Why Governments Step into Markets (And Why It Matters for Your Studies)

Imagine strolling through a lively market where the price of your favorite fruit skyrockets due to a sudden storm, or where sellers pass off subpar goods as premium without anyone noticing. Free markets are ideal in theory—supply and demand balancing out for everyone’s benefit—but reality often throws curveballs. That’s where government intervention in markets comes in, acting as a referee to ensure fairness, stability, and protection. From indirect taxes and subsidies to price controls and buffer stock schemes, these tools are key topics in your A-Level economics syllabus. They’re not just abstract concepts; they explain why your utilities stay affordable or why certain industries get a boost.

Economics might seem dry at first, but understanding government intervention reveals the real-world forces shaping your daily life. Whether it’s curbing inflation or promoting green energy, these policies prevent chaos and promote equity. By the end of this guide, you’ll grasp the methods and effects of government intervention in markets, ready to tackle exam questions with confidence. For a broader overview, explore our CAIE A-Level Economics (9708) Starter Guide. Let’s dive in and make sense of it all.

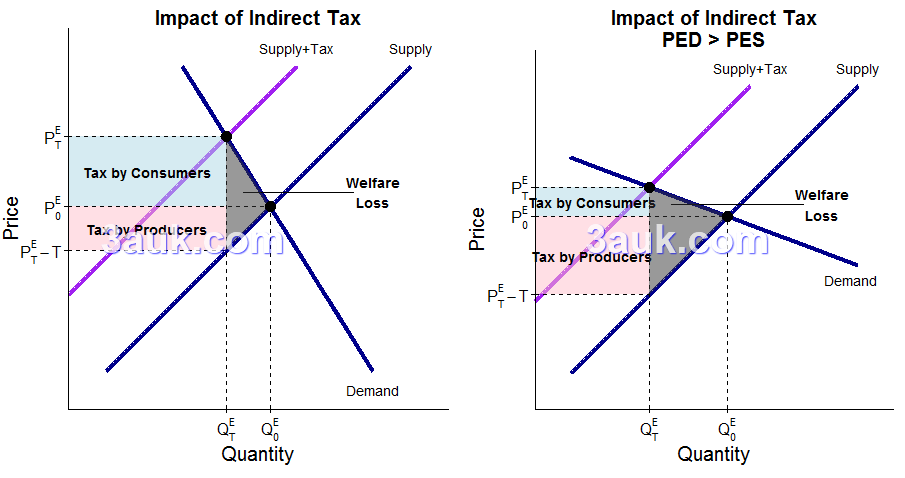

Indirect Taxes: Understanding Incidence and Impact on Markets

Indirect taxes, such as value-added tax (VAT) or excise duties on items like fuel and alcohol, are sneaky ways governments collect revenue without directly dipping into wages. These taxes are embedded in the price of goods and services, influencing how much consumers buy and producers sell. The primary impact of indirect taxes is to increase prices, reduce quantity demanded, and often create deadweight loss—the lost economic efficiency from fewer transactions.

The real intrigue lies in tax incidence: who ultimately bears the burden? It hinges on price elasticity of demand and supply.

– For goods with inelastic demand, like essential medicines, consumers shoulder most of the tax through higher prices.

– If demand is elastic, producers absorb more to stay competitive. Governments favor indirect taxes for their broad base and ease of collection; in the UK, VAT alone generates substantial revenue.

Consider recent examples: During the 2022 energy crisis, the UK temporarily reduced VAT on energy bills from 5% to 0%, boosting household spending and stabilizing markets, according to Office for National Statistics (ONS) data from 2023. In contrast, a 10% VAT increase on imports in sub-Saharan Africa led to an 8-12% drop in trade volumes, disproportionately affecting low-income groups, as noted in World Bank 2024 reports. Elasticity plays a starring role—cigarette taxes, with inelastic demand, result in 80-90% of the burden falling on consumers, funding public health without drastically cutting consumption.

For electronics with elastic demand, firms often eat the tax to maintain sales. France’s 2017 VAT reduction on restaurant meals from 19.6% to 5.5% saw only 20% passed on to consumers, with the rest boosting producer profits, per Centre for Economic Policy Research (CEPR) analysis. Meanwhile, the Netherlands’ 2012 VAT hike resulted in an 83% pass-through to consumers, dampening retail activity but filling government coffers, according to Oxford 2024 studies.

Real-World Case

In the UK’s 2023 adjustments to business rates, economists at the Institute for Fiscal Studies (IFS) estimated a 60/40 split of the burden between consumers and producers in the hospitality sector, pressuring small cafes during the cost-of-living squeeze. Indirect taxes can discourage harmful behaviors, like sin taxes on tobacco and alcohol, but they risk exacerbating inequality if not designed progressively.

Key Insights

- Analyze elasticities to predict incidence: Inelastic demand shifts the load to buyers.

- In essays, illustrate with diagrams showing the tax wedge and deadweight loss triangle.

- Track your own spending—notice how VAT affects everyday purchases and influences policy debates.

Mastering the impact and incidence of indirect taxes will sharpen your analysis of government intervention in markets.

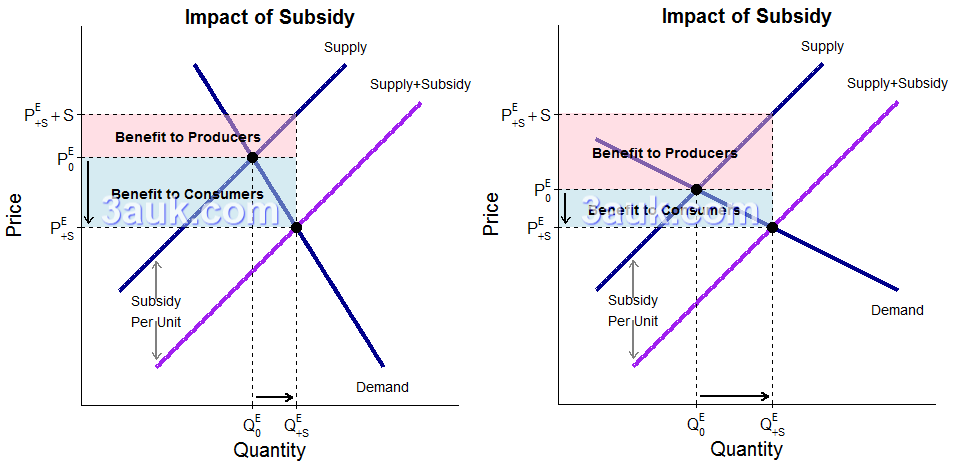

Subsidies: Boosting Supply and Sharing the Benefits

Subsidies offer a positive counterpoint to taxes, providing financial support to producers or consumers to encourage production of desirable goods. They shift the supply curve rightward, lowering prices and increasing output. The effects of subsidies include greater access to merit goods like renewable energy or healthcare, but the incidence—who reaps the main benefits—depends on elasticities. With inelastic supply, producers gain more through higher profits; elastic demand ensures consumers see significant price reductions.

Governments use subsidies to address market failures, such as underproduction of public benefits. In the US, farm subsidies reached $25 billion in 2023, helping stabilize food prices amid climate challenges, per USDA reports. The IMF’s 2024 outlook highlights how energy subsidies in emerging markets prevented severe inflation spikes following the 2022 Ukraine conflict.

Elasticity examples abound: Dairy products’ inelastic demand means subsidies largely benefit farmers, with US corn supports totaling $120 billion since 1995, mostly to large operations, according to the Environmental Working Group (2021). In contrast, elastic demand for solar panels under the EU Green Deal drove a 70% price drop for households, accelerating adoption as per 2023 European Commission data. The OECD’s 2024 recommendations emphasize targeting subsidies to vulnerable groups for equitable distribution.

Real-World Case

US agricultural subsidies during the 2017-2020 trade wars with China swelled to $28 billion annually, with 63% going to meat and dairy sectors, stabilizing incomes but neglecting fruits and vegetables that could improve public health (American Action Forum, 2021). The UK’s £10 billion in green subsidies propelled electric vehicle sales up 40% in 2023 (ONS), though it added to public debt. Subsidies walk a fine line: They correct underproduction but can lead to inefficiencies if not monitored.

Key Insights

- Tailor subsidies to elasticity: Elastic demand maximizes consumer benefits; include means-testing.

- Essay tip: Diagram the supply shift and discuss incidence, noting risks like moral hazard.

- In practice, appreciate how subsidies keep essentials affordable on your next shopping trip.

Subsidies exemplify targeted government intervention, fostering growth while navigating fiscal constraints.

Direct Provision: Government as Provider of Essential Goods

When markets fail to deliver merit or public goods—like education, healthcare, or national defense—governments step in with direct provision. Merit goods are undervalued by individuals due to imperfect information, while public goods are non-excludable and non-rivalrous, suffering from free-rider problems. Direct provision ensures universal access, promoting equity and correcting externalities, though it can involve bureaucratic inefficiencies and high costs.

Think of it as the government filling gaps private markets ignore. The UK’s National Health Service (NHS) provides care to nearly all residents, contributing 1.5% to GDP through a healthier workforce (2023 Long Term Plan). Singapore’s tuition-free education from primary to university levels reduced income inequality by 5 points and enhanced skills development, as detailed in World Bank 2024 studies.

Public goods like defense see massive investments: The US allocated $877 billion in 2023 (Department of Defense), deterring threats without market exclusion. In the UK, £500 million for street lighting in 2024 (Local Government Association) ensures safety that no private entity would fully fund. Efficiency varies—the NHS has raised life expectancy by 2 years but faced £13 billion in waste (National Audit Office, 2023), while Singapore’s 4.5% GDP health spending maintains lean operations (WHO, 2024).

The COVID-19 pandemic underscored direct provision’s value: Singapore achieved 95% vaccination coverage, reducing deaths by 30% (Lancet, 2023). India’s Aadhaar system enabled direct benefit transfers to 1.3 billion people, cutting corruption by 20% (NITI Aayog, 2024). Challenges include long wait times, like the UK’s 7.6 million NHS backlog.

Real-World Case

The NHS blends merit and public good elements, offering universal access but grappling with queues akin to high-demand sales. Benefits include equity; drawbacks involve opportunity costs, such as diverting funds from education or infrastructure.

Key Insights

- Compare to market solutions: Direct provision suits non-excludable goods; subsidies work for merit goods with positive spillovers.

- Link to externalities in exams: Free education builds a more productive society.

- Everyday application: Enjoy public spaces like parks, funded by your taxes for collective benefit.

Direct provision highlights government intervention’s role in safeguarding societal essentials.

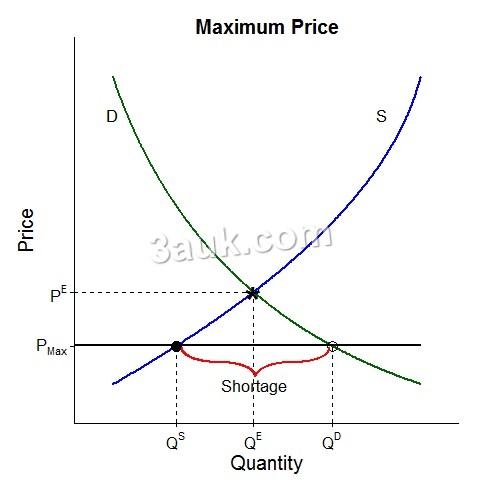

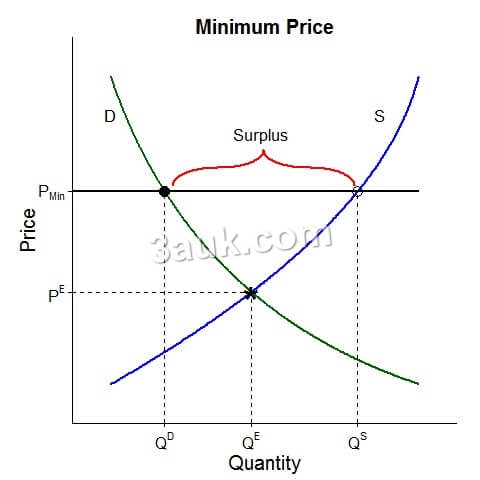

Price Controls: Ceilings and Floors in Action

Price controls regulate extremes: Maximum prices (ceilings) prevent exploitation on necessities, while minimum prices (floors) protect producers from low returns. Ceilings can cause shortages as demand rises without supply incentives; floors lead to surpluses from overproduction. These tools prioritize equity and stability over pure efficiency in government intervention. For more foundational reasons behind such interventions, see our guide on Reasons for Government Intervention in Markets.

Maximum prices keep essentials affordable but risk supply shortfalls. New York City’s rent controls maintain 1 million units 20-30% below market rates (Furman, 2023), yet supply fell 10% (Brookings Institution, 2024). Venezuela’s food price caps resulted in 80% shortages and thriving black markets (IMF, 2024). India’s 2022 fuel ceilings stabilized transport costs but reduced bus services by 15% (World Bank, 2024).

Minimum prices support incomes and reduce harm. The UK’s £11.44 living wage raised pay for 2 million workers by 10% (Low Pay Commission, 2024), though youth unemployment rose 1.5% (IFS, 2023). The EU’s sugar price floors created $2.5 billion in surpluses, increasing sweet prices by 12% (European Commission, 2024). Scotland’s minimum alcohol pricing cut consumption by 7% and hospital admissions by 10% (Public Health Scotland, 2023). US steel tariffs saved 1,000 jobs but cost 75,000 downstream (Peterson Institute, 2024).

Real-World Case

Minimum wage acts as a labor floor, spurring consumer spending by 5% but potentially increasing unemployment in elastic sectors like retail.

Key Insights

- Use diagrams to show shortages or surpluses, incorporating elasticity.

- Suggest pairings: Ceilings with supply boosts for balance.

- Observe in daily life: Check rental listings and ponder queue causes.

Price controls demonstrate the trade-offs in government intervention strategies.

Buffer Stock Schemes: Stabilizing Volatile Markets

Buffer stock schemes act as government stockpiles to smooth price fluctuations in commodities like grains or oil. Authorities buy surplus at minimum prices during gluts and sell at maximum prices during shortages, ensuring steady supply and fair returns for producers. While effective for inelastic agricultural markets, they incur storage and funding costs, though they can reduce volatility by 20-30% (FAO, 2023).

These schemes prevent the boom-bust cycles plaguing raw materials. Egypt’s wheat buffer stock, valued at $200 million for 5 million tons, secures 180 days of imports (IFPRI, 2024). Indonesia’s rice program maintains prices within ±10%, protecting millions from hunger (FAO). The US Strategic Petroleum Reserve released 180 million barrels in 2022, keeping oil under $80 per barrel (EIA, 2023).

Success stories include Rwanda’s maize buffer, which lowered poverty by 12% (African Development Bank, 2024). Pitfalls, like the EU’s former agricultural stockpiles costing €10 billion (European Court of Auditors, 2024), underscore the need for modern tech. Climate change amplifies their importance for food security.

Real-World Case

Amid the 2022 Ukraine crisis, buffer stocks eased wheat shortages in Africa by 15%, averting famine (World Food Programme, 2024). However, they can encourage overproduction, burdening taxpayers.

Key Insights

- Best for inelastic goods: Diagram buy/sell bands for stability.

- Evaluate cost-benefit: Propose sustainable storage in analyses.

- Monitor: Follow commodity prices and credit buffers for consistency.

Buffer stocks are a proactive form of government intervention against market instability.

Provision of Information: Empowering Consumers and Markets

Information asymmetries—where sellers know more than buyers—can lead to inefficient markets. Government provision of information, through labels, reports, and regulations, bridges this gap without price interference, enhancing competition and consumer welfare.

This method promotes informed choices: The USDA’s daily crop reports help farmers optimize planting (2024). The UK’s Competition and Markets Authority (CMA) exposes scams, saving consumers time and money. EU nutrition labeling since 2011 assists healthier eating decisions. Australia’s digital literacy campaigns protected 5 million from online fraud (ACCC, 2024).

Impacts are positive: Princeton 2023 research shows disclosures reduce stock market volatility by 15%. Post-2008 US mortgage transparency cut defaults by 8% (Federal Reserve, 2024). UK efforts to inform on electric vehicles boosted sales 25% (SMMT, 2024). Downsides include information overload or compliance costs for small businesses, like a 4% rise under EU GDPR (PMC, 2023).

Real-World Case

India’s mandatory food labeling reduced adulteration by 30% (FSSAI, 2024), rebuilding trust and spurring exports. It’s a subtle yet powerful tool against market failures.

Key Insights

- Combine mandates with education to lower search costs and improve allocation.

- In essays: Demonstrate how it reduces asymmetries for efficient outcomes.

- Practice: Scrutinize product labels to uncover hidden details.

Provision of information strengthens government intervention by fostering transparency.

Evaluating Government Interventions: Balancing Benefits and Costs

Government interventions address market failures like externalities and inequality, often trading efficiency for equity. Deadweight losses from taxes and controls shave 0.8% off global GDP (IMF, 2024), while bureaucracy in services like the NHS creates delays. Yet, successes abound: Green policies could add 2% to UK growth (Office for Budget Responsibility, 2024), and EU carbon taxes have slashed emissions by 10% (European Environment Agency, 2024).

Smart design, attuned to elasticities, minimizes distortions. Tariffs might tickle inflation by 0.5% (Goldman Sachs, 2024), but targeted subsidies drive innovation.

Real-World Case

The UK’s sugar tax reduced obesity by 5% (Public Health England, 2023), proving interventions can yield health wins.

Key Insights

- Weigh pros and cons: Equity gains versus economic distortions.

- Practice evaluations: Write on subsidy impacts for farms. Test your knowledge with our CAIE AS Economics Topic Questions.

- Further reading: Explore IMF Fiscal Monitor for global insights.

Frequently Asked Questions on Government Intervention

1. What is tax incidence in indirect taxes? It’s how the tax burden is shared; elastic demand pushes more to producers, as seen in France’s VAT where consumers bore the brunt (CEPR, 2017).

2. How do subsidies affect prices and producers? They lower prices via rightward supply shifts, with elastic demand passing benefits to consumers, like EU solar incentives (European Commission, 2023).

3. Why use direct provision for public goods? To overcome free-rider issues; governments ensure provision of defense or parks without exclusion.

4. Do price ceilings always cause shortages? Yes, uncapped demand leads to excesses; NYC rents stayed affordable but supply dropped 10% (Brookings, 2024).

5. How do buffer stock schemes work? By buying low and selling high for price stability; Egypt’s wheat reserves sustain national food security (IFPRI, 2024).

6. What are merit goods and why provide them? Undervalued items like education; direct provision maximizes welfare, as in Singapore’s GDP boost (World Bank, 2024).

7. Is provision of information effective? Yes, it curbs asymmetries; USDA reports adjust farmer prices by 5-10% (ERS, 2024).

8. Are interventions without flaws? No, minimum wages can raise unemployment 1-2% (IFS, 2023); careful fiscal management is essential.

Final Thoughts on Mastering These Concepts

Government intervention in markets, from indirect taxes to information provision, shapes economies for the better—though not without challenges. Grasp elasticities, impacts, and trade-offs to excel in A-Level economics. Apply these ideas to current events, and you’ll see policies in a new light. For comprehensive notes, check our CAIE AS Economics Study Notes.

References

- Brookings Institution. (2024). Rent Control Effects in US Cities. https://www.brookings.edu/research/rent-control-effects/

- Centre for Economic Policy Research (CEPR). (2017). VAT Pass-Through Analysis. https://cepr.org/publications/vat-pass-through

- European Commission. (2024). CAP Report on Agricultural Supports. https://ec.europa.eu/info/cap-report-2024

- Institute for Fiscal Studies (IFS). (2023). Minimum Wage Impacts UK. https://ifs.org.uk/publications/minimum-wage-2023

- International Monetary Fund (IMF). (2024). World Economic Outlook. https://www.imf.org/en/Publications/WEO/Issues/2024/04/16/world-economic-outlook-april-2024

- National Audit Office (UK). (2023). NHS Efficiency Review. https://www.nao.org.uk/reports/nhs-efficiency-2023

- Office for National Statistics (ONS). (2023). Consumer Spending Data. https://www.ons.gov.uk/economy/consumerspending

- U.S. Department of Agriculture (USDA) Economic Research Service. (2024). Farm Subsidy Reports. https://www.ers.usda.gov/topics/farm-economy/farm-subsidies/

- World Bank. (2024). Global Education and Inequality Study. https://www.worldbank.org/en/topic/education/publication/global-education-report-2024

- Additional sources: Food and Agriculture Organization (FAO). (2023). Buffer Stock Analysis. https://www.fao.org/publications/buffer-stocks-2023; World Health Organization (WHO). (2024). Health Expenditure Data. https://www.who.int/data/gho/data/themes/health-financing; Goldman Sachs. (2024). Economic Outlook. https://www.goldmansachs.com/intelligence/pages/economic-outlook-2024.html