- Topic Questions (MCQ – EASY): Government policies to correct market failure

- Topic Questions (MCQ – HARD): Government policies to correct market failure

Nudge theory

- Nudge theory is a concept developed in behavioral economics that suggests that positive reinforcement and indirect suggestions can influence the behavior and decision-making of individuals and groups.

- It aims to influence individuals to make decisions that are in their best interest, without imposing legal or financial penalties.

- The theory argues that by making small, subtle changes to the way choices are presented or framed, people can be nudged towards making better decisions.

- For example, placing healthier food options at eye-level in a supermarket or adding a calorie count to a menu can nudge people towards making healthier food choices.

- Nudge theory is based on the idea that people are influenced by their biases, heuristics, and other psychological factors when making decisions.

- By designing choices in a way that appeals to these biases, decision-making can be influenced towards more desirable outcomes.

- Critics of nudge theory argue that it can be manipulative and paternalistic, as it assumes that individuals are not capable of making rational decisions on their own. However, proponents argue that nudging can lead to positive outcomes for individuals and society as a whole, without infringing on individual freedom.

Correct market failure caused by information failure, externalities

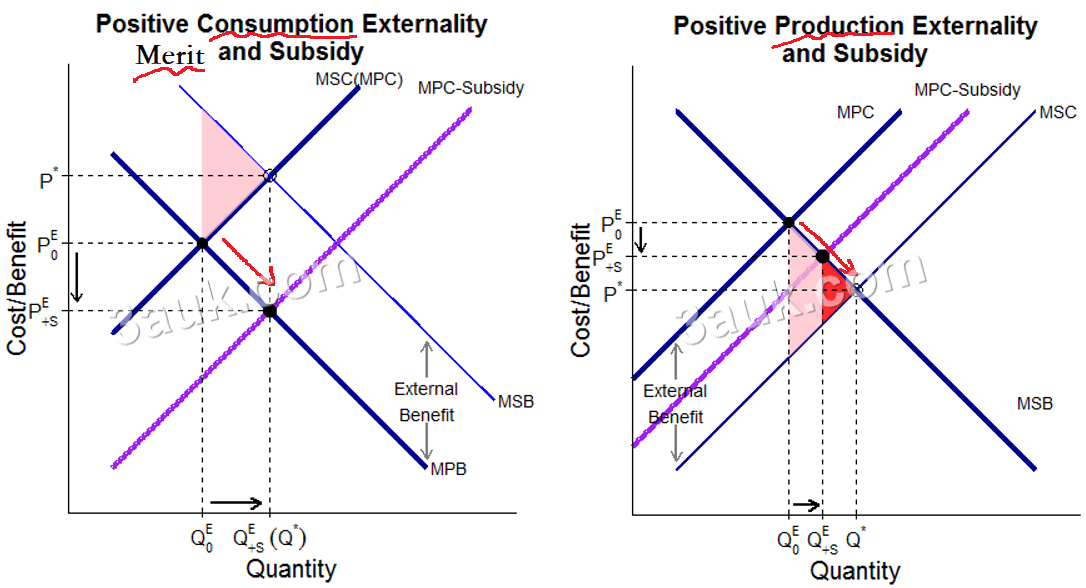

- Subsidies

- Merit goods, positive consumption externalities

- positive production externalities

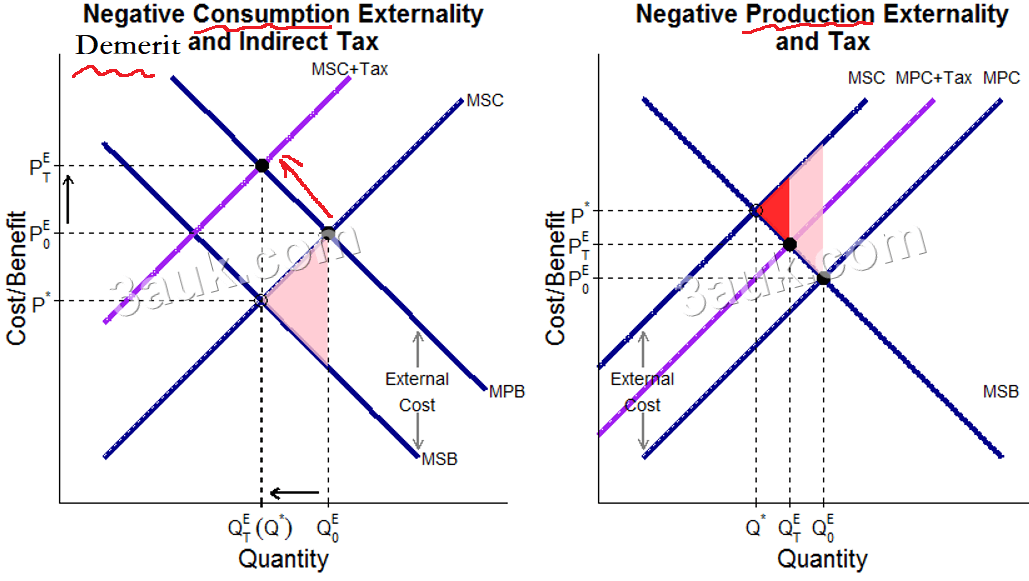

- Indirect taxes

- Demerit Goods, Negative consumption externalities

- Negative production externalities

- Policy effectiveness depends

- the size of PED

- accuracy of information: tax=external cost, subsidy=external subsidy (how to determine and value external costs/benefits and long term effects)

- regulation, prohibitions and licenses

- prohibit pollutions beyond the optimal level

- NIMBY (not in my back yard)

- a syndrome under which people are happy to support the construction of an unsightly or unsocial facility, so long as it is not in their neighbourhood

- Tradable pollution permits

- a form of licence given by governments that allows a firm to pollute up to a certain level

- Benefits

- provide incentives to cut pollution

- the overall level of pollution can be controlled

- Problems

- enforcement costs

- lack of information to decide on the correct number of permits to issue

- heavy polluters could pollute as much as they want if they can afford to buy enough permits

- property rights (internalize externalities)

- the right that owners have to decide how their assets may be used

- allocation of property rights can be effective in curbing the effects of

externalities so long as the transactions costs of implementing it are not too high - e.g. the right to clean air to local residents who are affected by pollution

- the government effectively takes over the property rights on behalf of the residents, and acts as a collective enforcer

- provision of information: nudge theory

Correct market failure caused by abuse of market power

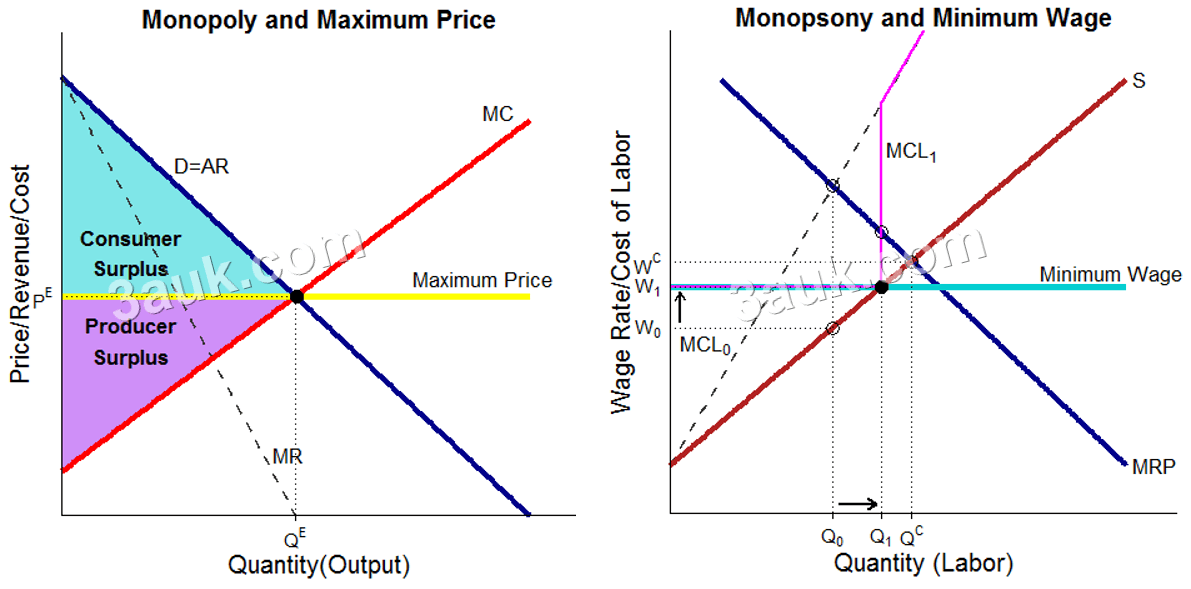

Maximum price and Minimum wage

- A maximum price, also known as price ceiling, is a government-imposed limit on the price that can be charged for a particular good or service.

- It is typically set below the equilibrium price determined by market forces.

- Maximum prices are implemented to protect consumers from excessive prices and ensure affordability.

- They can be particularly useful in markets where there is a lack of competition or when suppliers have significant market power.

- By capping prices, maximum price policies aim to prevent price gouging and ensure that essential goods or services remain accessible to consumers, especially in times of crises or emergencies.

- A minimum wage is the lowest wage rate that employers are legally required to pay their workers.

- It is set by the government to establish a floor for wages, ensuring that workers receive a fair and decent income.

- Minimum wages are intended to address market failures related to low-wage labor markets, such as exploitation, poverty wages, and income inequality.

- By setting a minimum wage, policymakers aim to provide workers with a basic level of economic security, reduce income disparities, and improve living standards.

- Both maximum prices and minimum wages aim to correct market failures by addressing power imbalances and ensuring more equitable outcomes.

- They can help protect vulnerable consumers and workers from exploitation, ensure access to essential goods and services, and contribute to a more equitable distribution of income and resources.

- However, it is important to carefully consider the potential unintended consequences, such as reduced supply or job losses, when implementing such policies to ensure their overall effectiveness.

Competition policy

- a set of measures designed to promote competition within markets to encourage efficiency and protect consumer interests

- ban monopoly, collusion, price fixing

- need to balance tradeoff between allocative efficiency and productive efficiency arising from economies of scale

- marginal pricing: P = MC

Correct market failure caused by public goods

- Direct Provision: The government can directly provide public goods by producing and supplying them to the public. This ensures that the goods are available to all individuals and that their production is not driven solely by profit motives.

- Examples of publicly provided goods include national defense, public parks, and street lighting.

- Public-Private Partnerships: The government can collaborate with private entities to provide public goods. Public-private partnerships involve a joint effort between the government and private companies to finance, develop, and operate public goods. This approach allows for a combination of public funding and private sector expertise and resources.

government failure in microeconomic intervention

Government failure refers to situations where government interventions or policies intended to correct market failures or improve economic outcomes end up producing unintended negative consequences or outcomes that are worse than the original market failure itself.

- It occurs when the government's actions or decisions fail to achieve their intended goals or result in undesirable outcomes.

Causes of government failure can include:

- Lack of Information: Governments may not have complete or accurate information about market conditions, consumer preferences, or the specific needs of different sectors. This can lead to ineffective policies that do not address the root causes of market failures or create unintended consequences.

- Regulatory Capture: Regulatory capture occurs when regulatory agencies become influenced or controlled by the industries they are supposed to regulate. This can result in policies that favor the interests of specific groups or companies rather than promoting the overall public interest.

- Political Considerations: Government decisions are often influenced by political considerations such as electoral cycles, lobbying by interest groups, or short-term political gains. These considerations can lead to policies that prioritize political objectives over economic efficiency or long-term sustainability.

- Bureaucratic Inefficiency: Government bureaucracies may suffer from inefficiencies, including red tape, excessive bureaucracy, and lack of accountability. These inefficiencies can hinder the effective implementation and enforcement of policies, leading to suboptimal outcomes.

- Unintended distorting effects

- Price Controls: Governments may impose price controls to address concerns about affordability or to protect consumers. However, these controls can lead to unintended consequences such as shortages, black markets, and reduced quality of goods and services.

- Agricultural Subsidies: Governments often provide subsidies to support agricultural sectors and stabilize farm incomes. However, these subsidies can distort market signals and incentivize overproduction.

Consequences of government failure can include:

- Allocative Inefficiency: Government interventions that distort market forces can lead to misallocation of resources. This can result in inefficiencies, such as overproduction or underproduction of goods and services, leading to a loss of economic welfare.

- Deadweight Loss: Government interventions can create deadweight loss, which is the loss of economic efficiency that occurs when resources are not allocated in the most productive way. This can arise from price controls, subsidies, or regulations that distort market prices and incentives.

- Rent-Seeking Behavior: Government interventions can create opportunities for rent-seeking behavior, where individuals or firms divert resources towards lobbying, seeking preferential treatment, or capturing government benefits rather than focusing on productive activities. This can lead to a misallocation of resources and reduce overall economic welfare.

- Fiscal Burden: Ineffective or inefficient government interventions can impose a heavy fiscal burden on taxpayers. This can result from the costs associated with implementing and maintaining ineffective policies or the need to finance government failures through taxation or borrowing.

It is important to note that government failure does not imply that market mechanisms are always superior. It simply highlights the limitations and challenges associated with government interventions and emphasizes the need for careful analysis, evaluation, and improvement of public policies to mitigate the risks of unintended consequences and maximize their effectiveness.