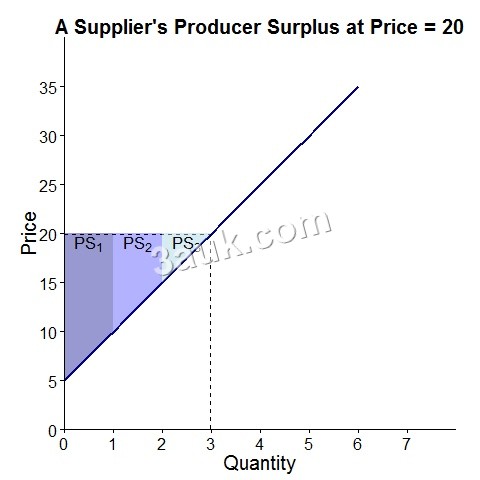

Shifting focus to the other side of the market, producer surplus is the benefit sellers receive. It’s the difference between the price they actually get for their goods and the minimum price they’d accept to cover production costs. On a graph, it appears as the area below the market price and above the supply curve, representing the extra profit producers earn beyond breaking even.

The supply curve slopes upward because producing more requires higher costs, like hiring additional staff or buying materials. For a single unit, producer surplus is the market price minus the cost of production. When aggregated across all sellers, it becomes the total producer surplus, which incentivizes businesses to supply more goods and innovate. For a visual breakdown of how demand and supply interact to create these surpluses, see our beginner’s guide to demand and supply interactions.

Picture a local farmer selling apples. If their costs are £1 per apple but they sell at £3, that £2 surplus can fund better equipment or expansion. This mechanism drives economic activity by rewarding efficiency. For beginners, sketching the supply curve and shading that lower triangle makes it clear: producer surplus keeps the wheels of commerce turning.

In popular terms, it’s like a tech inventor covering development costs but earning far more— that excess fuels further creations.

The Importance of Producer Surplus

Producer surplus is essential for understanding how markets sustain supply and foster growth. It encourages producers to invest in production, research, and development, which in turn creates jobs and keeps products available. Combined with consumer surplus, it forms total surplus, the maximum welfare achievable in a market without inefficiencies like deadweight loss.

In sectors with inelastic supply, such as agriculture, producer surplus acts as a buffer against risks like weather events, promoting stability and long-term investment. Governments often support this through policies like subsidies for renewable energy, which expand the surplus area and encourage sustainable practices.

Look at global events: In 2022, disruptions in grain supplies led to higher prices, increasing producer surplus for farmers elsewhere and helping stabilize food production. This balance is vital—while it benefits sellers, it also ensures goods reach consumers. For economics learners, grasping the significance of producer surplus reveals how competition and policy can optimize market outcomes, from tax impacts to incentives for innovation. Dive into free resources like our CAIE AS Economics topic questions to practice surplus-related scenarios.

Keep an eye on local business stories; a price rise due to supply changes might signal a boost in producer surplus, affecting everything from cafe menus to community economies.

Causes of Changes in Consumer and Producer Surplus

Markets are dynamic, and various factors can alter consumer and producer surplus by shifting the supply or demand curves, which in turn change the equilibrium price and quantity. Understanding the causes of changes in consumer and producer surplus is key to predicting economic outcomes.

A rightward shift in demand, perhaps from a popular trend, raises prices and quantity sold. This can reduce consumer surplus per unit due to higher costs but increase total consumer surplus through more transactions, while producers gain from elevated prices. Conversely, a leftward demand shift, like during a recession, lowers both surpluses as transactions decline.

On the supply side, improvements like technological advances shift the curve right, dropping prices and increasing quantity. Consumers enjoy larger surpluses from affordable goods, and producers may benefit from higher volumes if demand is elastic. Supply disruptions, such as natural disasters, shift left, raising prices and boosting producer surplus at consumers’ expense.

Government interventions add layers: Taxes effectively shift supply left, creating deadweight loss by reducing both surpluses. Subsidies do the opposite, enhancing total welfare. External shocks, like geopolitical conflicts, can have widespread effects—recent energy price surges diminished consumer surplus in many regions while aiding certain producers.

As inflation eases in 2024, recovering supply chains are helping restore consumer surplus without severely impacting producers. Graphing these shifts—comparing before-and-after triangles—illustrates how these causes influence overall market welfare.

How Price Elasticity Influences Surplus Changes

Price elasticity of demand (PED) and price elasticity of supply (PES) determine the magnitude of changes in consumer and producer surplus following market shifts. PED measures how sensitive quantity demanded is to price changes, while PES does the same for supply. The significance of price elasticity of demand and supply lies in how they amplify or dampen surplus variations.

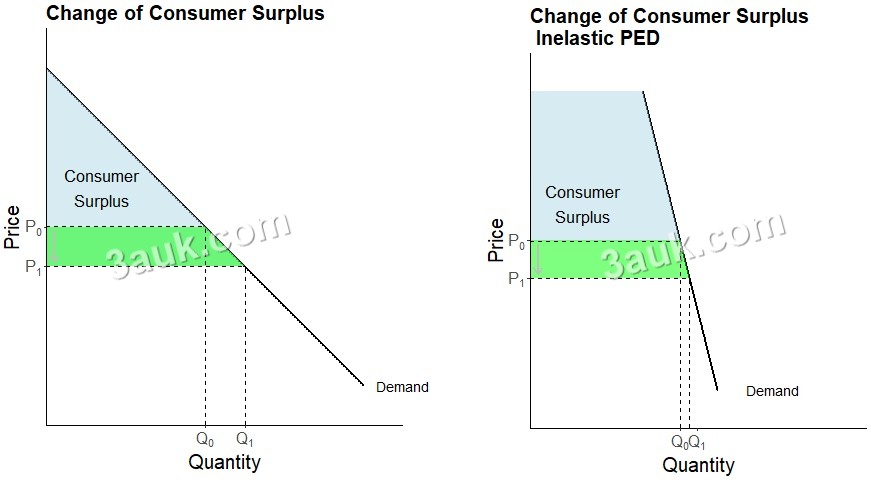

If PED is elastic (greater than 1), a price decrease from increased supply leads to a large demand response, significantly expanding consumer surplus—as seen in travel deals post-pandemic. A price increase causes sharp drops in consumer surplus due to reduced purchases. For inelastic PED (less than 1), like with necessities, quantity changes little, so surplus shifts hit harder per unit without big volume swings. To master PED, our beginner’s guide to price elasticity of demand provides clear explanations and examples.

PES elastic (greater than 1) allows quick supply adjustments, leading to stable producer surplus gains during demand booms, such as in digital goods markets. Inelastic PES (less than 1), common in agriculture or real estate, results in volatile surpluses—shortages can massively inflate producer surplus. Similarly, check out our guide to mastering price elasticity of supply for insights into PES dynamics.

Interactions matter: In oil markets with elastic PED but inelastic PES, supply shocks cause outsized consumer losses. Inelastic combinations, like with taxes on essentials, lead to greater deadweight losses. Here’s a quick overview:

| Elasticity Type | Impact on Surplus Changes | Example |

|---|---|---|

| PED Elastic | Large swings in consumer surplus from price changes | Entertainment tickets |

| PED Inelastic | Smaller quantity changes, bigger per-unit effects | Basic groceries |

| PES Elastic | Rapid supply response, even producer gains | Software products |

| PES Inelastic | Extreme producer surplus fluctuations | Seasonal crops |

Analyzing elasticity builds insight into real-world scenarios. When prices fluctuate, like with fuel, consider the elasticity to gauge surplus impacts—it sharpens economic analysis skills.

FAQ: Quick Insights on Consumer and Producer Surplus

- How do you identify consumer surplus on a graph? It’s the shaded area above the price line and below the demand curve.

- Can producer surplus negatively affect consumers? Yes, if it enables price gouging in less competitive markets.

- What happens to surpluses with a subsidy? Supply shifts right, increasing both consumer and producer surplus overall.

- Why is elasticity crucial for surplus changes? It determines the size of adjustments, affecting total welfare more in elastic scenarios.

- Example of a demand shift increasing surplus? The rise in home fitness equipment during lockdowns boosted both surpluses through higher engagement.

- Is negative surplus possible? No—producers won’t sell below costs, and consumers skip purchases if overpriced.

- How do wars impact surpluses? They disrupt curves, often increasing some producer surpluses while reducing consumer ones in affected areas.

- PED vs. PES: Which affects total surplus more? Inelastic pairs typically cause larger inefficiencies from shocks.

Wrapping Up: The Magic of Surpluses in Markets

Consumer surplus and producer surplus reveal the hidden benefits in every market transaction, influenced by curve shifts and moderated by elasticity. Mastering these concepts equips you to analyze economic policies and events, from price changes to global disruptions. Whether studying for exams or navigating daily decisions, these ideas show why markets create value for all. For more practice, explore our CAIE AS Economics topic questions to test your understanding of advanced surplus applications.

—

References:

– U.S. Energy Information Administration (EIA): Gasoline price data (eia.gov).

– U.S. Department of Agriculture (USDA): Ag surplus and subsidy stats (usda.gov).

– Bureau of Labor Statistics (BLS): Inflation figures (bls.gov).

– International Coffee Organization (ICO): Coffee market reports (ico.org).

– Purdue University Ag Reports: Ukraine impact analysis (ag.purdue.edu).

– St. Louis Federal Reserve: Elasticity and pharma examples (stlouisfed.org).

– McKinsey & Company: E-commerce surplus estimates (mckinsey.com).

– Khan Academy: Basic surplus explanations (khanacademy.org).