definition of money supply

Money supply refers to the total stock of money in circulation within an economy at a given point in time.

- It represents the amount of money available for individuals, businesses, and institutions to use for transactions, savings, and other financial activities.

- The measurement of money supply is important for understanding and analyzing the overall monetary conditions and economic activity within a country.

- Narrow money, also known as M1, represents the most liquid forms of money that can be readily used for transactions.

- It includes physical currency (coins and banknotes) held by the public and demand deposits (checking accounts) held by individuals and businesses at commercial banks.

- Narrow money provides immediate purchasing power and facilitates day-to-day transactions.

- Broad money, also known as M2 or M3, encompasses a broader definition of money that includes both narrow money (M1) and other less liquid forms of money.

- In addition to currency and demand deposits, broad money includes savings deposits, time deposits, and other types of relatively less liquid financial assets.

- These assets may require some notice or a penalty for early withdrawal but are still considered part of the overall money supply.

- The distinction between narrow money (M1) and broad money (M2 or M3) is based on the liquidity and accessibility of different financial assets.

- Narrow money represents the most immediately usable and widely accepted forms of money, while broad money encompasses a wider range of financial assets that may not be as easily and directly used for transactions but still hold value and serve as a store of wealth.

Central banks and monetary authorities closely monitor and regulate the money supply to maintain stability and support the overall functioning of the economy.

- They use various tools and policies, such as open market operations, reserve requirements, and interest rate adjustments, to manage the money supply in line with economic objectives and to ensure price stability and financial system stability.

Keynesian and Monetarist theoretical approaches

Keynesian and monetarist theoretical approaches are two contrasting perspectives in economics that provide different explanations and policy prescriptions for macroeconomic issues.

- Focus on Aggregate Demand:

- Keynesians emphasize the role of aggregate demand in driving economic activity.

- They argue that fluctuations in aggregate demand, caused by changes in consumption, investment, government spending, and net exports, are the primary drivers of business cycles.

- Monetarists emphasize the importance of the money supply and its impact on aggregate demand.

- They argue that changes in the money supply affect inflation and nominal variables in the long run but have limited influence on real output and employment.

- Keynesians emphasize the role of aggregate demand in driving economic activity.

- Role of Government:

- Keynesians advocate for an active role of government in stabilizing the economy.

- They argue that during recessions, the government should use fiscal policy, such as increasing government spending or cutting taxes, to stimulate aggregate demand and reduce unemployment.

- Monetarists have a more skeptical view of active government intervention.

- They believe that monetary policy, conducted by a central bank, is the primary tool for stabilizing the economy.

- They argue that the central bank should focus on controlling the money supply to maintain price stability.

- Keynesians advocate for an active role of government in stabilizing the economy.

- Short-Run vs Long-Run:

- Keynesians focus on the short-run and emphasize the importance of addressing short-term fluctuations in output and employment.

- They argue that the economy can experience prolonged periods of below full employment due to demand deficiencies, and that active government policies are necessary to stimulate demand and restore full employment.

- Monetarists take a long-run perspective and emphasize the importance of controlling inflation.

- They believe that in the long run, changes in the money supply primarily affect price levels and not real variables such as output and employment.

- They advocate for a stable monetary policy framework to maintain low and stable inflation.

- Keynesians focus on the short-run and emphasize the importance of addressing short-term fluctuations in output and employment.

- Expectations and Rationality:

- Keynesians often assume that individuals' expectations are not fully rational and that they may make decisions based on imperfect information or bounded rationality.

- They argue that these "animal spirits" can lead to fluctuations in aggregate demand.

- Monetarists generally assume that individuals have rational expectations and make decisions based on all available information.

- They believe that individuals' expectations are formed in a way that reflects the true underlying economic structure.

- Keynesians often assume that individuals' expectations are not fully rational and that they may make decisions based on imperfect information or bounded rationality.

quantity theory of money (MV = PT)

The Quantity Theory of Money, often represented by the equation MV=PT (Fisher Equation), is a theory in economics that relates the quantity of money in circulation (M) to the velocity of money (V), the average price level (P), and the level of transactions in the economy (T).

- It suggests that changes in the money supply will have proportional effects on the overall price level and the level of economic activity.

- M represents the money supply, which includes both physical currency and various types of bank deposits.

- V represents the velocity of money, which is the average number of times a unit of currency is spent in a given period. It captures the speed at which money circulates in the economy.

- P represents the average price level in the economy. It reflects the general level of prices for goods and services.

- T represents the total volume of transactions or the level of economic activity in the economy.

- The equation implies that the total value of transactions is determined by the amount of money available in the economy and how frequently it is used to conduct transactions.

- The theory suggests that if the money supply increases while the velocity of money and the level of transactions remain constant, there will be a proportional increase in the average price level (P).

- Similarly, if the money supply decreases, there will be a proportional decrease in the average price level.

Keynesian vs Monetarist

- Keynesians argue that velocity can vary and is influenced by factors such as interest rates and expectations.

- Monetarists view the velocity of money as relatively stable in the long run. They believe that changes in the money supply will primarily affect prices through changes in velocity.

- Keynesians advocate for active fiscal policy, including government spending and taxation, to stimulate aggregate demand and address economic downturns. They believe that monetary policy alone may not be sufficient to stabilize the economy.

- Monetarists emphasize the importance of monetary policy, particularly controlling the growth rate of money supply, to stabilize the economy. They argue that stable and predictable monetary policy can help maintain price stability and promote long-term economic growth.

functions of commercial banks

Commercial banks play a crucial role in the financial system and provide various functions that are essential for the functioning of the economy. Here are the key functions of commercial banks:

- Providing Deposit Accounts: Commercial banks offer various types of deposit accounts to individuals and businesses.

- These include demand deposit accounts (such as current accounts or checking accounts) and savings accounts.

- These accounts allow customers to deposit their money, make withdrawals, and earn interest on their savings.

- Lending Money: Commercial banks are responsible for lending money to individuals, businesses, and governments.

- They provide various forms of credit, such as overdraft facilities, personal loans, business loans, and mortgages.

- By providing loans, banks facilitate investment, consumption, and economic growth.

- Holding and Providing Financial Instruments: Commercial banks act as custodians for their customers' financial assets.

- They hold and manage cash, securities (such as stocks and bonds), loans, deposits, and equity investments on behalf of their clients.

- Banks also facilitate the trading and transfer of these financial instruments.

- Reserve Ratio and Capital Ratio: Commercial banks are subject to regulatory requirements that govern their reserve and capital ratios.

- The reserve ratio refers to the portion of customer deposits that banks must hold as reserves with the central bank.

- It serves as a safeguard to ensure banks have sufficient liquidity to meet customer withdrawal demands.

- The capital ratio represents the bank's capital as a percentage of its risk-weighted assets.

- It is designed to ensure that banks have enough capital to absorb potential losses and maintain stability.

- Objectives of Commercial Banks: Commercial banks have several objectives that guide their operations:

- Liquidity: Banks aim to maintain sufficient liquidity to meet customer demands for withdrawals and to manage potential financial shocks.

- Security: Banks strive to protect customer deposits and investments through sound risk management practices and adherence to regulatory requirements.

- Profitability: Banks aim to generate profits by earning interest on loans, fees on services, and returns on investments.

- Profitability allows banks to cover operational costs, provide shareholder returns, and strengthen their capital base.

causes of changes in the money supply in an open economy

- commercial banks as sources of credit creation and the bank credit multiplier

- role of a central bank

- government deficit financing

- quantitative easing

- changes in the balance of payments

Commercial banks play a vital role in the process of credit creation, which expands the money supply in the economy.

- This process is facilitated by the bank credit multiplier, which determines the extent to which an initial deposit can generate new loans and deposits.

- Assume Bank X receives a deposit of $1,000 from a customer. The central bank has set a reserve ratio of 10%, which means Bank X is required to hold 10% of the deposit as reserves and can lend out the remaining 90%. Additionally, the capital ratio, which represents the bank's capital as a percentage of its assets, is set at 8%.

- Initial Deposit: A customer deposits $1,000 into their account at Bank X.

- Reserve Requirement: Based on the reserve ratio of 10%, Bank X must hold $100 (10% of $1,000) as reserves.

- Excess Reserves: The remaining $900 ($1,000 - $100) is considered excess reserves that can be used for lending.

- Lending and Deposit Creation: Bank X lends out $900 to a borrower.

- The borrower then uses the loan to make a purchase, which is subsequently deposited into another bank, Bank Y.

- Reserve Requirement for Bank Y: Following the same reserve ratio of 10%, Bank Y must hold 10% of the $900 deposit, which amounts to $90, as reserves.

- Excess Reserves and Further Lending: With $810 ($900 - $90) as excess reserves, Bank Y can lend this amount to another borrower.

- The process of lending, spending, and depositing repeats, leading to the creation of new loans and deposits in the banking system. This cycle continues as long as banks have excess reserves and borrowers are willing to take out loans.

Bank Credit Multiplier = 1 / Reserve Ratio

= 1 / 0.10 = 10

-

- This means that for every $1 deposited in the banking system, the potential credit creation can reach approximately $10.

- In our example, the initial deposit of $1,000 can lead to the creation of up to $10,000 ($1,000 x 10) in new loans and deposits.

Role of a Central Bank

- The central bank, such as the Federal Reserve in the United States or the European Central Bank in the Eurozone, plays a crucial role in managing the money supply.

- It has the authority to control the supply of money and credit in the economy through various monetary policy tools.

- For example, the central bank can adjust interest rates, implement open market operations (buying or selling government securities), and set reserve requirements for commercial banks.

- It is responsible for issuing banknotes and overseeing the production of coins.

- It serves as the primary bank for commercial banks, which maintain deposits with the central bank.

- This arrangement enables commercial banks to facilitate transactions with other banks, make and receive payments, and access funds when necessary.

- The deposits held by commercial banks at the central bank are considered highly liquid assets.

- In times of financial distress, the central bank typically provides lending support to commercial banks.

- The central bank also acts as the banker to the government and plays a crucial role in implementing the government's monetary policy.

- It manages the government's accounts and transactions, including handling the collection and disbursement of funds.

Government Deficit Financing

- When the government runs a budget deficit, it needs to finance the shortfall by borrowing money.

- This can be done by issuing government bonds.

- This borrowing process is facilitated by the central bank.

- If the central bank borrows on behalf of the government by selling government securities, such as National Savings certificates, to the non-bank private sector (including individuals and non-bank businesses), it essentially utilizes existing money.

- Consequently, the purchasers of these securities are likely to withdraw funds from their bank deposits.

- Therefore, the increase in liquid assets resulting from the government's augmented spending will be offset by an equivalent decrease in liquid assets as money is withdrawn.

- If the budget deficit is financed by borrowing from commercial banks or directly from the central bank itself, it will lead to an expansion of the money supply.

- When the government borrows from the central bank, it spends the money obtained from its account held at the central bank.

- This spending subsequently increases deposits in commercial banks, thereby augmenting their liquid assets.

- With greater liquid assets, commercial banks are able to extend more loans.

- Similarly, if the government borrows from commercial banks by selling them short-term government securities, these securities are considered liquid assets and can serve as the basis for lending activities.

- When the government borrows from the central bank, it spends the money obtained from its account held at the central bank.

Quantitative easing (QE) is a monetary policy tool used by central banks to stimulate the economy during periods of economic downturn or deflationary pressures.

- In QE, the central bank buys financial assets, such as government bonds or corporate bonds, from the market, injecting money into the economy.

- By increasing the money supply, the central bank aims to lower interest rates, encourage lending, and stimulate economic activity.

- QE can have an impact on the money supply and overall liquidity in the financial system.

changes in the balance of payments

- The total currency flow in an economy represents the net inflow or outflow of money resulting from international transactions, as recorded in the various components of the balance of payments.

- When the revenue generated from exports exceeds the expenditure on imports, there is a positive trade balance, and money flows into the country.

- Exporters, upon receiving payment, deposit the money into domestic commercial banks, leading to a multiplication effect on the money supply.

- When exporters deposit their earnings, it increases the reserves of commercial banks.

- These banks can then use a fraction of these deposits to extend loans to businesses and individuals, thereby expanding the money supply further through the process of credit creation.

- This multiple increase in the money supply is driven by the initial inflow of money resulting from the favorable trade balance.

policies to reduce inflation and their effectiveness

To combat inflation and maintain price stability, policymakers implement various policies.

- Monetary Policy: Central banks use monetary policy tools to influence the money supply and interest rates in the economy. They can increase interest rates to reduce borrowing and spending, which helps in curbing inflationary pressures. By tightening monetary policy, central banks aim to control aggregate demand and limit the growth of the money supply.

- The effectiveness of monetary policy in reducing inflation depends on factors such as the credibility of the central bank and the responsiveness of businesses and households to changes in interest rates.

- Fiscal Policy: Governments can use fiscal policy to manage inflation. They can reduce public spending or increase taxes to reduce aggregate demand and control inflationary pressures. Additionally, governments can implement policies to reduce budget deficits and maintain fiscal discipline, which can contribute to price stability.

- The effectiveness of fiscal policy in reducing inflation depends on factors such as the government's ability to control spending and the impact of fiscal measures on aggregate demand.

- Supply-side policies aim to increase the productive capacity of the economy and reduce production costs. These policies focus on improving factors such as labor market flexibility, investment in infrastructure, technological advancements, and promoting competition. By enhancing productivity and efficiency, supply-side policies can help mitigate cost-push inflationary pressures.

- The effectiveness of these policies may vary depending on the specific structural characteristics of the economy and the implementation strategies (cost and long time horizon).

- Wage and Price Controls: In certain situations, policymakers may consider implementing wage and price controls to directly manage inflation. These controls involve setting limits on wage increases and price adjustments for specific goods and services.

- While wage and price controls can provide short-term relief, they are often viewed as temporary solutions and may have unintended consequences such as reduced supply, black market activities, and distortions in resource allocation.

- Incomes Policy: Incomes policies involve voluntary or negotiated agreements between the government, employers, and labor unions to control wage increases and prevent excessive cost-push inflation. These policies aim to strike a balance between income growth and price stability.

- Their effectiveness depends on the cooperation and commitment of all parties involved and may face challenges in implementation.

monetary transmission mechanism

The monetary transmission mechanism refers to the process through which monetary policy decisions made by the central bank affect the broader economy.

- It describes the channels and mechanisms by which changes in monetary policy variables, such as interest rates and money supply, influence various economic agents and their behavior.

The monetary transmission mechanism operates through several channels:

- Interest Rate Channel: Changes in the policy interest rate directly affect the borrowing costs for households and businesses.

- When the central bank lowers interest rates, it becomes cheaper for individuals and businesses to borrow money.

- This encourages increased spending and investment, leading to higher economic activity and potentially higher inflation.

- Conversely, when the central bank raises interest rates, borrowing becomes more expensive, which can dampen spending and investment.

- When the central bank lowers interest rates, it becomes cheaper for individuals and businesses to borrow money.

- Credit Channel: Changes in interest rates also impact the availability of credit in the economy.

- Lower interest rates tend to stimulate borrowing and lending by banks, making credit more accessible to households and businesses.

- Increased credit availability can spur consumption and investment, contributing to economic growth.

- Conversely, higher interest rates may constrain credit availability, leading to reduced spending and economic activity.

- Lower interest rates tend to stimulate borrowing and lending by banks, making credit more accessible to households and businesses.

- Asset Price Channel: Monetary policy actions can influence asset prices, such as stock prices and housing prices.

- Changes in interest rates affect the cost of borrowing to finance asset purchases.

- Lower interest rates can increase demand for assets, pushing their prices up.

- Higher asset prices can boost household wealth, leading to increased consumer spending.

- Conversely, higher interest rates can reduce demand for assets, potentially leading to price declines and wealth effects that dampen consumer spending.

- Changes in interest rates affect the cost of borrowing to finance asset purchases.

- Exchange Rate Channel: Changes in monetary policy can influence the exchange rate of a country's currency.

- By adjusting interest rates, the central bank affects the attractiveness of holding the currency, which can impact its exchange rate relative to other currencies.

- A depreciation of the currency can boost exports and discourage imports, thereby stimulating economic activity.

- Conversely, an appreciation of the currency can have the opposite effect.

- Expectations Channel: Expectations of future monetary policy actions can impact current economic decisions.

- Central bank communication and forward guidance play a crucial role in shaping expectations about future interest rates and economic conditions.

- If individuals and businesses anticipate future policy changes, they may adjust their spending and investment decisions accordingly.

The effectiveness of the monetary transmission mechanism can vary depending on several factors, including the state of the economy, the financial system's health, and the credibility and transparency of the central bank's policies.

demand for money: liquidity preference theory

The liquidity preference theory, proposed by economist John Maynard Keynes, provides an explanation for the demand for money based on individuals' preference for holding liquid assets. This theory suggests that people have various motives for holding money, which determine their desired level of cash balances.

The transactions motive refers to the demand for money to facilitate everyday transactions.

- Individuals need money for regular expenses, such as buying goods and services or paying bills.

- Active balances are the desired level of money holdings that individuals actively choose to hold for transactions, precautionary, and speculative purposes.

- The transactions motive is typically characterized by a relatively low interest elasticity.

- This means that the demand for money for transaction purposes is not highly sensitive to changes in interest rates.

- The reason for this is that people require a certain amount of money to meet their regular expenses and conduct routine transactions regardless of the prevailing interest rates.

- The higher the level of income and the frequency of transactions, the greater the demand for money for transactional purposes.

The precautionary motive relates to the demand for money as a precautionary measure against unforeseen future expenses or emergencies.

- Individuals hold money to provide a buffer against unexpected events, such as medical emergencies or job loss.

- The precautionary motive is typically characterized by a relatively low to moderate interest elasticity.

- The amount of money demanded for precautionary purposes depends on factors like income stability and the perceived risk of unforeseen events.

The speculative motive refers to the demand for money based on the expectation of earning a return by holding money rather than investing it in other assets.

- It arises from individuals' desire to take advantage of potential future opportunities that may arise in financial markets.

- The speculative motive is closely related to the interest rate.

- When interest rates are high, the return on holding money is relatively low compared to investing in interest-bearing assets such as bonds or stocks.

- In such circumstances, individuals are more inclined to invest their money, reducing the speculative demand for money.

- Conversely, when interest rates are low, the return on alternative investments is relatively less attractive, leading individuals to hold more money in the hope of earning higher returns in the future. This increases the speculative motive for money.

- The interest elasticity of the speculative motive is generally considered to be high.

- This means that the demand for money for speculative purposes is highly responsive to changes in interest rates.

- When interest rates change, individuals quickly adjust their portfolio allocation between money and other assets based on the perceived profitability of various investments.

- When interest rates are high, the return on holding money is relatively low compared to investing in interest-bearing assets such as bonds or stocks.

- Several factors influence the interest elasticity of the speculative motive. Some of these factors include:

- Expected returns on alternative investments: If individuals anticipate higher returns from other assets, they are more likely to reduce their speculative demand for money and invest in those assets instead.

- Risk perception: The willingness to hold money for speculative purposes depends on individuals' risk appetite. If individuals perceive higher risk in the financial markets, they may opt to hold more money rather than investing in potentially risky assets.

- Market liquidity: The ease with which individuals can buy or sell assets affects the demand for money for speculative purposes. If markets are highly liquid and individuals can quickly convert their money into other assets, the speculative motive for money may be lower.

- The idle balance is a related concept to the speculative motive.

- The idle balance represents money that is not actively used but kept as a reserve or held in anticipation of future investment opportunities.

- The level of the idle balance is influenced by the speculative motive and reflects individuals' willingness to hold money for potential future gains.

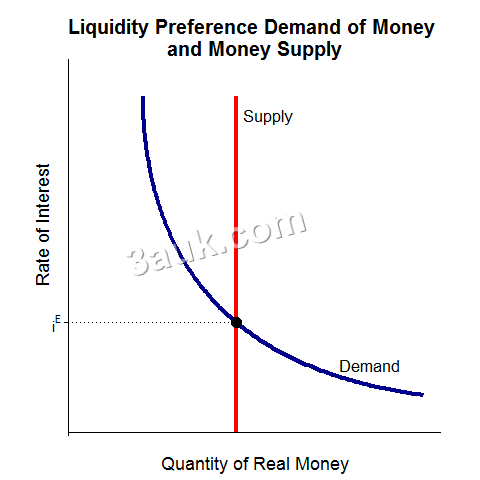

interest rate determination: Keynesian theory

interest rate determination: Keynesian theory

- In Keynesian theory, the demand for money is divided into three motives: the transactions motive, the precautionary motive, and the speculative motive.

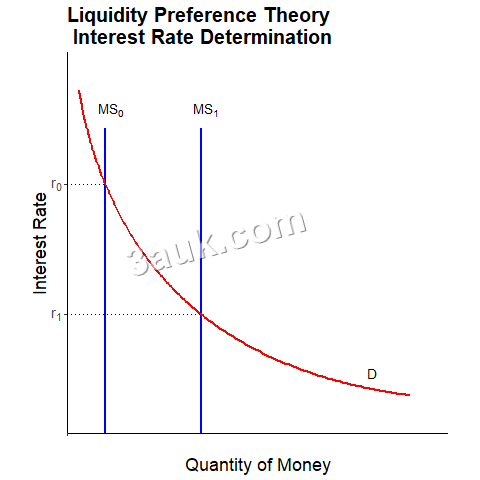

- The supply of money is determined by the central bank's monetary policy decisions, specifically through open market operations, reserve requirements, and discount rate changes. The central bank can increase or decrease the money supply to influence interest rates.

- The interest rate is determined at the point where the demand for money equals the supply of money.

- If the demand for money exceeds the supply, individuals and businesses will bid up interest rates to obtain the desired amount of money.

- Conversely, if the supply of money exceeds the demand, interest rates will fall as individuals and businesses have excess funds available for investment.

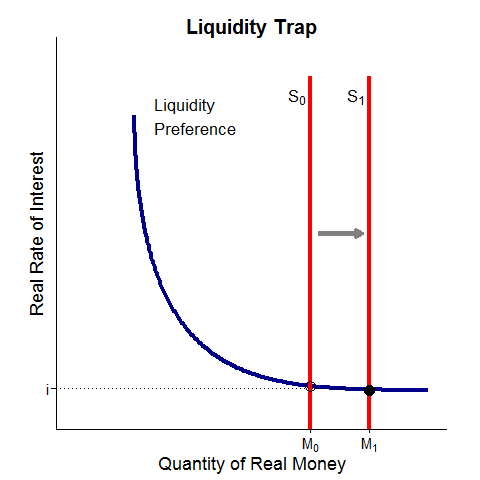

A liquidity trap refers to a situation in monetary policy where conventional methods of stimulating economic activity through interest rate adjustments become ineffective.

- It occurs when nominal interest rates are very low or near zero, and individuals and businesses prefer to hold onto cash rather than investing or spending it.

- In a liquidity trap, the demand for money becomes highly elastic, meaning that even if interest rates are lowered, there is limited response in terms of increased borrowing and spending. This is because individuals and businesses have a strong preference for holding cash due to uncertain economic conditions or a lack of confidence in the future.

- During a liquidity trap, the central bank's attempts to stimulate the economy through interest rate reductions may fail to have the desired effect.

- Lowering interest rates further may not lead to increased borrowing or investment because individuals and businesses already have ample cash holdings and are reluctant to take on additional debt or make long-term commitments.

- Central banks may need to employ unconventional measures, such as quantitative easing or direct injections of liquidity into the financial system, to try to break free from the liquidity trap and encourage borrowing and investment.

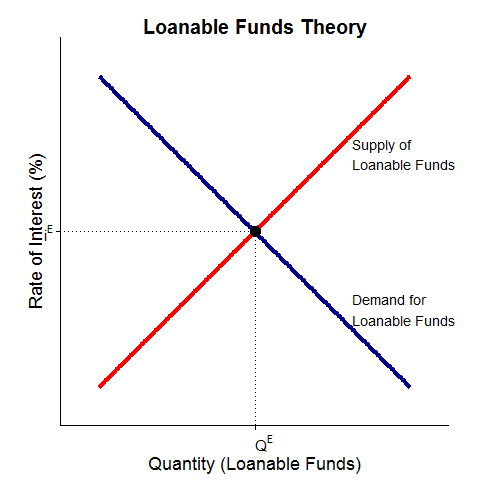

interest rate determination: loanable funds theory

The loanable funds theory is an economic theory that explains how interest rates are determined in financial markets, specifically in the market for loanable funds.

- According to this theory, interest rates are determined by the interaction of the demand for loans from borrowers and the supply of funds from lenders.

- Interest rates serve as the price that balances the demand for funds and the supply of funds.

- The demand for funds comes from borrowers, such as individuals, businesses, or governments, who seek to borrow money for various purposes, such as investment or consumption.

- Households want to buy goods on credit (sensitive/elastic)

- Firms need loans to invest (sensitive/elastic to interest rate change)

- Government seeks loans to fund a budget deficit (not sensitive/inelastic)

- The supply of funds comes from savers, investors, and financial institutions that have surplus funds available for lending.

- The equilibrium interest rate in the loanable funds market is determined by the point where the demand for loans and the supply of funds intersect.

- This equilibrium rate is often referred to as the market-clearing interest rate, as it ensures that the quantity of funds demanded by borrowers is equal to the quantity of funds supplied by lenders.