determination of exchange rates under fixed and managed systems

Under a fixed exchange rate system, the value of a country's currency is set and maintained at a specific rate relative to another currency or a basket of currencies.

- The determination of exchange rates in a fixed system is primarily the responsibility of the central bank or monetary authority of the country.

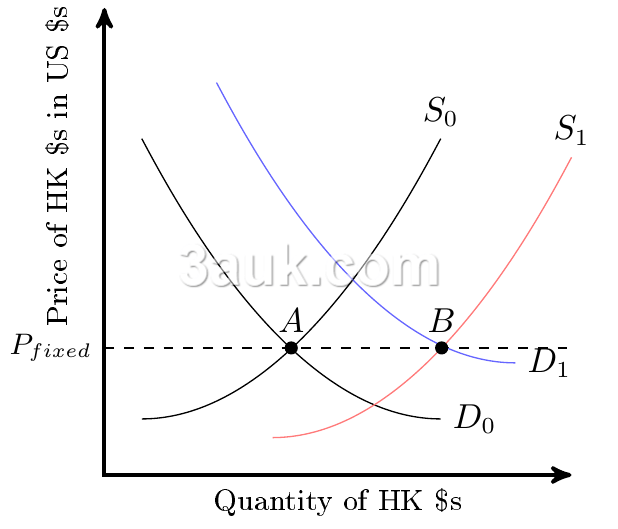

- Example: If the supply of a currency increases to S1, the central bank may intervene by purchasing a sufficient amount of the currency. This action aims to shift the demand curve to D1 and ensure that the value of the currency remains at Pfixed.

- Advantages of a fixed exchange rate system:

- Stability: A fixed exchange rate provides stability in international trade and investment by reducing uncertainty about exchange rate fluctuations.

- Price stability: It helps in controlling inflation as the central bank can directly intervene to stabilize the currency value.

- Confidence: Fixed exchange rates can enhance investor confidence and attract foreign investment due to the predictability and stability they offer.

- Monetary discipline: It imposes discipline on the government and central bank to maintain fiscal and monetary policies conducive to maintaining the fixed rate.

- Disadvantages of a fixed exchange rate system:

- Loss of flexibility: Countries with fixed exchange rates have limited flexibility to adjust their exchange rates to respond to changing economic conditions, such as trade imbalances or economic shocks.

- Speculative attacks: Fixed exchange rate regimes can be vulnerable to speculative attacks by investors seeking to profit from perceived misalignments between the fixed rate and market fundamentals.

- Economic divergence: If countries within a fixed exchange rate system experience diverging economic conditions, such as varying inflation rates or productivity levels, maintaining the fixed rate can lead to economic imbalances.

- Need for reserves: Countries with fixed exchange rates often need to maintain significant foreign exchange reserves to intervene in the currency market and defend the fixed rate, which can impose a burden on their financial resources.

In a managed exchange rate system, the value of a country's currency is allowed to fluctuate within a specific range or band set by the central bank or monetary authorities.

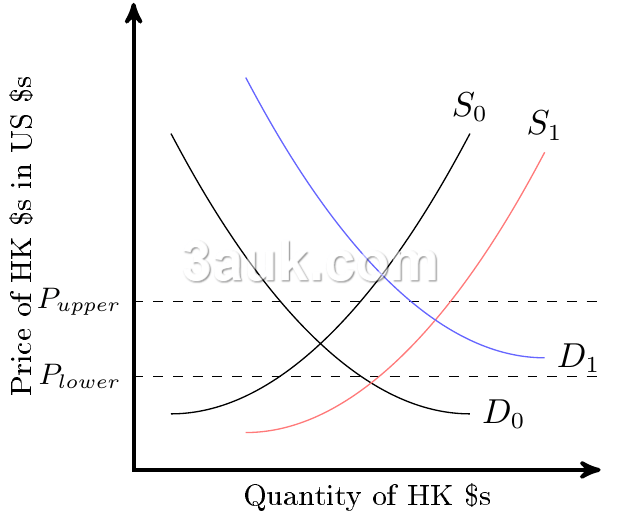

- This range defines the upper and lower limits within which the exchange rate can vary.

- The central bank actively intervenes in the foreign exchange market to ensure that the exchange rate remains within these predetermined limits.

- If the value of the currency approaches the upper limit, the central bank will sell its own currency and buy foreign currencies to prevent further appreciation.

- On the other hand, if the value of the currency nears the lower limit, the central bank will buy its own currency and sell foreign currencies to prevent excessive depreciation.

- Example: If the exchange rate is within the prescribed limits, no intervention is required. However, if there is an increase in demand for the currency, leading to a shift in the demand curve to D1, the central bank will respond by selling its domestic currency. This action increases the supply of the currency to S1, ensuring that the exchange rate remains within the desired band.

The purpose of setting upper and lower limits is to provide a degree of stability to the exchange rate while allowing for some flexibility. It helps to avoid extreme fluctuations that can disrupt economic stability and create uncertainty for businesses and investors.

distinction between revaluation and devaluation of a fixed exchange rate

- Revaluation occurs when a country's central bank increases the value of its currency in relation to the reference currency or currencies.

- This can be achieved by either reducing the supply of the domestic currency or increasing the demand for it.

- As a result, the exchange rate strengthens, meaning that it takes fewer units of the domestic currency to buy one unit of the reference currency.

- Revaluation is typically implemented to address an overvalued currency and can have several objectives, such as reducing import prices, improving the balance of payments, or addressing inflationary pressures.

- Devaluation refers to the deliberate decrease in the value of a country's currency relative to the reference currency or currencies.

- This can be accomplished by increasing the supply of the domestic currency or reducing the demand for it.

- Devaluation leads to a weaker exchange rate, meaning that more units of the domestic currency are needed to purchase one unit of the reference currency.

- Devaluation is often employed to boost exports, stimulate economic growth, enhance competitiveness, or address a trade imbalance by making exports more affordable and imports more expensive.

changes in the exchange rate under different exchange rate systems

- Fixed Exchange Rate System: In a fixed exchange rate system, the exchange rate is set and maintained by the government or central bank. Changes in the exchange rate are typically implemented through official actions by the authorities. They can adjust the value of the currency by buying or selling foreign currency reserves or by implementing monetary policies. The exchange rate remains relatively stable within a predetermined range, and any changes are deliberate and controlled by the authorities.

- Floating Exchange Rate System: In a floating exchange rate system, the exchange rate is determined by market forces of supply and demand. Changes in the exchange rate occur freely based on the market's perception of a currency's value. Factors such as economic conditions, interest rates, trade flows, and investor sentiment influence supply and demand for currencies, leading to fluctuations in exchange rates. Governments and central banks do not intervene directly to set or maintain the exchange rate.

- Managed Float Exchange Rate System: This system combines elements of both fixed and floating exchange rate systems. The exchange rate is allowed to fluctuate based on market forces, but the central bank or government may intervene occasionally to influence the exchange rate. They may buy or sell foreign currency reserves or implement certain policies to manage the exchange rate within a desired range or to address extreme volatility.

the effects of changing exchange rates on the external economy using Marshall-Lerner and J curve analysis

Marshall-Lerner Condition

- The Marshall-Lerner condition examines the impact of exchange rate changes on a country's trade balance.

- According to this concept, a depreciation (fall) in the domestic currency will improve the trade balance if the sum of price elasticities of demand for exports and imports is greater than one.

- If the price elasticities of demand for exports and imports are highly elastic (responsive to price changes), a depreciation of the domestic currency will lead to a larger percentage increase in export revenue and a larger percentage decrease in import expenditure. This improves the trade balance.

- Conversely, if the price elasticities of demand for exports and imports are inelastic (less responsive to price changes), a depreciation of the domestic currency will have a smaller impact on export revenue and import expenditure. The trade balance may not improve significantly.

J Curve Effect

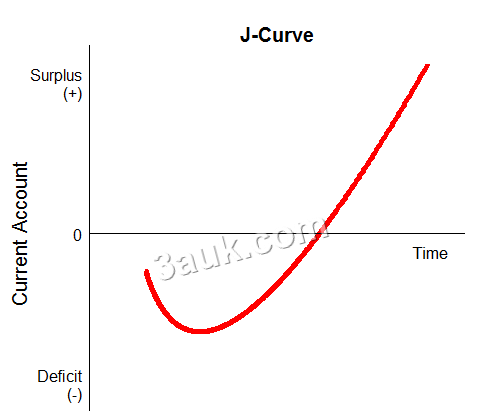

The J curve effect describes the pattern of adjustment in the trade balance following a currency depreciation.

- Initially, after a currency depreciation, the prices of imported goods increase, making them more expensive for domestic consumers. This leads to higher import expenditure.

- At the same time, the prices of exported goods in foreign currency remain relatively unchanged, resulting in a smaller increase in export revenue.

- Consequently, in the short run, the increase in import expenditure exceeds the increase in export revenue, causing the trade balance to worsen.

- However, over time, as demand becomes more responsive to price changes and domestic producers become more competitive, the volume of exports may increase and the volume of imports may decrease. This adjustment can eventually lead to an improvement in the trade balance.

Reverse J Curve Effect

The reverse J curve effect is the opposite pattern observed when a country's currency appreciates in value.

It suggests that in the short run, an appreciation of the domestic currency may initially lead to an improvement in the trade balance, followed by a worsening over time.

- Initially, after a currency appreciation, the prices of imported goods decrease, making them cheaper for domestic consumers. This leads to lower import expenditure.

- At the same time, the prices of exported goods in foreign currency remain relatively unchanged, resulting in a smaller decrease in export revenue.

- Consequently, in the short run, the decrease in import expenditure exceeds the decrease in export revenue, causing the trade balance to improve.

- However, over time, as demand becomes more responsive to price changes and domestic producers face more competition from cheaper imports, the volume of exports may decrease and the volume of imports may increase. This adjustment can eventually lead to a worsening of the trade balance.