- Topic Questions (MCQ – EASY): A2 Macro Intervention

- Topic Questions (MCQ – HARD): A2 Macro Intervention

effectiveness of MONETARY policy in relation to different macroeconomic objectives

Economic Growth and Low Unemployment

- Monetary policy can influence economic growth by adjusting interest rates and credit availability. Lower interest rates encourage borrowing and investment, stimulating economic activity and potentially reducing unemployment.

- By controlling money supply and interest rates, the central bank can create conditions that support job creation and reduce unemployment. Lower interest rates can incentivize businesses to expand and hire more workers.

Balance of Payments Stability and Price Stability

- Monetary policy plays a role in maintaining balance of payments stability by influencing the exchange rate. Central banks may intervene in the foreign exchange market to stabilize the currency and manage trade imbalances.

- Price stability is a key objective of monetary policy. By controlling inflation through interest rate adjustments, the central bank aims to maintain stable prices. Lower inflation can enhance economic stability and consumer purchasing power.

Unexpected Responses

- When the central bank adjusts interest rates, its intention is to influence borrowing costs, investment decisions, and overall economic activity. However, the impact of interest rate changes can differ across sectors due to variations in their sensitivity to interest rate fluctuations and the specific conditions they face.

- For instance, a reduction in interest rates can stimulate borrowing and investment in sectors such as housing and construction, as lower borrowing costs make financing more attractive. This can lead to increased construction activity, job creation, and demand for related goods and services.

- On the other hand, sectors that are more interest rate-sensitive, such as financial services or consumer durables, may experience more pronounced changes in demand and investment in response to interest rate adjustments.

- Additionally, the responsiveness of economic agents to changes in interest rates can be influenced by factors such as consumer confidence, market expectations, and the overall economic climate.

- If consumers and businesses perceive interest rate changes as temporary or lacking credibility, their behavioral responses may be limited, dampening the desired effects of monetary policy.

- Furthermore, unanticipated outcomes can arise from interactions between different sectors and their interconnectedness within the economy.

- For example, a change in interest rates that spurs investment in one sector may have spillover effects on other sectors through supply chain linkages or changes in input costs. These interdependencies can lead to complex and sometimes unexpected adjustments throughout the economy.

The occurrence of unexpected responses highlights the challenges faced by policymakers in predicting and managing the full range of economic dynamics. It emphasizes the importance of continuously monitoring and analyzing the effects of monetary policy to ensure its effectiveness and make timely adjustments when necessary.

- Policymakers rely on a range of economic indicators, data analysis, and feedback from various stakeholders to better understand the potential responses and mitigate any adverse consequences that may arise.

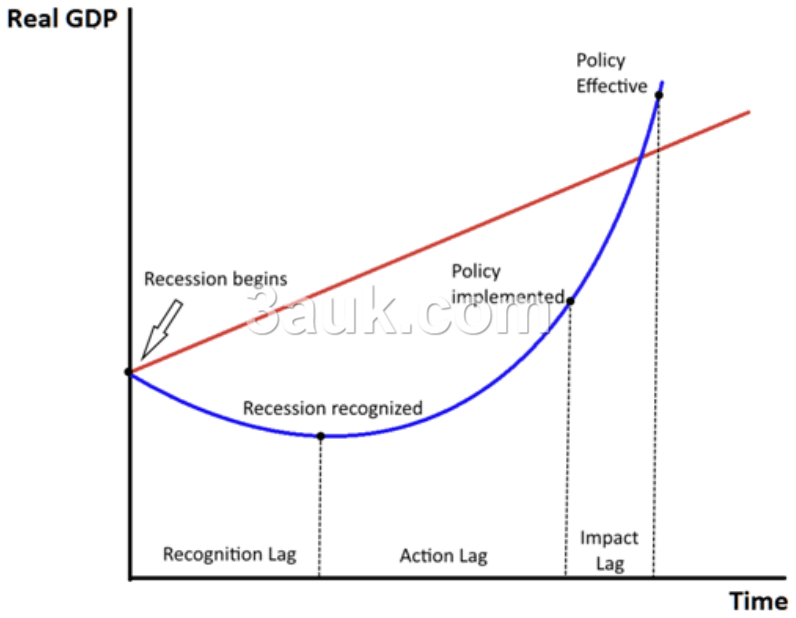

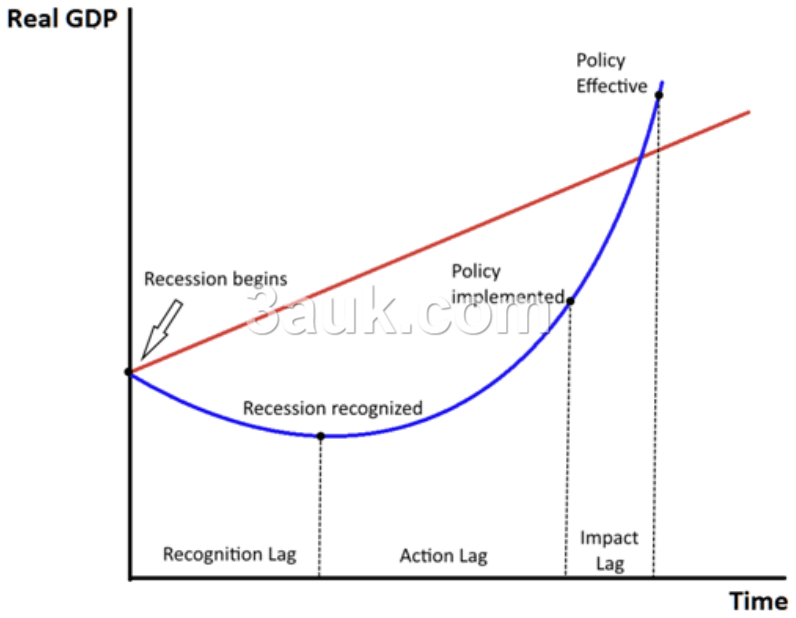

Time lags

- Time lags are inherent in the transmission of monetary policy. It takes time for policy changes to influence the economy. Long and variable time lags can make the impact of monetary policy less immediate and predictable.

- Monetary policy generally exhibits a shorter time lag compared to fiscal policy. Adjusting interest rates can be implemented relatively quickly, whereas modifying tax rates, government spending, and obtaining legislative approval for these adjustments can be a lengthier process.

Response of Commercial Banks

- Commercial banks play a crucial role in the transmission of monetary policy. When the central bank adjusts interest rates, commercial banks respond by adjusting their lending rates, affecting borrowing costs for businesses and individuals.

- The availability of credit and willingness of commercial banks to lend can impact the effectiveness of monetary policy. If banks become more risk-averse or face funding constraints, they can be reluctant to lend more, thus limit the impact of policy measures.

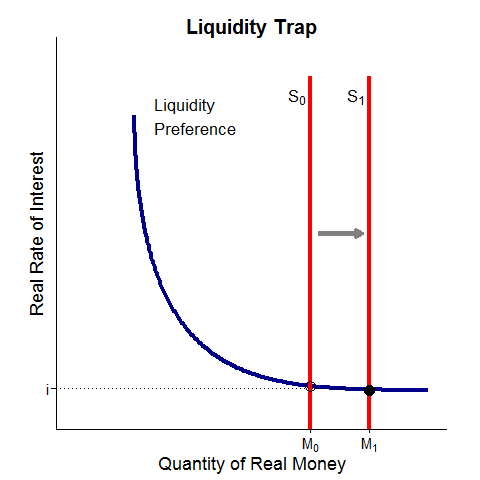

Liquidity trap

- A liquidity trap occurs when monetary policy becomes ineffective due to very low interest rates and a lack of responsiveness in investment and borrowing.

- In such situations, individuals and businesses may prefer holding cash rather than investing or spending, limiting the impact of monetary policy on stimulating the economy.

Influences of Changes in Other Countries:

- Changes in monetary policy by other countries can affect the effectiveness of domestic monetary policy. International capital flows, exchange rate movements, and interest rate differentials can influence domestic economic conditions and the transmission mechanism of monetary policy.

Mobility of Financial Investment

- Capital flows can be influenced by interest rate differentials between countries, affecting exchange rates and domestic economic conditions. Unanticipated capital flows can complicate the control of domestic monetary conditions.

Coordination between Monetary and Fiscal Policies

Coordination between monetary and fiscal policies is important to achieve macroeconomic goals.

If the monetary and fiscal authorities are not coordinated, their policies may work against each other, resulting in unintended consequences.

- For example, if the government is pursuing an expansionary fiscal policy by increasing its spending and lowering taxes, while the central bank is pursuing a contractionary monetary policy by increasing interest rates, it can result in reduced private investment and lower economic growth.

On the other hand, if both the government and the central bank coordinate their policies, they can work together to achieve a balanced macroeconomic environment.

- For instance, if the government is increasing spending, the central bank may keep interest rates low to stimulate borrowing and investment, which can lead to higher economic growth.

The effectiveness of fiscal policy and monetary policy relies heavily on the ability of government and central bank authorities to evaluate the current state of the economy and anticipate future economic activity. However, both types of policies can face challenges when unexpected demand-side and supply-side shocks occur.

- For instance, a central bank may predict an upcoming economic expansion and decide to increase interest rates to moderate future aggregate demand growth. However, if a global recession occurs during the time it takes for the interest rate change to impact aggregate demand, the economy may face a deeper recession than initially anticipated.

These unanticipated shocks can disrupt the intended outcomes of fiscal and monetary policies, underscoring the need for flexibility and adaptation in economic policymaking.

effectiveness of SUPPLY-SIDE policy in relation to different macroeconomic objectives

Market-Based Supply-Side Policy refers to a set of economic measures and interventions aimed at promoting economic growth and improving productivity by creating a favorable environment for businesses and individuals to operate within a free market system.

These policies typically involve reducing government intervention and regulations, lowering taxes, promoting competition, and encouraging innovation and entrepreneurship. Here are a few examples of market-based supply-side policies:

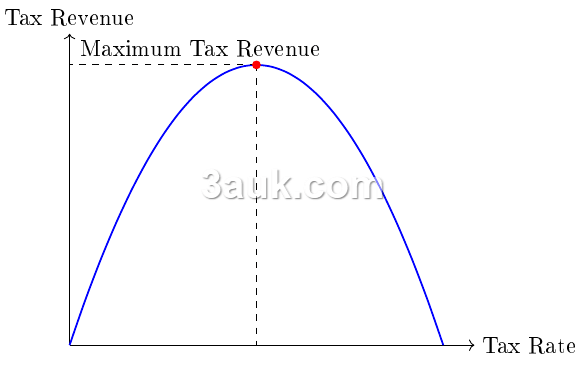

- Tax Cuts: Governments can implement tax cuts, such as reducing corporate income tax rates or lowering personal income tax rates, to provide individuals and businesses with more disposable income.

- This can incentivize investment, encourage consumer spending, and stimulate economic growth.

- Deregulation: Governments can streamline regulations and reduce bureaucratic barriers to make it easier for businesses to start, operate, and expand.

- Removing unnecessary regulations can foster competition, promote innovation, and encourage new market entrants.

- Trade Liberalization: Opening up international trade through agreements and reducing trade barriers, such as tariffs and quotas, can increase market access for domestic businesses, leading to greater export opportunities and increased competition.

- This can drive economic growth and improve efficiency.

- Investment Incentives: Governments can offer incentives, such as tax breaks or grants, to encourage private sector investment in key sectors or regions.

- These incentives can attract businesses, promote capital investment, create jobs, and enhance productivity.

- Education and Skills Development: Investing in education and skills development programs equips individuals with the necessary knowledge and abilities to contribute effectively to the workforce.

- This can enhance labor productivity, drive innovation, and support economic growth.

- Innovation and Research Support: Governments can provide funding, grants, and other forms of support to research institutions, startups, and businesses engaged in innovation.

- This can spur technological advancements, promote new product development, and boost productivity.

- Competition Policy: Implementing and enforcing competition laws and regulations helps ensure a level playing field for businesses, discourages monopolistic practices, and promotes fair competition.

- This fosters efficiency, encourages innovation, and benefits consumers through lower prices and improved quality.

While market-based supply-side policies can have various benefits, they also pose potential problems that need to be considered.

- Inequality: Market-based policies may exacerbate income inequality. When policies prioritize market efficiency and deregulation, they can lead to unequal distribution of resources and benefits. Certain segments of society, such as low-skilled workers or disadvantaged groups, may struggle to adapt to market changes and face income disparities.

- Externalities: Market-based policies may not adequately address negative externalities, such as pollution or environmental degradation. When businesses prioritize profit maximization, they may not consider the full social and environmental costs of their activities. This can result in market failures and negative impacts on public goods.

- Market Concentration: Unregulated markets may lead to market concentration, where a few dominant firms gain significant market power. This concentration can hinder competition, limit consumer choice, and stifle innovation. It may also result in monopolistic behavior, such as price-fixing or anti-competitive practices.

- Lack of Investment in Public Goods: Market-based policies may neglect the provision of essential public goods and services, such as infrastructure, education, or healthcare. Private firms may not have sufficient incentives to invest in these areas, leading to undersupply or unequal access to vital public goods.

- Short-Term Focus: Market-based policies can encourage short-term decision-making by businesses. Firms may prioritize immediate profits over long-term investments, research and development, or sustainable practices. This short-term orientation can hinder innovation, long-term economic growth, and societal well-being.

- Market Failures: Markets do not always allocate resources efficiently, and market-based policies may not adequately address market failures. Examples of market failures include asymmetric information, externalities, public goods, and natural monopolies. Without appropriate regulations and interventions, these market failures can persist, leading to suboptimal outcomes.

- Social Safety Nets: Market-based policies may require a strong social safety net to mitigate the negative effects of market forces. If support systems are insufficient, individuals who face job displacement or income volatility due to market changes may struggle to cope, leading to social and economic instability.

Interventionist Supply-Side Policy refers to a set of economic measures and interventions undertaken by the government to actively shape and influence the supply-side of the economy.

Interventionist policies involve direct government intervention and regulation in various aspects of the economy. These policies are designed to address market failures, promote equity, and achieve specific macroeconomic objectives. Here are a few examples of interventionist supply-side policies:

- Industrial Policy: Governments can implement industrial policies to support specific industries or sectors that are deemed strategic or have growth potential.

- This may include providing subsidies, grants, or tax incentives to encourage investment, research and development, and technological advancements in targeted sectors.

- Infrastructure Development: Governments can invest in the development of public infrastructure, such as transportation networks, communication systems, and energy facilities.

- These investments can enhance productivity, attract private investment, and create a conducive environment for businesses to thrive.

- Education and Training Programs: Governments can implement education and training programs to address skill gaps in the labor market.

- This can involve providing funding for vocational training, apprenticeship programs, or initiatives to improve the quality of education.

- By developing a skilled workforce, interventionist policies aim to improve productivity and increase employment opportunities.

- Subsidies and Grants: Governments can provide subsidies or grants to businesses, particularly small and medium-sized enterprises (SMEs), to support their growth and development.

- These financial incentives can help reduce costs, stimulate investment, and promote innovation.

- Regional Development Initiatives: Governments may implement policies specifically targeting underdeveloped regions or areas with high unemployment rates.

- These interventions can include infrastructure investments, tax incentives, and job creation programs to stimulate economic activity and promote regional equity.

- Regulation and Consumer Protection: Interventionist policies may involve stricter regulation and oversight in sectors where market failures exist or where consumer protection is necessary.

- This can include measures to ensure fair competition, prevent anti-competitive behavior, and safeguard consumer rights.

- Income Redistribution: Governments may use interventionist policies to address income inequality by implementing progressive tax systems and redistributive measures.

- These policies aim to achieve a more equitable distribution of wealth and income in society.

Interventionist supply-side policies, while aiming to address market failures and promote economic growth, can also face potential problems.

- Government Failure: Interventionist policies require effective implementation and management by the government. However, government failures, such as corruption, bureaucracy, or inefficiency, can hinder the successful execution of these policies. If interventions are poorly designed or executed, they may not achieve the intended outcomes or even exacerbate existing problems.

- Misallocation of Resources: Government interventions in the market can lead to misallocation of resources. For example, when the government provides subsidies or grants to specific industries or companies, it may artificially distort market signals and divert resources from more efficient sectors. This can result in a misallocation of capital, reduced productivity, and hindered economic growth.

- Reduced Incentives for Innovation and Entrepreneurship: Interventionist policies can dampen incentives for innovation and entrepreneurship. Excessive regulation, high taxes, or government monopolies may discourage businesses from taking risks, investing in research and development, or entering new markets. This can hinder dynamic and innovative sectors of the economy, limiting long-term growth potential.

- Rent-Seeking Behavior: Interventionist policies can create opportunities for rent-seeking behavior, where individuals or businesses seek to gain economic benefits through lobbying, favoritism, or seeking special privileges. This behavior can distort competition, lead to the inefficient allocation of resources, and create inequality.

- Market Distortions: Interventions can lead to market distortions, such as price controls, quotas, or trade restrictions. While these measures may be intended to address market failures or protect certain industries, they can result in unintended consequences. For example, price controls can lead to shortages or surpluses, quotas can hinder international trade, and trade restrictions can increase consumer prices.

- Political Interference and Lack of Flexibility: Interventionist policies are susceptible to political influences and may be subject to changes with shifting political priorities. This can introduce uncertainties and reduce the ability of businesses to make long-term plans or investments. Additionally, interventions may lack the flexibility needed to respond quickly to changing economic conditions or emerging challenges.

- Opportunity Costs: Interventions often require financial resources and government spending. The allocation of these resources to interventionist policies means that they are not available for other essential areas such as public infrastructure, education, or healthcare. This opportunity cost may limit the overall welfare of society and constrain the government's ability to address other pressing needs.

effectiveness of EXCHANGE RATE policy in relation to different macroeconomic objectives

Balance of payments stability, economic growth and low unemployment vs price stability

- A competitive exchange rate can boost exports, increase production, and stimulate economic growth, thereby creating employment opportunities.

- However, an excessively weak exchange rate may lead to higher import prices, potentially fueling inflationary pressures.

- Therefore, maintaining a balance between exchange rate competitiveness and price stability is crucial.

- The effectiveness of exchange rate policy in promoting economic growth and employment while maintaining price stability depends on the country's specific economic conditions, the flexibility of the exchange rate regime, and the responsiveness of domestic industries to exchange rate changes.

The effectiveness of exchange rate policy in influencing export revenue and import expenditure depends on the price elasticity of demand (PED).

- When demand for exports is elastic, meaning that a change in price leads to a relatively larger change in quantity demanded, an increase in the price of exports will result in a rise in export revenue.

- This is because the higher price does not significantly reduce the quantity demanded, allowing exporters to earn more revenue.

- Conversely, when demand for imports is elastic, a rise in the price of imports will lead to a decrease in import expenditure as consumers and businesses reduce their quantity demanded due to the higher prices.

Therefore, the price elasticity of demand plays a crucial role in determining the impact of exchange rate policy on the balance of payments.

Speculation: Exchange rate policy can be influenced by speculative activities in foreign exchange markets.

- Speculators may anticipate changes in exchange rates based on various factors, such as interest rate differentials, economic indicators, or market sentiment.

- Their actions can impact the effectiveness of exchange rate policy by creating volatility and unpredictable movements in exchange rates.

- Central banks and policymakers need to carefully monitor and manage speculative activities to ensure that exchange rate policy remains effective in achieving macroeconomic objectives.

Objectives of Other Countries

Exchange rate policy effectiveness can be influenced by the objectives and actions of other countries.

- When multiple countries adopt exchange rate policies, their interactions can lead to currency wars or competitive devaluations.

- In such cases, the effectiveness of individual country's exchange rate policy may be limited, as exchange rate movements become influenced by the actions of other countries.

- Coordination and cooperation among countries can help enhance the effectiveness of exchange rate policies in achieving desired outcomes.

Availability of Foreign Currency

The availability of foreign currency can impact the effectiveness of exchange rate policy.

- If a country lacks sufficient foreign currency reserves or faces constraints in accessing foreign capital markets, its ability to influence the exchange rate may be limited.

- Insufficient foreign currency reserves can make it difficult for the central bank to intervene in the foreign exchange market to support its desired exchange rate policy.

Actions of Other Central Banks

The actions of other central banks, particularly those of major currencies, can impact the effectiveness of exchange rate policy.

- For example, changes in monetary policy by major central banks can influence interest rate differentials and capital flows, which can subsequently affect exchange rates.

- Additionally, interventions by other central banks in the foreign exchange market can create spillover effects on exchange rates and influence the effectiveness of a country's exchange rate policy.

effectiveness of INTERNATIONAL TRADE policy in relation to different macroeconomic objectives

Governments have the option to pursue free international trade by eliminating restrictions on imports and exports.

- By embracing free trade, countries can harness the benefits of comparative advantage, leading to increased economic growth.

- However, the effectiveness of such a policy relies on the cooperation of other governments who also adopt free trade measures.

On the other hand, some governments lean towards trade protectionism to safeguard domestic employment, foster the growth of emerging industries, and deter dumping practices.

While trade protectionism may offer short-term benefits, there are several factors that can limit its success.

- One limitation is the risk of fostering dependency among domestic firms on protective measures, which can hinder their competitiveness in the long run.

- Additionally, protectionist actions may provoke retaliatory measures from other governments, potentially escalating into a trade war.

- Furthermore, membership in a trade bloc may impose constraints on a government's ability to impose trade restrictions on fellow member countries.

In summary, governments face the choice between promoting free trade or adopting trade protectionist measures. Each approach has its advantages and limitations.

- Free trade can foster economic growth and capitalize on comparative advantage, but it requires global cooperation.

- Trade protectionism can safeguard certain industries and employment, but it risks creating dependency, provoking trade disputes, and may be restricted by trade bloc memberships.

Governments must carefully evaluate the potential consequences and trade-offs when formulating their international trade policies.

problems and conflicts arising from the outcome of these policies

Low unemployment and economic growth vs price stability

- When there is low unemployment and robust economic growth, the demand for goods and services tends to increase. This heightened demand can lead to upward pressure on prices, resulting in inflation. High inflation erodes the purchasing power of individuals and businesses, leading to a decline in overall economic welfare.

- Wage-Price Spiral: In a scenario of low unemployment and strong economic growth, workers have more bargaining power to demand higher wages. As wages increase, production costs rise, which businesses may pass on to consumers through higher prices. This wage-price spiral can create a cycle of rising wages and prices, contributing to inflationary pressures.

- Trade-Offs and Policy Dilemmas: Policymakers face dilemmas when trying to balance the objectives of price stability, low unemployment, and economic growth. For instance, pursuing expansionary policies to stimulate economic activity and reduce unemployment can increase the risk of inflation. Conversely, tightening monetary or fiscal policies to curb inflation may slow down economic growth and impact job creation.

- Achieving low unemployment and strong economic growth can be challenging if policies aimed at promoting price stability are overly restrictive. Strict monetary or fiscal policies can hinder business investment and limit job creation, potentially leading to higher unemployment rates. Balancing the need for price stability with the objective of reducing unemployment requires careful policy calibration.

low inflation vs balance of payments stability

When a central bank decides to increase interest rates in order to combat inflation, it can have unintended consequences for the balance of payments and the exchange rate.

- Increasing interest rates can influence the balance of payments position. It is likely to result in an appreciation of the domestic currency, making exports relatively more expensive and imports cheaper. This shift in exchange rates can worsen the current account deficit as exports become less competitive and imports become more attractive to domestic consumers.

- The appreciation of the exchange rate due to higher interest rates can attract speculative capital flows, often referred to as "hot money." While these inflows can temporarily strengthen the currency and provide short-term stability, they may also contribute to an unsustainable exchange rate level, leading to potential disruptions in the balance of payments.

redistribution of income vs economic growth

- Incentives for Productivity and Investment: Policies focused on income redistribution, such as progressive taxation or wealth redistribution measures, can reduce the incentives for individuals and businesses to work hard, invest, and innovate. When higher-income individuals or businesses face higher tax rates or wealth redistribution measures, they may be less motivated to engage in productive activities. This can have negative consequences for overall economic growth and productivity.

- Impact on Saving and Investment: Redistribution policies that target higher-income individuals and businesses to provide resources for lower-income groups can reduce the amount of savings and investment in the economy. Higher taxes on the wealthy can reduce their ability or willingness to save and invest, which are crucial drivers of economic growth. Insufficient savings and investment can limit the availability of capital for productive activities, hindering long-term economic expansion.

- Distortion of Labor Market Dynamics: Policies aimed at income redistribution may create unintended consequences in the labor market. For instance, high progressive tax rates on high-income earners can disincentivize work and entrepreneurship. This can lead to a decrease in labor supply, reduced job creation, and hindered economic growth. Furthermore, if the redistribution measures create significant income disparities between different segments of the population, it may create social tensions and hamper economic stability.

Number of policy tools

To address the potential conflicts between different policy objectives, governments often employ multiple policy tools. By using a combination of fiscal, monetary, and supply-side policies, they can tackle various economic goals simultaneously.

- Let's consider a government facing the challenge of reducing unemployment while also improving the current account position. To tackle unemployment, the government might implement fiscal policy measures such as cutting income taxes.

- This can stimulate consumer spending and business investment, creating a favorable environment for job creation.

- At the same time, the government may use monetary policy tools to address the current account imbalance.

- They might decide to devalue the currency, making exports more competitive and encouraging domestic production.

- This can help increase export revenue, reduce import expenditure, and contribute to a more favorable balance of payments.

government failure in macroeconomic policies

Government failure in macroeconomic policies refers to situations where government interventions or actions aimed at achieving specific economic objectives end up producing unintended or adverse outcomes.

- Miscalculation of the multiplier

- If policymakers inaccurately estimate the size of the multiplier, their fiscal policies may not have the desired effect on economic growth or employment.

- Miscalculations can lead to ineffective policies and wasted resources.

- Time lags: There are often delays in implementing and experiencing the effects of macroeconomic policies.

-

- Recognition lags, decision-making lags, and implementation lags can hinder the timely and effective response to economic challenges.

- If policies are implemented too late or take too long to show results, they may not address the current economic conditions appropriately.

- Political influence: The desire of policymakers to win elections and gain political support can influence their decisions regarding macroeconomic policies.

- Sometimes, short-term political considerations may take precedence over long-term economic stability. This can lead to populist measures that prioritize immediate benefits but have negative consequences in the future.

- Pressure groups: Various interest groups, such as industry associations or labor unions, can exert pressure on policymakers to adopt policies that benefit their specific interests.

- These pressures can lead to biased policy decisions that favor certain groups at the expense of broader economic welfare. In such cases, the policies may not effectively address macroeconomic challenges or achieve optimal outcomes.

- Corruption: Corruption within the government can undermine the effectiveness of macroeconomic policies.

- When policymakers or public officials engage in corrupt practices, such as accepting bribes or embezzling public funds, the intended benefits of economic policies may be siphoned away or misallocated. This can distort resource allocation, hinder economic growth, and contribute to inefficiency and inequality.

To mitigate government failure in macroeconomic policies, it is crucial to enhance transparency, accountability, and good governance. Implementing rigorous policy evaluation processes, reducing political interference, and promoting ethical behavior among public officials can help improve the effectiveness of macroeconomic policies and minimize adverse outcomes. Additionally, fostering an environment of open dialogue and engagement with various stakeholders can ensure that policies reflect the diverse needs and interests of the economy as a whole.