Content

diminishing marginal utility

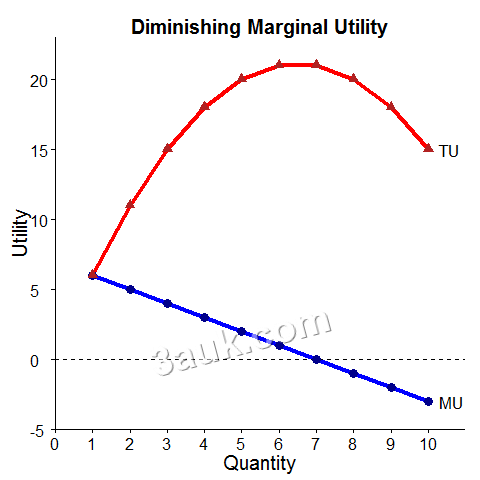

- Diminishing marginal utility is an economic concept that explains the decrease in the additional satisfaction or usefulness that a consumer derives from consuming an additional unit of a good or service, as they consume more and more of that good or service, while keeping all other factors constant.

- It means that the more of something you consume, the less satisfaction you will derive from consuming each additional unit of that thing.

- For example, if you are hungry and you eat one slice of pizza, you will enjoy it immensely. If you eat a second slice, you may still enjoy it, but not as much as the first slice. As you continue to eat more and more slices of pizza, you will eventually reach a point where you are so full that you may not enjoy eating any more slices of pizza, or even find it unpleasant to do so.

- The concept of diminishing marginal utility has important implications for economic decision-making.

- For example, it helps to explain why consumers are willing to pay more for the first unit of a good than for subsequent units.

- It also suggests that consumers will tend to purchase a variety of goods and services, rather than just one item, in order to maximize their overall satisfaction or utility.

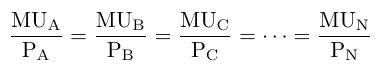

equi-marginal principle

where MU = marginal utility

P = the price

A, B, C and N = different products

- The equi-marginal principle states that a rational consumer will allocate their resources (such as money or time) in a way that maximizes their total utility or satisfaction.

- The principle suggests that a consumer should distribute their resources among different goods or activities in such a way that the marginal utility per unit of resource is equal for each good or activity.

- The equi-marginal principle advises consumers to allocate their resources in such a way that the additional satisfaction gained from the last unit of spending on each good or activity is the same.

- This is because if one good or activity provides more marginal utility per unit of resource spent, then it would be more rational to allocate more resources to that good or activity until the marginal utility per unit of resource spent becomes equal across all goods and activities.

- For example, imagine a consumer has $10 to spend on X and Y.

| Product | Price | Quantity | Marginal Utility | Marginal Utility per Dollar |

|---|---|---|---|---|

| X | $1.00 | 1 | 60 | 60 |

| X | $1.00 | 2 | 40 | 40 |

| X | $1.00 | 3 | 25 | 25 |

| X | $1.00 | 4 | 12 | 12 |

| X | $1.00 | 5 | 5 | 5 |

| Y | $2.00 | 1 | 42 | 21 |

| Y | $2.00 | 2 | 32 | 16 |

| Y | $2.00 | 3 | 24 | 12 |

| Y | $2.00 | 4 | 18 | 9 |

| Y | $2.00 | 5 | 14 | 7 |

- Consumer equilibrium

- is where marginal utility per dollar is the same for each product - This is where 4X and 3Y are consumed with a total utility of 235.

- The equi-marginal principle is important because it allows consumers to make more efficient choices when allocating their limited resources among competing alternatives.

- By comparing the marginal utility of different goods or activities and allocating their resources accordingly, consumers can achieve a higher level of total utility or satisfaction from their spending.

derivation of an individual demand curve

We can use the equi-marginal principle to derive an individual's demand curve.

| Product | Price | Quantity | Marginal Utility | Marginal Utility per Dollar |

|---|---|---|---|---|

| X | $1.00 | 1 | 60 | 60 |

| X | $1.00 | 2 | 40 | 40 |

| X | $1.00 | 3 | 25 | 25 |

| X | $1.00 | 4 | 12 | 12 |

| X | $1.00 | 5 | 5 | 5 |

| Y | $2.00 | 1 | 42 | 21 |

| Y | $2.00 | 2 | 32 | 16 |

| Y | $2.00 | 3 | 24 | 12 |

| Y | $2.00 | 4 | 18 | 9 |

| Y | $2.00 | 5 | 14 | 7 |

- In the previous example, given $10 to spend and PX=$1 and PY=$2, a rational consumer would choose to buy 4X and 3Y.

- Now decrease the price of Y to $1, the new equilibrium would be 4X and 4Y.

- Thus give the price of X and income, the consumer's demand for Y is

- At the price $2, the quantity demanded for Y is 3.

- At the price $1, the quantity demanded for Y is 6.

- As we continue to vary Y's price, we can derive the Y's demand schedule/curve using the equi-marginal principle.

limitations of marginal utility theory and its assumptions of rational behaviour

- The assumption of rational behavior: The theory assumes that individuals are rational and make choices that maximize their utility. However, this assumption may not always hold true in the real world, as individuals may make decisions that are influenced by emotions, social norms, or other factors beyond rational calculation.

- Difficulty in measuring utility: The theory assumes that utility can be measured objectively and accurately. However, measuring utility is difficult, as it is a subjective experience that varies from person to person and may depend on factors beyond the specific good or service being consumed.

- Diminishing marginal utility may not always hold: The theory assumes that marginal utility decreases as more units of a good or service are consumed. However, this may not always be the case, as some goods or services may provide increasing marginal utility, particularly if they are consumed in combination with other goods or services.

- Ignores non-monetary factors: The theory assumes that the only factor affecting consumer choice is the price of a good or service. However, consumers may also consider non-monetary factors such as convenience, brand loyalty, or environmental sustainability when making choices.

Join the conversation