definition and calculation of revenue: total, average and marginal revenue (TR, AR, MR)

Revenue refers to the income generated by a firm through the sale of its products or services. The different types of revenue are:

- Total Revenue (TR) - Total revenue is the total amount of money a firm earns by selling its products or services.

- It can be calculated by multiplying the price of the product by the quantity sold.

- Average Revenue (AR) - Average revenue is the revenue earned per unit of product or service sold.

- It can be calculated by dividing total revenue by the quantity sold.

- Marginal Revenue (MR) - Marginal revenue is the revenue generated by selling one additional unit of product or service.

- It can be calculated by finding the change in total revenue when one additional unit is sold.

Let's take an example to illustrate the calculation of these revenue measures:

Suppose a firm sells 100 units of a product at a price of $10 per unit. The total revenue for the firm would be:

- Total Revenue (TR) = Price × Quantity Sold

TR = $10 x 100 = $1,000 - The average revenue for the firm would be:Average Revenue (AR) = Total Revenue / Quantity Sold

AR = $1,000 / 100 = $10 - Now suppose the firm sells an additional unit, and the price falls to $9 due to increased competition. The total revenue for the firm after selling 101 units would be:Total Revenue = Price × Quantity Sold

TR = $9 × 101 = $909The marginal revenue for the firm from selling the 101st unit would be:Marginal Revenue (MR) = Change in Total Revenue / Change in Quantity

MR = ($909 - $1,000) / (101 - 100) = -$91The negative value of marginal revenue indicates that selling the additional unit has led to a decrease in total revenue for the firm. This is due to the fact that the firm has had to lower the price to sell the additional unit, which has reduced the revenue per unit.

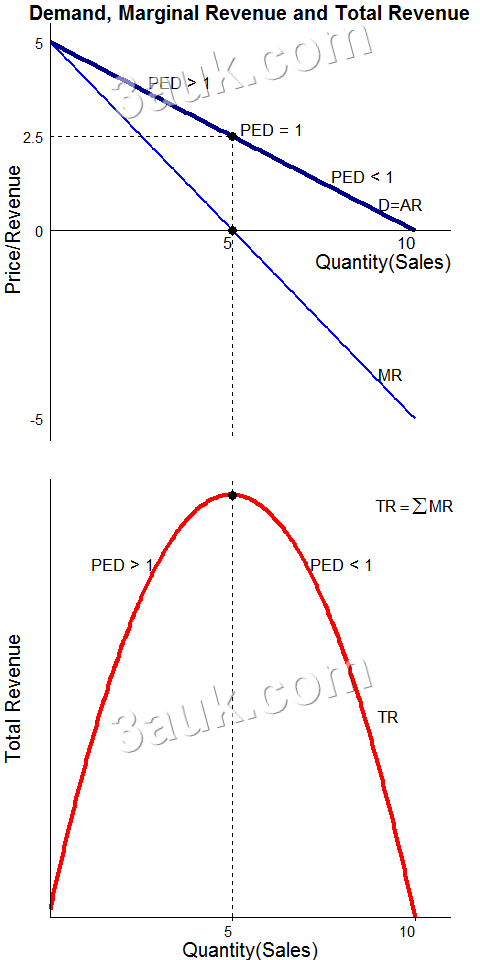

- relationship between price elasticity of demand and a firm’s revenue

normal, subnormal and supernormal profit

- Normal profit is the minimum amount of profit required to keep a firm operating in the long run.

- It is the amount of profit that covers all of a firm's opportunity costs, including the implicit cost of the owner's time and capital.

- It is the amount of profit that covers all of a firm's opportunity costs, including the implicit cost of the owner's time and capital.

- Subnormal profit occurs when a firm is earning less than the normal profit, which means that the firm is not covering all of its opportunity costs and may eventually be forced to exit the market.

- Supernormal profit is any profit earned in excess of the normal profit. It occurs when a firm is earning more than enough to cover all of its opportunity costs.

To calculate profit, you need to subtract all of the explicit and implicit costs of production from the total revenue earned by the firm.

- If the result is positive, the firm is earning supernormal profit.

- If the result is zero or negative, the firm is not earning any supernormal profit.

- If the result is negative, the firm is earning subnormal profit. If the result is zero or positive, the firm is not earning any subnormal profit.

For example, let's say a firm has a total revenue of $1,000 and its explicit and implicit costs of production are $800. To calculate the supernormal profit, we can use the formula:

Supernormal Profit = Total Revenue - Explicit Costs - Implicit Costs Supernormal Profit = $1,000 - $800 Supernormal Profit = $200

In this case, the firm is earning a supernormal profit of $200.

For example, let's say a firm has a total revenue of $500 and its explicit and implicit costs of production are $600. To calculate the subnormal profit, we can use the formula:

Subnormal Profit = Total Revenue - Explicit Costs - Implicit Costs Subnormal Profit = $500 - $600 Subnormal Profit = -$100

In this case, the firm is earning a subnormal profit of -$100. This means that the firm is not earning enough revenue to cover its explicit and implicit costs of production. If this situation persists in the long run, the firm may be forced to exit the market.

other pricing policies: limit pricing; predatory pricing; price leadership

- Limit pricing: This is a pricing policy where a dominant firm in the market sets a price lower than its usual profit-maximizing level (but no lower than the cost of production) to deter potential entrants from entering the market. The goal is to make it unprofitable for new firms to enter the market.

- Predatory pricing: This occurs when a dominant firm in the market lowers its prices significantly (below the cost of production) to drive out or weaken competitors. The goal is to make it difficult for competitors to compete in the market and maintain market share.

- Price leadership: This is a pricing policy where a dominant firm in the market sets a price, and other firms in the market follow. The goal is to avoid price wars and maintain market stability.