Content

- Topic Questions (MCQ – EASY): A2 Macro Intervention

- Topic Questions (MCQ – HARD): A2 Macro Intervention

relationship between the balance of payments and inflation

- When a country's inflation rate surpasses that of its major competitors, its price competitiveness in international markets tends to decline.

- This can result in a decrease in export revenue while import expenditure rises, leading to a deterioration in the country's current account balance.

- An increase in the current account surplus may initially contribute to inflation, as net exports make a larger contribution to aggregate demand, causing more money to flow into the country than leaving it.

- However, this upward pressure on domestic prices and the corresponding downward pressure on the internal value of the currency may be temporary.

- This is because an expanding current account surplus can lead to an appreciation of the country's exchange rate.

- The appreciation, in turn, may reduce the surplus and exert downward pressure on the inflation rate.

- It occurs as the prices of imported goods fall, and domestic firms face increased pressure to keep their prices competitive.

- If there is a net inflow on the financial account, such as multinational companies bringing in advanced technology and intensifying competition within the economy, it may contribute to a decrease in the country's inflation rate.

relationship between growth and inflation

A high rate of inflation is likely to have a negative effect on a country's economic growth.

- Uncertainty and Planning: High and unpredictable inflation levels can create uncertainty among consumers, businesses, and investors. This uncertainty can make it difficult for businesses to plan for the future, make long-term investment decisions, and allocate resources efficiently. It may also discourage individuals from saving and investing, as the value of their money erodes over time. This uncertainty can hinder economic growth by reducing investment and productivity.

- Purchasing Power: Inflation erodes the purchasing power of money. When prices rise, consumers need to spend more money to purchase the same goods and services. If wages do not keep up with inflation, people's real incomes decrease, leading to a decrease in their purchasing power. This can reduce consumer spending, which is a significant driver of economic growth. When consumers have less purchasing power, it can dampen demand and adversely affect businesses.

- Cost-Push Inflation: Inflation can be caused by an increase in input costs, such as wages, raw materials, or energy prices. This type of inflation, known as cost-push inflation, can negatively impact businesses by increasing their production costs. Higher costs can lead to reduced profit margins and, in some cases, business closures or job losses. This can hinder investment, expansion, and innovation, thereby limiting economic growth.

- Net exports are likely to fall as exports become relatively more expensive. Thus the lower aggregate demand would reduce the growth of the country's output.

- On the other hand, a low and stable inflation can promote economic growth.

The effect of economic growth on inflation is complex and can vary depending on various factors and economic conditions.

- Economic growth can lead to increased aggregate demand in an economy.

- When the demand for goods and services surpasses the available supply, it can result in demand-pull inflation.

- This occurs when businesses raise prices to match the higher demand, leading to a general increase in the overall price level.

- Economic growth can also exert inflationary pressures through cost-push factors.

- As the economy expands, input costs such as labor, raw materials, and energy may increase.

- These cost increases can be passed on to consumers through higher prices, resulting in cost-push inflation.

- Economic growth, particularly when it leads to higher wages and production costs, can contribute to this type of inflation.

- Economic growth can influence inflationary expectations among consumers, businesses, and investors.

- If people expect prices to rise in the future due to economic expansion, they may adjust their behavior accordingly. For instance, workers may demand higher wages to keep up with anticipated inflation, and businesses may increase prices in anticipation of higher costs.

- These inflationary expectations can become self-fulfilling and contribute to actual inflation.

- Supply-Side Factors: sustained economic growth can enhance productivity, technological advancements, and investment in capital infrastructure.

- These factors can improve the supply-side of the economy, leading to increased production capacity and efficiency.

- When the economy operates closer to its full potential, it can help alleviate inflationary pressures.

relationship between growth and the balance of payments

Growth Affects the Balance of Payments:

- Increased Domestic Demand: Economic growth often leads to increased domestic demand for goods and services.

- If the domestic demand outpaces the production capacity of the economy, it can result in higher imports to meet the growing demand.

- This can lead to a deterioration in the balance of payments, specifically the current account balance, as import expenditure exceeds export revenue.

- Increased Export Competitiveness: Economic growth can enhance a country's export competitiveness by improving productivity, technological advancements, and the development of new industries.

- This can lead to increased export revenue, which improves the current account balance and contributes to a favorable balance of payments.

Balance of Payments Affects Growth:

- Export-Led Growth: A favorable balance of payments, particularly a current account surplus driven by strong exports, can support economic growth.

- Export revenue provides income and stimulates economic activity, including investments, job creation, and improved living standards.

- The surplus in the balance of payments can contribute to the accumulation of foreign exchange reserves, which can provide stability and confidence in the economy.

- Import Constraints and Economic Constraints: A persistent imbalance in the balance of payments, such as a chronic current account deficit, can have adverse effects on economic growth.

- It can strain the availability of foreign exchange reserves, limit imports of essential goods and technologies, and lead to external debt accumulation.

- These constraints can hinder investment, productivity, and overall economic performance.

relationship between inflation and unemployment: Phillips curve

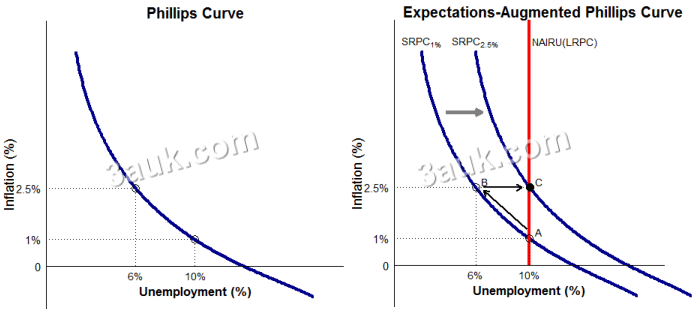

The relationship between inflation and unemployment is often discussed in the context of the Phillips curve, which suggests an inverse relationship between the two variables. There are two main versions of the Phillips curve: the traditional Phillips curve and the expectations-augmented Phillips curve.

- Traditional Phillips Curve (Keynesians): there is an inverse relationship between inflation and unemployment.

- According to this view, when unemployment is low, there is upward pressure on wages as workers have more bargaining power, leading to higher inflation.

- Conversely, when unemployment is high, there is downward pressure on wages, which tends to reduce inflation.

- Expectations-Augmented Phillips Curve (Monetarists): builds upon the traditional Phillips curve by incorporating the role of inflation expectations.

- It recognizes that individuals and firms form expectations about future inflation when making decisions about wages, prices, and other economic variables.

- In this framework, the relationship between inflation and unemployment depends on expected inflation.

- Short-Run Phillips Curve: In the short run, there can be a trade-off between inflation and unemployment.

- When the actual inflation rate exceeds expected inflation, workers and firms may adjust their behavior, leading to higher inflation and lower unemployment.

- This suggests that policymakers could use expansionary monetary or fiscal policies to stimulate aggregate demand and reduce unemployment in the short run.

- Long-Run Phillips Curve: In the long run, the expectations-augmented Phillips curve suggests that there is no permanent trade-off between inflation and unemployment.

- Over time, people adjust their inflation expectations based on actual inflation, leading to a shifting of the Phillips curve.

- In the long run, the Phillips curve becomes vertical at the natural rate of unemployment, indicating that unemployment will tend to return to its natural rate regardless of the level of inflation.

Join the conversation