- Topic Questions (MCQ – EASY): Developing and Developed Countries

- Topic Questions (MCQ – HARD): Developing and Developed Countries

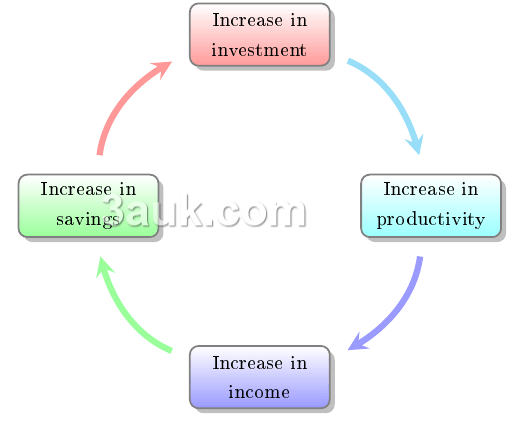

trade and investment

Trade

- Comparative Advantage: Countries at different levels of development often engage in trade based on their comparative advantage. Developing countries may specialize in the production and export of goods or services that they can produce more efficiently or at a lower cost compared to other countries.

- Market Access: Developed countries often have larger consumer markets and higher purchasing power, which can provide opportunities for developing countries to export their products and expand their trade. Trade can facilitate access to technology, capital, and markets, enabling developing countries to diversify their economies and promote economic growth.

- Dependency: However, there can be concerns about the dependency of developing countries on exports of primary commodities or low-value-added goods, which may make them vulnerable to price fluctuations and market volatility. Diversifying the export base and moving towards higher value-added products is often a goal for countries seeking to enhance their development prospects.

Investment

- Foreign Direct Investment (FDI): Developed countries often serve as sources of foreign direct investment, which can bring capital, technology, managerial expertise, and access to global markets to developing countries. FDI can contribute to economic growth, job creation, technology transfer, and infrastructure development.

- Investment Climate: Creating an attractive investment climate through policies that promote stability, transparency, rule of law, and protection of property rights is crucial for attracting investment. Developing countries may need to implement reforms to improve their investment climate and attract both domestic and foreign investment.

- Technology Transfer: Investment from developed countries can facilitate the transfer of technology and knowledge to developing countries, promoting innovation, productivity, and competitiveness.

- Capital Flight: There can be concerns about capital flight from developing countries, where capital and resources are transferred to more developed countries. This can create challenges for the development and economic stability of developing countries.

Overall, trade and investment can offer opportunities for economic development and growth for countries at different levels of development. However, it is essential for developing countries to have policies and strategies in place to maximize the benefits of trade and investment while managing potential risks and challenges. This includes focusing on diversification, improving the investment climate, promoting technology transfer, and ensuring inclusive and sustainable development outcomes.

role of multinational companies (MNCs)

A multinational company (MNC), also known as a multinational corporation, is a business organization that operates in multiple countries, typically with headquarters in one country and subsidiaries or operations in other countries.

- MNCs engage in various business activities, including production, marketing, and distribution of goods and services on a global scale.

Activities of MNCs:

- Foreign Direct Investment (FDI): MNCs often make substantial investments in foreign countries through FDI, establishing subsidiaries or acquiring local companies. This investment can bring capital, technology, managerial expertise, and access to global markets.

- Global Supply Chains: MNCs play a significant role in global supply chains, sourcing inputs, components, and services from different countries. They coordinate production activities across borders to optimize efficiency, cost, and quality.

- Technology Transfer: MNCs can facilitate the transfer of advanced technology, knowledge, and best practices to host countries. This can contribute to technological advancement, innovation, and capacity building in local industries.

- Employment Generation: MNCs create job opportunities in host countries through their direct employment and indirect employment generated in supporting industries and supply chains. They can contribute to skill development, training, and human capital formation.

Consequences of MNCs:

- Economic Development: MNCs can stimulate economic growth and development in host countries by attracting investment, creating employment, and generating tax revenues. They can contribute to industrialization, export diversification, and the development of local industries.

- Technology Spillovers: MNCs bring advanced technologies and management practices, which can lead to knowledge spillovers and improvements in the productivity and competitiveness of local firms.

- Market Access: MNCs provide access to global markets for host country products and services, helping local firms reach a broader customer base and expand their international presence.

- Challenges and Risks: There can be challenges associated with the presence of MNCs, including concerns about labor standards, environmental impact, market concentration, and the potential for profit repatriation. It is crucial for host countries to establish appropriate regulations, policies, and institutions to ensure that MNC activities align with national development goals and benefit local economies.

Overall, the relationship between countries at different levels of development and MNCs is complex. While MNCs can bring numerous benefits, it is important for host countries to carefully manage and regulate their operations to maximize the positive impacts and minimize any potential negative consequences. This includes promoting technology transfer, encouraging linkages with local industries, ensuring fair labor practices, protecting the environment, and fostering a conducive business environment for both MNCs and domestic firms.

Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) refers to the investment made by individuals, companies, or entities from one country (the home country) into another country (the host country) with the intention of establishing a lasting interest and significant control over the operations of an enterprise in the host country.

- FDI involves a direct ownership stake and active management participation in the foreign enterprise.

Consequences of FDI:

- Capital Inflows: FDI brings significant capital inflows into the host country, which can be used for investment in physical infrastructure, technology, research and development, and other productive activities. This helps to fill the investment gap, especially in countries with limited domestic savings.

- Technology Transfer: FDI often involves the transfer of advanced technology, know-how, and managerial expertise from the home country to the host country. This transfer of technology can contribute to the upgrading of domestic industries, improving productivity, and enhancing competitiveness.

- Employment Generation: FDI has the potential to create employment opportunities in the host country. As foreign investors establish new ventures or expand existing operations, they hire local workers, thereby reducing unemployment and providing income opportunities.

- Access to Global Markets: FDI can facilitate host country firms' access to global markets through the integration of their operations into multinational corporations' supply chains and distribution networks. This can help local firms expand their export capabilities and gain exposure to international markets.

- Knowledge Spillovers: FDI can lead to knowledge spillovers, where domestic firms and industries benefit from the presence of foreign investors. This occurs through interactions, collaborations, and learning opportunities with foreign firms, leading to improvements in productivity, innovation, and technological capabilities.

- Linkages and Upgrading: FDI can stimulate the development of backward and forward linkages in the host country's economy. This means that local suppliers, subcontractors, and service providers can benefit from the demand created by foreign investors, fostering the growth and development of local industries.

- Government Revenue: FDI can generate tax revenues for the host country's government through corporate taxes, import duties, and other forms of fiscal contributions. These revenues can be utilized for public investments in infrastructure, education, healthcare, and other social programs.

- Challenges and Risks: While FDI brings significant advantages, there can be challenges and risks associated with it. These include concerns about the exploitation of natural resources, environmental sustainability, labor standards, potential for profit repatriation, and the risk of creating economic dependency on foreign investors. It is important for host countries to establish effective policies, regulations, and institutions to maximize the benefits of FDI while mitigating potential risks.

Overall, FDI can have a transformative impact on countries at different levels of development by boosting investment, technology, employment, and market access. However, host countries need to carefully manage and regulate FDI inflows to ensure that the benefits are maximized, and any potential negative consequences are minimized. This involves creating an enabling business environment, promoting technology transfer, encouraging linkages with domestic firms, and adopting sustainable and inclusive development strategies.

external debt

The relationship between countries at different levels of development and external debt is an important aspect of international finance.

Causes of Debt:

- Borrowing for Development Projects: Developing countries often borrow from external sources to finance infrastructure projects, such as building roads, schools, hospitals, and other developmental initiatives. These investments are intended to promote economic growth and social development but may result in the accumulation of debt.

- Fiscal Imbalances: When a country's government spends more than it generates in revenue, it may resort to borrowing to cover the budget deficit. This can occur due to excessive public expenditure, inefficient tax collection systems, or macroeconomic imbalances.

- Economic Shocks: External debt can arise from economic shocks such as natural disasters, commodity price fluctuations, or financial crises. These events can disrupt a country's economy and necessitate borrowing to stabilize the situation and finance recovery efforts.

- Trade Imbalances: Persistent trade deficits, where a country imports more than it exports, can lead to external borrowing to bridge the gap between imports and exports. This is often the result of structural factors, such as reliance on imports for essential goods or an imbalance in domestic production and consumption.

Consequences of Debt:

- Debt Servicing: Countries with high external debt levels often face challenges in servicing their debt obligations. Debt repayments, including principal and interest payments, can consume a significant portion of a country's budget, limiting resources available for public investments, social programs, and economic development.

- Economic Instability: Heavy external debt burdens can lead to economic instability and financial vulnerability. Debt repayment obligations may divert resources away from productive investments, hinder economic growth, and increase the risk of financial crises.

- Reduced Borrowing Capacity: High levels of external debt can limit a country's ability to borrow in the future. Lenders may be reluctant to provide additional funds if a country's debt-to-GDP ratio or debt sustainability indicators are deemed unsustainable, resulting in restricted access to international capital markets.

- Dependence on Creditors: Countries heavily reliant on external borrowing may become dependent on creditors, potentially compromising their economic and political sovereignty. The conditions and terms attached to borrowing, such as loan conditionality and structural adjustment programs, can exert influence over a country's economic policies and decision-making.

- Debt Distress and Default Risk: In extreme cases, countries may face debt distress, where they struggle to meet their debt obligations. This can lead to debt restructuring, renegotiation, or even default, which can have severe consequences, including reputational damage, loss of access to international finance, and strained relationships with creditors.

- Social Implications: The consequences of high external debt can extend to social aspects, such as reduced public spending on education, healthcare, and poverty alleviation programs. This can hinder human development and exacerbate inequalities within society.

It is important for countries to manage their external debt levels prudently, strike a balance between borrowing for development and maintaining debt sustainability, and implement effective debt management strategies. International cooperation, debt relief initiatives, and transparent financial governance can contribute to alleviating the burden of external debt and promoting sustainable economic development.

role of the International Monetary Fund (IMF) and the World Bank

Role of the International Monetary Fund (IMF):

- Promoting Global Monetary Cooperation: The IMF aims to foster international monetary cooperation and ensure the stability of the global financial system. It provides a platform for member countries to discuss and coordinate policies related to exchange rates, monetary systems, and macroeconomic stability.

- Surveillance and Economic Analysis: The IMF conducts surveillance of member countries' economies to assess their economic and financial conditions, identify vulnerabilities, and provide policy advice. It monitors global economic trends and developments and publishes reports and forecasts that help guide policymakers in making informed decisions.

- Financial Assistance and Crisis Management: One of the key roles of the IMF is to provide financial assistance to member countries facing economic difficulties or balance of payment crises. It offers loans and financial support programs designed to help countries stabilize their economies, implement necessary reforms, and restore confidence among international investors.

- Technical Assistance and Capacity Development: The IMF provides technical assistance and capacity development to member countries in areas such as fiscal policy, monetary policy, public financial management, and banking supervision. This support helps countries strengthen their economic institutions and build the necessary expertise for effective policy implementation.

- Collaboration and Cooperation: The IMF collaborates with other international organizations, central banks, and policymakers to promote global economic stability and address common challenges. It works closely with regional development banks, such as the Asian Development Bank and the African Development Bank, to coordinate efforts in providing financial assistance and technical support.

Role of the World Bank:

- Poverty Alleviation and Development Financing: The World Bank's primary goal is to reduce poverty and promote sustainable development. It provides financial resources, technical expertise, and policy advice to help countries implement projects and programs aimed at reducing poverty, improving living standards, and fostering economic growth.

- Financing for Development Projects: The World Bank offers loans and grants to member countries for a wide range of development projects, including infrastructure development, education and healthcare initiatives, agriculture and rural development, and environmental sustainability. It supports both public and private sector projects that have the potential to contribute to the economic development of member countries.

- Policy Advice and Technical Expertise: The World Bank provides policy advice and technical assistance to member countries, helping them formulate effective development strategies, implement structural reforms, and strengthen governance and institutional capacity. It conducts research, produces reports, and shares knowledge to support evidence-based policymaking.

- Capacity Building and Knowledge Sharing: The World Bank plays a crucial role in capacity building by helping countries enhance their skills and expertise in various areas of development. It facilitates knowledge sharing and learning through publications, conferences, seminars, and online platforms, enabling countries to access global best practices and lessons learned.

- Collaboration and Partnerships: The World Bank works in partnership with other international organizations, governments, civil society, and the private sector to leverage resources and expertise for development initiatives. It collaborates with regional development banks and other stakeholders to address regional challenges and promote cooperation in areas such as regional integration, climate change, and disaster resilience.

Both the IMF and the World Bank play complementary roles in supporting global economic stability, poverty reduction, and sustainable development. Their collaboration and cooperation with member countries and other stakeholders are essential for addressing complex economic challenges and promoting inclusive and resilient growth.