- Topic Questions (MCQ – EASY): Circular Flow of Income, Multiplier

- Topic Questions (MCQ – HARD): Circular Flow of Income, Multiplier

formulae for and calculation of multiplier in a closed and open economy, with and without a government sector

Multiplier = change in equilibrium income / change in injection

= 1 / marginal propensity to withdraw

- Calculation of the Multiplier in a Closed Economy (Without Government)

- In a closed economy without government involvement, the multiplier is determined by the marginal propensity to consume (MPC).

- The MPC represents the portion of each additional unit of income that is spent on consumption.

- The formula to calculate the multiplier in a closed economy is:

- In a closed economy without government involvement, the multiplier is determined by the marginal propensity to consume (MPC).

Multiplier = 1 / (1 - MPC) = 1 / MPS

-

- For example, if the MPC is 0.8, the multiplier would be:

Multiplier = 1 / (1 - 0.8) = 5

-

-

- This implies that a $1 increase in investment or spending would result in a $5 increase in the national income or output.

-

- Calculation of the Multiplier in a Closed Economy (With Government):

- In a closed economy with government involvement, the multiplier formula incorporates both the marginal propensity to save (MPS) and the marginal rate of tax (MRT), which represents the portion of each additional unit of income that is saved rather than spent. The formula to calculate the multiplier in this case is:

Multiplier = 1 / (MPS + MRT)

-

- For example, if the MPS is 0.2 and the MRTis 0.1, the multiplier would be:

Multiplier = 1 / (0.2 + 0.1) = 3.33

-

-

- This indicates that a $1 increase in investment or spending would lead to a $3.33 increase in the national income or output.

-

- Calculation of the Multiplier in an Open Economy with government

- In an open economy, which involves international trade, the multiplier calculation takes into account the marginal propensity to import (MPI), representing the portion of each additional unit of income that is spent on imports.

- The formula to calculate the multiplier in an open economy is

Multiplier = 1 / (MPS + MRT + MPI)

-

- For instance, if the MPS is 0.1, the MRT is 0.1 and the MPI is 0.1, the multiplier would be:

Multiplier = 1 / (0.2 + 0.1 + 0.1) = 2.5

-

-

- This means that a $1 increase in investment or spending would lead to a $2.5 increase in the national income or output, considering the impact of imports and taxation.

-

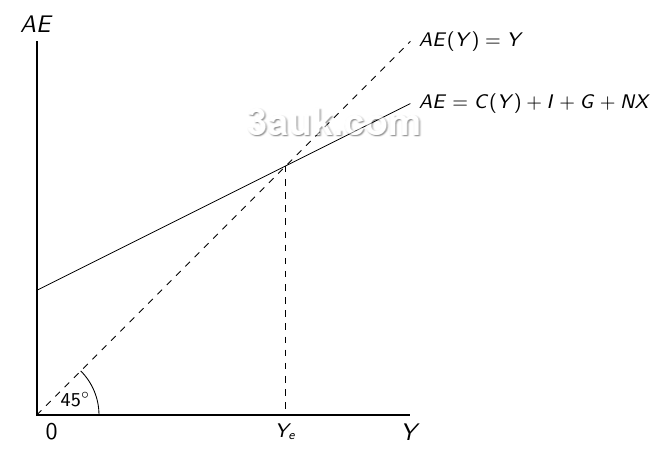

national income determination using AD and income approach with the multiplier proces

The AD approach emphasizes the relationship between aggregate demand and national income. It states that the total spending in an economy determines the level of output and income. Aggregate demand consists of four main components: consumption (C), investment (I), government spending (G), and net exports (X - M).

- The AD equation is given by: AD = C + I + G + (X - M)

- The equilibrium is achieved at

AD = Y

Aggregate Expenditure = Income

To understand the multiplier process, we need to consider the concept of induced expenditure.

- Induced expenditure refers to the additional spending that occurs when income increases. It includes consumption, which is the largest component of aggregate demand.

- The multiplier effect occurs because an initial change in spending leads to a chain reaction of increased income and further spending.

- This process is driven by the marginal propensity to consume (MPC), which is the fraction of additional income that people spend on consumption.

- The multiplier (K) represents the ratio of the change in national income to the initial change in spending.

- It is calculated as the reciprocal of the marginal propensity to save (MPS), which is the fraction of additional income that people save rather than spend.

The formula for the multiplier is: K = 1 / MPS

- The multiplier effect works as follows:

-

- An initial increase in autonomous spending, such as an increase in investment or government spending, leads to an increase in aggregate demand.

- This increase in aggregate demand stimulates production and leads to an increase in national income.

- As income rises, people's consumption increases, creating additional rounds of spending.

- The increased consumption leads to further increases in production and income.

- This process continues in a cumulative fashion, with each round of increased income leading to additional spending, amplifying the initial change in autonomous expenditure.

- The multiplier process has a magnifying effect on changes in aggregate demand. For example, if the initial increase in spending is $100 and the multiplier is 5, the total increase in national income will be $500 (5 times the initial change in spending).

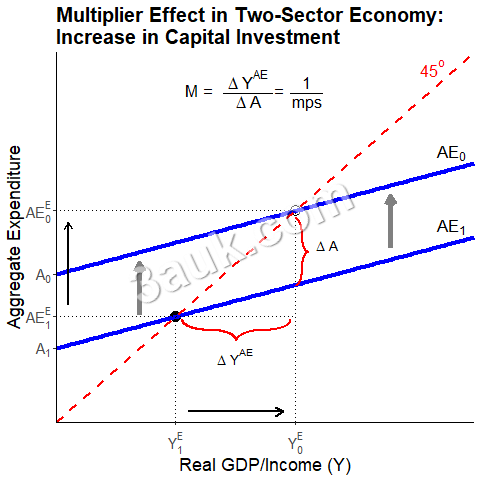

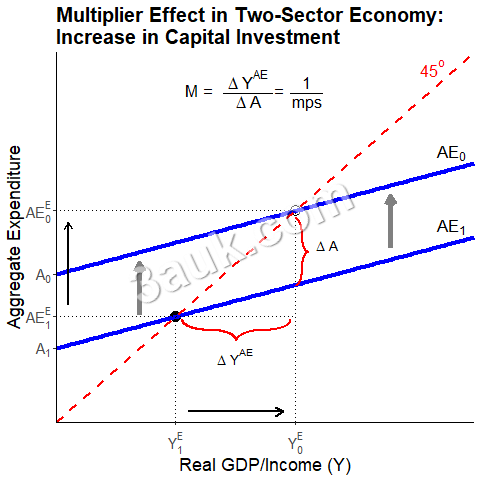

calculation of effect of changing AD on national income using the multiplier

Assume we have an economy where the marginal propensity to consume (MPC) is 0.8. This means that for every additional dollar of income, people tend to spend 80 cents and save 20 cents.

Now, suppose there is an increase in private capital investment by $100 million. We want to calculate the effect of this increase on the national income using the multiplier.

- Calculate the multiplier:

- The multiplier (K) is the reciprocal of the marginal propensity to save (MPS), which is equal to 1-MPC.

- In this case, MPS would be 1−0.8=0.2. Therefore, the multiplier is 1/0.2 = 5.

- Determine the total change in national income: Multiply the initial change in autonomous expenditure (government spending) by the multiplier.

- In this example, the initial change is $100 million, and the multiplier is 5.

- So, the total change in national income is $100 million × 5 = $500 million.

- Determine the final level of national income:

- Add the total change in national income to the initial level of national income. Let's say the initial level of national income was $1 billion.

- The final level of national income would be $1 billion + $500 million = $1.5 billion.

Therefore, the increase in government spending by $100 million leads to an increase in national income of $500 million, resulting in a final level of $1.5 billion.

- It's important to note that this example assumes simplified conditions and a closed economy without leakages like taxes or imports. In reality, the multiplier effect can be influenced by various factors, and the actual impact on national income can be more complex.

The calculation of the effect of changing AD on national income using the multiplier helps us understand how changes in spending can have a multiplied effect on the overall level of income in an economy. It demonstrates the interplay between spending, consumption, and the resulting impact on national income.

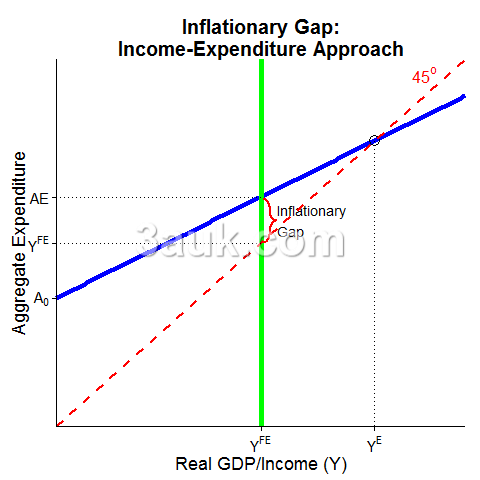

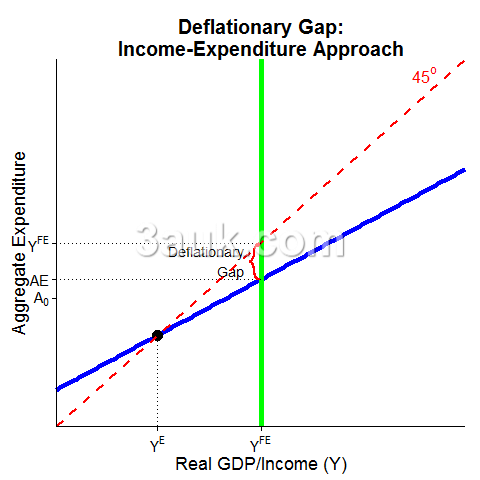

full employment level of national income and equilibrium level of national income: inflationary and deflationary gaps

- The full employment level of national income refers to the level of real GDP (gross domestic product) that an economy can produce when all available resources, such as labor and capital, are fully utilized.

- At this level, the economy is operating at its maximum productive capacity, and there is no cyclical unemployment. It represents the point where the economy is producing goods and services to meet the demands of all willing and able workers.

- An inflationary gap occurs when the equilibrium level of national income exceeds the full employment level of national income.

- In other words, aggregate demand is higher than the economy's productive capacity.

- This situation can lead to upward pressure on prices as demand outstrips supply. It may result in inflationary pressures in the economy, as firms may increase prices to match the increased demand.

- A deflationary gap occurs when the equilibrium level of national income falls below the full employment level of national income.

- In this case, aggregate demand is insufficient to support the economy's productive capacity.

- This situation can lead to downward pressure on prices as supply exceeds demand. It may result in deflationary pressures, as firms may lower prices to stimulate demand and reduce excess inventory.

The concepts of full employment level of national income and equilibrium level of national income help economists analyze the state of an economy and identify any gaps between actual output and potential output. Understanding inflationary and deflationary gaps is crucial for policymakers to implement appropriate measures to stabilize the economy, such as fiscal or monetary policies, to bring the economy back to equilibrium and promote stable economic growth.