Hey, picture the free market as that wild friend at the party—handing out gadgets like iPhones and fancy coffees non-stop—but then it starts monopolizing the snacks and skipping the requests for public parks or affordable vaccines. Total chaos right? That’s when the government swoops in like the cool chaperone, slapping taxes on the bad habits and handing out subsidies for the good ones. If you’re just starting with A-level economics under the CAIE syllabus (sections 3.1 to 3.3), this is your fun, no-stress intro to government intervention in markets. For a broader overview to kick off your studies, check out our Econ, But Friendly: 2025–26 CAIE A‑level Economics (9708) Starter Guide. We’ll break down why they step into market failures, the tools they use, and how they bridge the gap between the haves and have-nots. Kept light and meme-like, because economics should feel as addictive as your favorite binge-watch.

Real talk: Without these interventions, we’d be navigating pothole-riddled streets without maps and arguing over who funds the big fireworks shows. Pulling from real-life cases like the UK’s sugar tax saga, we’ll explore efficiency, equity, and why policies act like essential band-aids—useful, but occasionally irritating. Hang tight; by the end, you’ll critique a minimum wage increase like a seasoned economist dropping TED Talk wisdom.

Core Concepts That Make Sense of the Madness

Think of economics like a blockbuster Marvel flick: the storyline twists and turns, but you need the backstory to keep up. The key concepts from the syllabus are your superhero squad—marginal analysis, efficiency, the role of government, and equality versus equity. Yeah, it might sound as dry as plain toast, but let’s spice it up so your eyes don’t glaze over. To build a strong foundation on basic ideas like scarcity and resource allocation that underpin these concepts, dive into our CAIE AS Level Economics: Scarcity, PPCs and Resource Allocation guide.

Start with marginal decision-making. It’s all about that next step: do you grab one more coffee, or skip it? Governments influence this through taxes or incentives, steering away from harmful choices like lighting up another cigarette. It’s similar to how a bad prank in The Office escalates to HR trouble; government intervention in markets prevents those negative spillovers from affecting everyone.

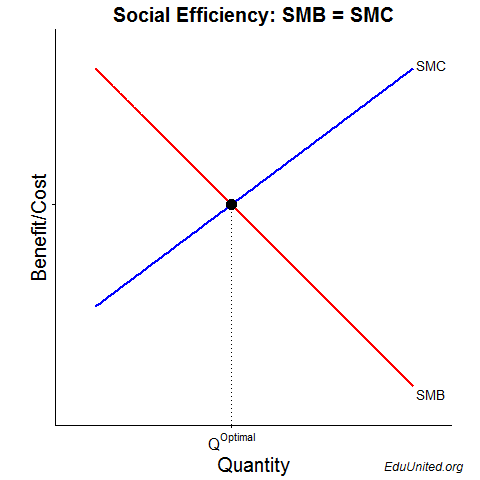

Next, efficiency and inefficiency. Allocative efficiency means society’s getting the perfect mix of goods—no waste, just right quantities where marginal social benefit (MSB) matches marginal social cost (MSC). Productive efficiency is cranking it out at the lowest cost, like clever IKEA assembly tricks. Markets often miss the mark, creating deadweight loss—that’s the lost value from not hitting the social optimum. Inefficiencies are the bad guys, like overfishing until oceans run dry. Cool example: The UK’s plastic bag charge cut usage by 95% since 2015, boosting resource efficiency in a way that feels like a heroic turnaround in Avengers: Endgame.

The government’s big job? Dealing with externalities—those unaccounted side effects, like a neighbor’s smoky barbecue cramping your style (negative) or vaccinations protecting the whole community (positive). They also provide public goods that private markets ignore. And don’t forget equality vs. equity: Equality gives everyone identical tools; equity adjusts for fairness, like giving the shorter person a leg up. Policies blend these to fend off inequality’s slow-burn crisis—where the wealthy stockpile and others struggle.

You tracking? These aren’t just terms to memorize; they’re tools for spotting why a carbon tax succeeds (or stumbles) in fixing market failures. Pro tip: Get these down, and you’ll detect economic flaws quicker than plot twists in a cheesy rom-com.

Example: London’s congestion charge is a prime case of government intervention in markets—a £15 fee to drive in the center reduces traffic congestion (an externality), enhancing overall efficiency, much like upgrading tech in a superhero suit.

Actionable Takeaways:

- Draw MSB/MSC diagrams for policies: Does it bridge the inefficiency gap?

- Chat with friends: Is free higher education true equity or just disguised equality?

- Self-quiz: What’s the marginal cost of your next fast-fashion purchase on the environment? For practice, try our CAIE AS Economics – Topic Questions to test your understanding.

Trust me, these concepts pop up on exams—consider this your heads-up.

Why Governments Play Referee: The Big Reasons for Market Meddling

Markets can be like moody teens: brilliant in bursts, but they dodge responsibilities like providing public goods, overindulge in demerit goods, and freak out over price swings. Enter government intervention in markets from syllabus 3.1—correcting these market failures to promote efficiency and fairness. Skip it, and we’d lack basic streetlights with avocado prices through the roof. Dramatic, huh? Pure dystopia. If you’re new to the price system driving these market dynamics, our CAIE AS Level Economics: The Price System and Microeconomy – Beginner’s Essential Guide is a great next step.

Profit-driven markets overlook broader social benefits, causing under-supply or excess production. Interventions realign supply and demand toward the MSB = MSC ideal. But they’re no fairy tale—bureaucratic downsides and trade-offs exist. For newbies, view it as economic first aid: identify the issue, apply the remedy.

Public Goods: When Markets Ghost the Essentials

Public goods are non-excludable (you can’t block access to fireworks) and non-rivalrous (one person’s enjoyment doesn’t reduce another’s). Markets abandon them because free-riders snag benefits without paying—leading to zero supply and huge inefficiencies. Governments step in with tax funding to ensure provision for all.

Consider national defense: The UK’s £56.9 billion investment in 2023-24 safeguards everyone without private firms billing per missile (UK Ministry of Defence, 2024). Streetlights? No dark-night jogging nightmares thanks to intervention. Pros: Broad access, safer communities. Cons: Higher taxes, risk of wasteful spending.

Effectiveness is high for pure public goods—deadweight loss eliminated. Graph it: Market supply hits zero; government boosts it to meet demand. Equity bonus: Everyone benefits equally, no elite access required.

Demerit Drama and Merit Misses: Curbing Bad Habits, Boosting Good Ones

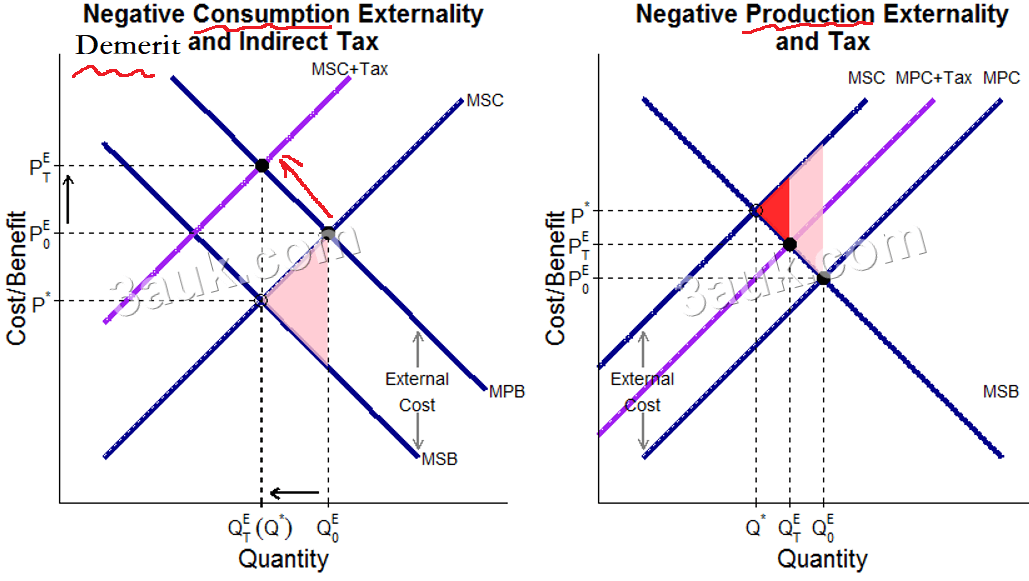

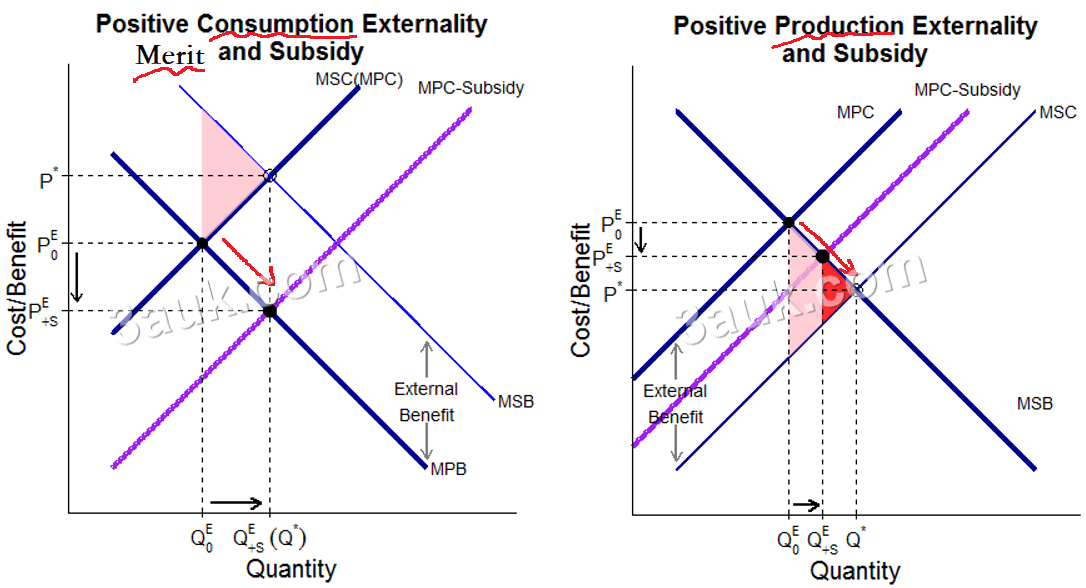

Demerit goods like cigarettes and alcohol see overconsumption because people ignore costs like healthcare burdens (£2.5 billion from smoking in the UK, UK Dept of Health, 2023). Negative externalities make MSB fall short of MSC. Merit goods like education and healthcare are underconsumed due to lack of info or affordability, missing out on benefits like boosted GDP (9-10% per extra year of schooling, OECD 2022).

Government fixes include taxes on demerits to raise prices and subsidies for merits. The UK’s sugar tax reduced purchases by 10%, nerfing unhealthy trends (PHE 2023). Smoking rates dropped to 12.9% with bans (ONS 2023). For merits, free education narrows inequality.

Pros: Shields vulnerable groups, enhances equity. Cons: Potential black markets. Super effective—youth smoking halved since 2010. Marginal nudge: Taxes make you rethink that extra drink, saving societal costs.

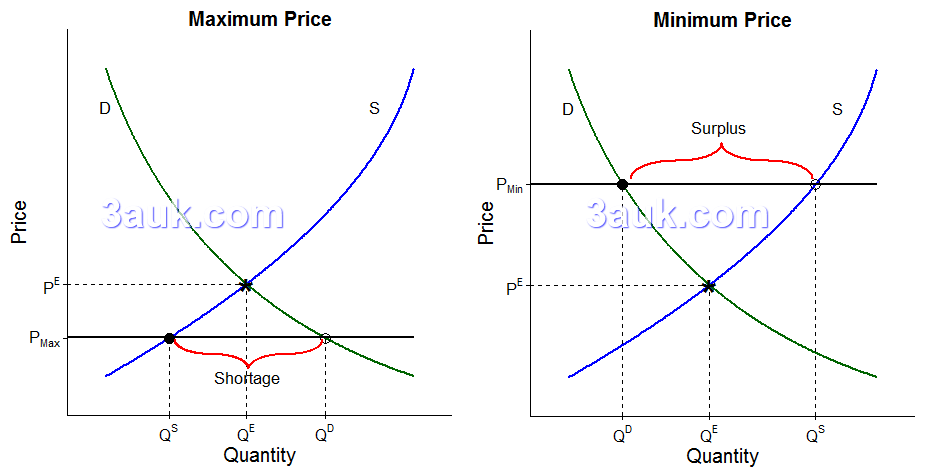

Price Pandemonium: Keeping Essentials from Bankrupting Us

Price volatility from supply shocks (like the Ukraine conflict spiking energy costs) or monopolies hits equity hard—global inflation hit 8.7% in 2022 (IMF 2023). People cut essentials; inefficiency spreads.

Controls like price caps or floors help. The UK’s Ofgem energy cap limited 2023 increases to 28%, protecting households (Ofgem 2023). Agricultural floors support farmers. Pros: Price stability, poverty reduction. Cons: Shortages from caps or surpluses from floors.

Great for short-term relief, but combine with supply improvements for sustainability. India’s rice price controls prevent famines—equity at work.

See the pattern? These market failures demand government intervention in markets, but done wisely to avoid new problems.

Example: Think Jaws—the shark (market failure) terrorizes the beach (society); the sheriff (government) deploys barriers (policies) to restore order.

Actionable Takeaways:

- Identify failures: Public good or externality? Suggest a solution.

- Follow news: How is the UK’s energy cap holding up this winter?

- Assess: Balance equity and efficiency in price control debates.

Tax Tricks and Subs Shenanigans: Fiscal Tools to Tweak the Market

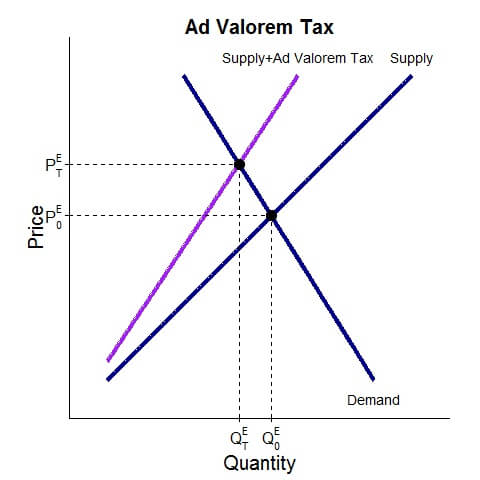

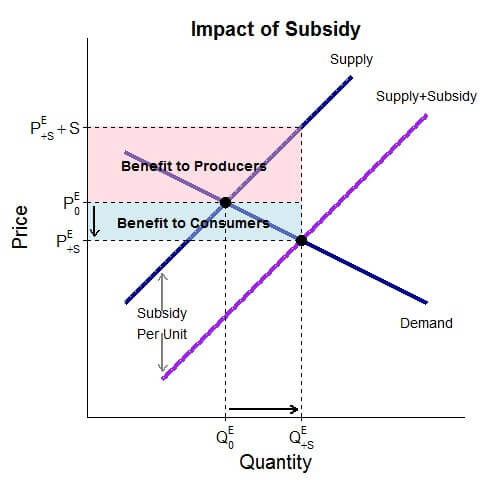

Governments don’t just officiate—they remix the economy like DJs with taxes and subsidies. Syllabus 3.2 covers indirect taxes targeting demerits, subsidies promoting merits, shifting curves to the social optimum. Effects include price and quantity changes; incidence depends on elasticity (inelastic demand? Consumers bear more).

Graphs are key: Taxes shift supply left (higher prices, lower quantity); subsidies right (lower prices, higher quantity). Pros: Correct externalities. Cons: Deadweight loss, disputes over who pays. Let’s break it down engagingly.

Indirect Taxes: The Price-Hiking Heroes (or Villains?)

Taxes on producers for demerit goods raise costs, hike prices, and cut consumption to align with social costs. UK’s cigarette duty pushes packs to £12.50, reducing youth smoking by 14% (PHE 2023). Revenue: £9.3 billion for public health (HMRC 2023).

Incidence: Inelastic addicts absorb most—regressive, hitting low-income harder (bottom 20% spend 10% of income on vices vs. top’s 2%). UK’s carbon tax (£18/tonne) cut emissions 5% (BEIS 2023), environmental win.

Pros: Generates funds for remedies, effective marginal nudges. Cons: Evasion, minor deadweight loss (but beneficial reductions). Sugar tax saw 10% sales drop—health triumph. Equity aid: Rebates for the poor.

Subsidies: The Feel-Good Freebies

These reduce costs for merits or producers, shifting supply right for lower prices and higher quantity where MSB > MSC. EU’s €58 billion agricultural subsidies in 2023 support global food security amid climate challenges (European Commission 2023). UK’s £2.4 billion post-Brexit aids farmers (Defra 2023).

Vaccine subsidies in developing countries boosted uptake 30% (WHO 2023). Incidence: Elastic supply means producers gain; inelastic demand benefits consumers.

Pros: Improves equity (affordable essentials), captures positive externalities. Cons: Budget strains (£100b+ in EU), overproduction risks. UK’s R&D subsidies increased tech output 15% (ONS 2023).

Taxes tackle negatives; subsidies positives—tailor to elasticity for best results. Avoid untargeted ones that favor big firms over small.

Example: Taxes are like a villain-slaying snap, reducing overconsumption; subsidies empower the underdogs, boosting vital supplies.

Actionable Takeaways:

- Estimate incidence: For elastic goods, why do producers pay more?

- Pitch a policy: Subsidize electric vehicles—what are the impacts?

- Research: UK’s plastic tax effects on businesses for real-world evaluation. For deeper dives into these tools, explore our CAIE A2 Economics Study Notes.

Hands-On Hacks: Price Controls, Direct Dives, Buffers, and Info Drops

Taxes not direct enough? Governments get hands-on with syllabus 3.2 tools for volatility, shortages, and uninformed choices. These targeted interventions are fast but can distort markets. Check efficiency (hits social optimum?), equity (fair distribution?), and feasibility (cost-effective?).

Focus on practical applications, like jury-rigging economic fixes. To reinforce with practice questions on these interventions, head to our CAIE A2 Economics – Topic Questions.

Price Ceilings and Floors: Caps and Boosts to Tame the Wild

Ceilings cap prices below equilibrium for affordability—Scotland’s 3% rent cap in 2023 protects tenants in tight markets (Scottish Gov 2023). Drawback: Shortages, fueling black markets; UK’s 4.3 million home shortfall grows (Shelter 2023). Pros: Quick equity. Cons: Reduced investment.

Floors set minimums—UK’s £11.44 living wage in 2024 pulled 2 million from poverty (IFS 2023). Surplus labor possible, but minimal. Job impacts? Negligible (0.2% per 10% rise). Pros: Income support. Cons: Business pressures.

Ideal for crises, but excess use backfires.

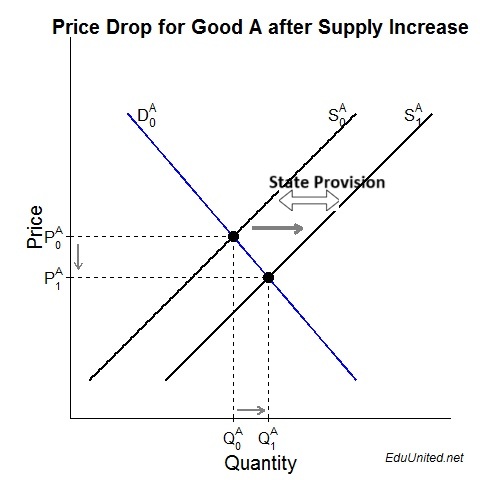

Direct Provision: Gov as the Ultimate Provider

When markets fail, governments deliver directly via taxes—universal access to merit and public goods. The NHS’s £186.4 billion budget in 2023-24 provides free care, adding 10 years to life expectancy since 1948 and 5% productivity gain (OECD 2023; NHS England 2023). Includes libraries and public transport.

Pros: Barrier-free equity, externality internalization. Cons: Long waits (7.6 million NHS backlog 2023). Essential for stubborn market failures.

Buffer Stocks: The Price Stabilizer Stash

For volatile commodities, governments stockpile low and release high—India’s 50 million tonne grain reserve feeds 800 million, costing £4 billion but averting famines (FAO 2023).

Pros: Stabilizes prices, aids the poor. Cons: Storage losses, high costs. Post-2010 coffee buffers smoothed global prices (ICO 2023). Strong for agriculture.

Info Provision: The Cheap Wake-Up Call

Inform consumers to fix ignorance—EU nutrition labels reduced obesity risks 8% (EFSA 2023). UK’s ‘5-a-day’ campaign upped fruit intake 20% (NHS 2023).

Pros: Low-cost, encourages voluntary change. Cons: Ignores fixed behaviors. Enhances other interventions by 15-20%.

Blend these for optimal government intervention in markets, but avoid overkill.

Example: Rent caps mirror sitcom housing squabbles—affordable but shortage-prone, like endless roommate battles.

Actionable Takeaways:

- Simulate: Create a UK milk buffer stock—what outcomes?

- Practice: Read labels to see information provision live.

- Analyze: Is NHS direct provision efficient? Pros and cons.

The Inequality Inferno: Flows, Stocks, and How to Measure the Mess

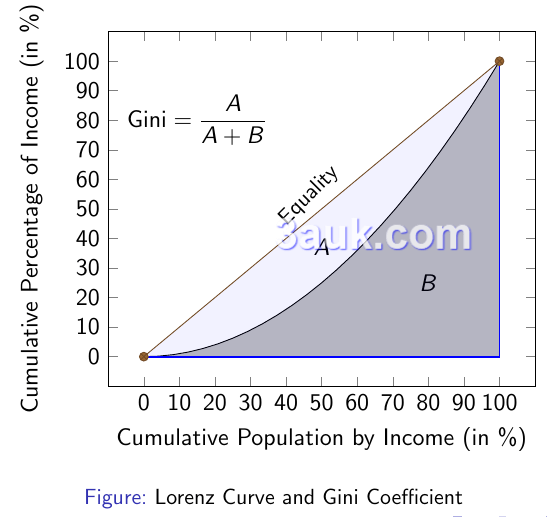

Markets reward winners big-time but leave others behind, fueling inequality as inefficiency’s shadow (wasted potential, 1-2% GDP drag, World Bank 2023). Syllabus 3.3 examines income/wealth divides; government intervention in markets redistributes for equity, balancing incentives.

Income is yearly flow (UK median £35,600, ONS 2023); wealth is accumulated stock (top 10% hold 43% of £14 trillion, ONS 2023). Wealth generates income, perpetuating cycles. Inequality stark: Wealth Gini 0.63 vs. income’s 0.35; inheritance sustains it.

Gini coefficient measures: 0 perfect equality, 1 total disparity. UK’s income Gini 0.329 (2022-23, ONS 2023)—decent after welfare. US 0.41, Sweden 0.28 (World Bank 2023). Lorenz curve bends show gaps; COVID widened, policies narrowed. As IMF’s Georgieva noted, “Inequality chokes opportunity” (2023).

| Country | Income Gini | Wealth Gini (est.) |

|---|---|---|

| UK | 0.329 | 0.63 |

| US | 0.41 | 0.85 |

| Sweden | 0.28 | 0.52 |

Nordics excel; use Gini to evaluate policies—lower means success.

Example: Like a family dynasty drama—vast wealth stock ensures endless income flow for heirs, while others hustle.

Actionable Takeaways:

- Track flows: Monitor your weekly budget to feel inequality.

- Research Gini: Look up yours; brainstorm solutions.

- Visualize: Draw a Lorenz curve to illustrate disparities.

Why the Gap Gapes: Market Mayhem Behind Inequality

Markets prize marginal productivity—skills and risks reap rewards (CEOs earn 300x average, Equilar 2023). But unequal starts amplify: Inheritance accounts for 40% of UK wealth (Resolution Foundation 2023), creating unearned advantages.

Globalization and tech displace low-skill jobs; AI exacerbates (global Gini up 4% since 2000, IMF 2023). Capital outpaces labor. Discrimination adds: Women earn 15% less (ONS 2023), squandering talent. Education divides, luck, too.

This breeds inefficiency (talent loss), inequity (social tension). Unaddressed, it traps in poverty, stalls growth (equality adds 0.5-1% GDP, World Bank). Supply-side view: Uneven inputs yield skewed outputs.

Example: The tech surge is like a startup origin story—one clever idea nets billions; overlooked innovators get nothing.

Actionable Takeaways:

- Reflect: Assess your inheritance advantages (or absences).

- Explore news: AI’s role in UK inequality shifts?

- Debate: Is inheritance tax equitable? List arguments.

Redistribution Remix: Policies to Even the Score

Governments take from peaks, give to valleys—syllabus tools for equity without killing motivation. Nordics combine for Gini around 0.28 (OECD 2023); excess drives capital away.

Minimum wage: UK’s £11.44 base reduces poverty 1.5%, lifting 100k children (IFS 2023). Pros: Spending boost. Cons: Slight unemployment (0.1%), small firm strain.

Transfers: Universal Credit at £260 billion (DWP 2023-24) cuts Gini 20% (ONS 2023). Pros: Precise aid. Cons: Benefit cliffs.

Progressive taxes: 45% top rate, 40% inheritance over £325k, 28% capital gains. Funds 40% welfare (HMRC 2023), trims wealth Gini 5%. Pros: Ability-based. Cons: Dodging, potential revenue dips. IMF suggests 70% top rate ideal.

State services: Free education/health drop effective Gini 25% (IFS 2023). Pros: Levels opportunities. Cons: Delays, tax burdens.

Integrated approach wins—taxes support others; check marginal impacts.

Example: Redistribution is heroic thievery—pilfer from the mighty, aid the needy, minus admin ‘tolls’.

Actionable Takeaways:

- Design mix: UK’s optimal redistribution—rate equity/efficiency.

- Compute: 10% wage rise effect on pay?

- Compare: Sweden’s Gini secrets for ideas.

FAQ: Your Burning Econ Questions, Answered with Sass

- Public good or club good? Public: Free-for-all like defense. Club: Subscription like streaming—markets manage.

- Taxes on demerits: Effective or eye-roll? Highly—UK tobacco tax cut smoking 15%, funds fixes (PHE 2023). Add education to ease gripes.

- Merit vs. demerit: Quick diff? Merits: Undervalued boons like vaccines (big societal wins). Demerits: Overused harms like junk (costly cleanups).

- Buffer stocks: Genius or waste? Genius for security—India’s reserves save lives, despite storage costs (FAO 2023).

- Gini lowdown without math? Inequality gauge: 0=equal shares; 1=one takes all. UK’s 0.329 needs work (ONS 2023).

- Minimum wage = job killer? No—UK rises show tiny effects (0.1-0.2%, Low Pay Commission 2024).

- Progressive taxes: Robin Hood or robber? Equity heroes—tax more from rich, funds 40% welfare (HMRC 2023), but evasion lurks.

- Can policies erase inequality forever? No—markets evolve; target roots like education, ongoing tweaks (IMF 2023).

Wrapping the Econ Rant: Markets Need a Nudge, Not a Nanny

From rescuing public goods to slashing Gini via transfers, government intervention in markets prevents microeconomic meltdowns—efficient, equitable, low-drama. We’ve covered reasons, methods, inequality tackles, with trade-offs like deadweight and disincentives in mind. UK’s NHS equity or Nordic balance? Evidence of smart policies shining. For AS-level beginners looking to build on this, our CAIE AS Level Economics 2025–2026: Beginner’s Essential Guide offers more foundational insights.

A-level starters: Wield marginals and MSB/MSC; analyze like a dystopian plot. Hit past papers, ONS data (ons.gov.uk), Khan Academy visuals. You’re building skills for real-world economies.

You made it through economics awake—now spread the insights.

References

- World Bank. (2023). Poverty and Shared Prosperity Report. https://www.worldbank.org/en/publication/poverty-and-shared-prosperity

- UK Office for National Statistics (ONS). (2023). Household Finances and Inequality. https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth

- International Monetary Fund (IMF). (2023). World Economic Outlook: Inequality Chapter. https://www.imf.org/en/Publications/WEO

- Organisation for Economic Co-operation and Development (OECD). (2022). Education at a Glance. https://www.oecd.org/education/education-at-a-glance/

- UK Ministry of Defence. (2024). Annual Report and Accounts. https://www.gov.uk/government/publications/mod-annual-report-and-accounts

- UK Department of Health and Social Care. (2023). Smoking and Health Statistics. https://www.gov.uk/government/collections/smoking-statistics

- Public Health England (PHE). (2023). Sugar and Tobacco Tax Impacts. https://www.gov.uk/government/organisations/public-health-england

- Ofgem. (2023). Energy Price Cap Report. https://www.ofgem.gov.uk/energy-price-cap

- HMRC. (2023). Tobacco Duty Revenue. https://www.gov.uk/government/statistics

- European Commission. (2023). Common Agricultural Policy Budget. https://ec.europa.eu/info/food-farming-fisheries

- Defra. (2023). UK Agricultural Subsidies. https://www.gov.uk/government/organisations/department-for-environment-food-rural-affairs

- World Health Organization (WHO). (2023). Vaccine Subsidy Effects. https://www.who.int/publications

- NHS England. (2023). Annual Report. https://www.england.nhs.uk/publication/annual-report/

- Food and Agriculture Organization (FAO). (2023). India Buffer Stocks. https://www.fao.org/publications

- European Food Safety Authority (EFSA). (2023). Nutrition Labelling Impact. https://www.efsa.europa.eu/en/topics/topic/food-labelling

- Institute for Fiscal Studies (IFS). (2023). Minimum Wage and Poverty Analysis. https://ifs.org.uk/publications

- Department for Work and Pensions (DWP). (2023). Universal Credit Expenditure. https://www.gov.uk/government/organisations/department-for-work-pensions

- Low Pay Commission. (2024). National Living Wage Report. https://www.gov.uk/government/organisations/low-pay-commission

- Resolution Foundation. (2023). Inheritance and Wealth. https://www.resolutionfoundation.org/publications

- Equilar. (2023). CEO Pay Study. https://www.equilar.com/reports

- Shelter. (2023). UK Housing Shortage. https://england.shelter.org.uk/

- Scottish Government. (2023). Rent Control Policy. https://www.gov.scot/policies/housing-and-regeneration/rent-regulation/

- International Coffee Organization (ICO). (2023). Price Stabilization. https://www.ico.org/

- Department for Business, Energy & Industrial Strategy (BEIS). (2023). Carbon Tax Emissions. (Now DESNZ) https://www.gov.uk/government/organisations/department-for-energy-security-and-net-zero